Sensex, Nifty end flat despite Brent crude crosses $69/bbl

10 Jan 2018

3:30 pm Market Closing: Benchmark indices closed flat after volatility throughout the session.

The 30-share BSE Sensex was down 10.12 points at 34,433.07 and the 50-share NSE Nifty fell 4.80 points to 10,632.20.

About 1,604 shares declined against 1,312 advancing shares on the BSE.

3:15 pm IPO subscription: Apollo Micro Systems' Rs 156 crore IPO has been subscribed 1.42 times, as per data available on NSE website.

3:05 pm TCS rallied nearly 4 percent ahead of third quarter earnings tomorrow.

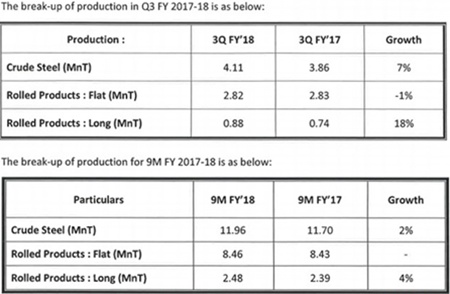

2:55 pm JSW Steel Q3 production:

2:50 pm Lumax in focus: Lumax Industries informed exchange that its newly set-up unit in Sanand, Gujarat has started commercial production today.

The unit has been set up to manufacture and supply new age headlamps and rear lamps to its esteemed customer Suzuki Motors, Gujarat.

2:45 pm India Inc growth in Q3: Ahead of the start of earnings season, domestic rating agency Crisil today said it expects India Inc's revenue growth to hit a five-year high of 9 percent for the October-December 2017 period.

However, profits will continue to contract, primarily due to the rising commodity prices, the note by its research wing said.

The aggregate topline of companies in key sectors will grow 9 per cent over same period last year on higher realisations in steel, aluminium, cement and crude oil-linked sectors, and a pick-up in consumption-driven sectors such as auto and aviation, its research wing said.

The revenue growth, which comes after a broadbased improvement in the preceding second quarter that was taken as a prelude to a cyclical upturn, is ahead of inflation by a meaningful margin now, Crisil Ratings' senior director Prasad Koparkar said.

2:40 pm Glenmark in focus: Glenmark Pharmaceuticals today said it expects the US, Indian and European markets, along with active pharmaceutical ingredient (API) segment, to contribute over 80 per cent to its sales by 2021.

As part of its medium term strategy, the company is also looking at increasing presence in complex generics, Glenmark said in a presentation to be made at the J P Morgan Healthcare Conference in the US, as per its BSE filing.

The company is also planning to scale up its speciality business in the US as part of its future outlook for 2021, it added.

In next three to five years, the new molecular entity (NME) pipeline will be in advanced stages of development, Glenmark said.

2:34 pm Experts' take on FDI in retail: Rabindra Jhunjhunwala, Partner, Khaitan & Co said, "The approval through automatic route with respect to single brand retail trading will quicken the FDI clearance process as no prior government approval would be required."

He expects that FDI in single brand retail trading sector will now gain further momentum due to the process not being subject to regulatory scrutiny and approval process.

Stuti Galiya, Counsel, Khaitan & Co said, "This is a welcome move by the Government and is expected to boost FDI in single brand retail trade sector. It is aimed at providing investor friendly climate to the foreign investors."

2:25 pm Gold Trade: Gold edged lower by Rs 25 to Rs 30,475 per ten gram at the bullion market today owing to slackened demand from local jewellers amid a weak trend overseas.

Silver plunged by Rs 400 to Rs 39,500 per kg due to reduced offtake by industrial units and coin makers.

2:16 pm IPO: Malaysia-based carrier AirAsia Bhd's India unit is looking at a potential initial public offering, the group's chief executive, Tony Fernandes, said today.

The company will seek approval at AirAsia India's next board meeting to pick a banker to start the preliminary process for the IPO, Fernandes said on Twitter.

"Analysts (are) giving zero value to AirAsia India. Not far from 20 planes and a potential IPO," Fernandes tweeted.

It's a "very valuable asset with huge growth potential," he said.

AirAsia India, a tie-up between Asia's biggest low-cost airline and India's Tata Sons conglomerate, made revenue of Rs 600 crore (USD 94.24 million) in 2016 and expects revenue to double to Rs 1,200 crore in 2017.

2:05 pm Crude Update: Oil prices hit their highest levels since 2014 due to ongoing production cuts led by OPEC as well as healthy demand, although analysts cautioned that markets may be overheating.

A broad global market rally, including stocks, has also been fueling investment into crude oil futures.

US West Texas Intermediate (WTI) crude futures were at USD 63.52 a barrel - 56 cents, or 0.89 percent, above their last settlement.

Brent crude futures were at USD 69.17 a barrel, 35 cents, or 0.51 percent, above their last close. Brent touched USD 69.29 in late Tuesday trading, its strongest since an intraday spike in May 2015 and, before that, in December 2014.

2:00 pm USFDA nod: Lupin has received USFDA nod for Tamiflu capsules. The capsule has market size of USD 468 million in US as of October 2017.

1:50 pm IDBI cancels Essar loan sale: IDBI has cancelled USD 315 million Essar loan sale without giving any reason, according to sources.

It may have found other bidders for Bond.

The auction of Essar Steel bonds owned by IDBI Bank was scheduled for today.

BofAML, Deutsche Bank, SC Lowy were among shortlisted buyers for Essar bonds.

1:45 pm Order Win: Simplex Infrastructures informed exchanges that it has received an order from Mumbai Metropolitan Region Development Authority (MMRDA)for Rs 1,080 crore for part design and construction of elevated viaduct and 11 elevated stations.

1:40 pm Europe Trade: European equities opened lower as investors watch out for corporate earnings and fresh data.

The pan-European Stoxx 600 was down by 0.13 percent with most sectors trading in negative territory.

In Asia, most markets were trading lower despite a strong end to the session in Wall Street on Tuesday. In commodities trading, oil prices were trading at their highest level since 2014. WTI was up by 0.8 percent, being sold at USD 63.45 and Brent rose 0.5 percent, trading at USD 69.15 a barrel.

1:20 pm Management Interview: While most non-banking financial companies (NBFCs) are under pressure, Magma Fincorp seems to be bucking the trend and has gained in trade on back of bullish notes form IIFL and Kotak Securities.

Talking about the trends in LAP (loan against property) segment, Kailash Baheti, CFO, Magma Fincorp said the focus is on reducing the large ticket size of around Rs 50 lakh and above to average ticket size of Rs 12 lakh.

In an effort to reduce pressure in LAP segment, going forward as well they would scale up the LAP segment in the ticket size less than Rs 25 lakhs and only a few would be in the above Rs 50 lakh size, said Baheti.

Stress in the LAP segment was mainly seen in the ticket sizes above Rs 50 lakh, he added.

1:04 pm Market Update: Benchmark indices continued to trade mildly lower in afternoon, with the Sensex falling 59.36 points to 34,383.83, dragged by banking & financials, infra and metals stocks.

The 50-share NSE Nifty continued to hold 10,600, though it was down 21 points at 10,616.

About three shares declined for every two shares rising on the BSE.

Tinplate, Welspun India, Aban Offshore, Ujjivan Financial, SpiceJet, Jet Airways and Coal India were most active shares.

12:44 pm FDI in Retail: Cabinet has approved allowing 100 percent FDI in single-brand retail via automatic route.

FDI norms for construction and aviation also eased by the government.

V2 Retail and Avenue Supermarts gained 2-3 percent. InterGlobe Aviation gained 1.4 percent and Jet Airways rallied 3 percent.

12:25 pm Management Interview: The Sarda Energy & Minerals stock has had a good start to the year with a 20 percent gain so far. In an interview with CNBC-TV18, Padam Jain, Director & CFO said there has been 25-30 percent price rise in last two months in almost all the segments. Pellet prices have risen by 30 percent in last two months, he said.

According to him, the raw material price increase has followed the increase in the selling prices.

With the focus on the infrastructure from the government's side, demand should be maintained. Affordable housing is another sector which is bringing in demand, he added.

Steel raw material prices are up 25-30 percent, said Jain.

12:15 pm Market Outlook: Aditya Birla Capital believes the NSE Nifty which rallied 29 percent in 2017 on hopes of recovery is not in a bubble territory and will look cheaper as earnings recover going ahead. In fact, the Nifty has merit in trading at premium valuations compared to historical averages and also 2008 peak, it said.

"Considering other parameters like P/B, P/S, dividend yield etc, there is no froth in the markets. Infact, IIP, eight core industries and other indicators point to bottom of the cycle is behind and the economy is recovering. Composition of Nifty50 index has also changed with more weightage to non-cyclical sectors. Hence, it commands more valuation than in the past," it further explained.

12:01 pm Budget Expectations: The government is likely to increase the budget allocation for the Pradhan Mantri Fasal Bima Yojana (PMFBY) to Rs 13,000 crore for 2018-19 from Rs 10,701 crore for the current financial year, sources said.

The Union Budget for 2018-19 will be presented on February 1.

Under the upgraded crop insurance scheme PMFBY, launched early 2016, farmers pay very nominal premium and get full claim for the crop damage.

According to sources, the budget allocation for the PMFBY could go up to Rs 13,000 crore for the next fiscal taking into account about 10 per cent likely increase in the sum insured. While the Agriculture Ministry has demanded Rs 11,000 crore budget for the next fiscal for the flagship scheme, but the ministry is hopeful of getting more funds from the Finance Ministry considering the importance of the scheme.

11:50 am Market Check: Benchmark indices traded lower in late morning deals, with the Nifty testing 10,600 level amid volatility. Banks and auto stocks drove market lower.

The 30-share BSE Sensex was down 94.86 points at 34,348.33 and the 50-share NSE Nifty declined 31.50 points to 10,605.50.

About three shares declined for every two shares rising on the BSE.

The most active stocks were Welspun India which zoomed over 10 percent followed by Suzlon Energy, Reliance Communications, Unitech and JP Associates. More than 100 stocks hit a fresh 52-week high on the NSE while nearly 300 stocks hit record fresh 12-month high on BSE.

11:40 am Management Interview: The V-Mart Retail stock has been on fire with a 250 percent gain in the last one year and is trading near an all-time high. The company is also in focus as at a cabinet meeting later today, the government may allow 100 percent foreign direct investment (FDI) in single-brand retail through automatic route.

Lalit Agarwal, CMD of V-Mart said that the industry had been pushing for FDI via automatic route already.

He further said that more foreign competition would result in better competition.

According to him, 100 percent FDI in single-brand retail via automatic route will create level playing field.

Talking about business, he said that in second half, the same-store-sales growth will not be as good as first half due to high base.

We will see FY18 same-store-sales growth at 10-12 percent, he added.

11:20 am Buzzing: Share price of Steel Strips Wheels (SSWL) advanced 2.5 percent intraday as the company has bagged maiden truck wheels order from USA.

The company has bagged a maiden exports order from high potential US Truck & Trailer Aftermarket for its Truck Steel wheels plant in Chennai.

The total annual potential of this business is 45,000 wheels.

The said wheels to be dispatched from its new truck wheels plant in Chennai from this month onwards. The total order value would be close to USD 2 million.

This order marks company's entry into US territory. The company is in discussions with other large truck & trailer makers in USA and expects to get more orders in this segment in near future.

11:07 am Silver Update: Taking cues from overseas markets, silver prices eased Rs 60 to Rs 38,785 per kg in futures trade today as participants cut bets.

Also, profit-booking at existing levels by speculators weighed on silver prices.

At the Multi Commodity Exchange, silver for delivery in March dropped Rs 607, or 0.15 percent, to Rs 39,785 per kg in a business turnover of 185 lots.

Similarly, the white metal for delivery in far-month May traded Rs 48, or 0.12 per cent, lower at Rs 30,283 per kg in 9 lots.

11:00 am Market Outlook: The market gave a big surprise to investors in 2017 as the 50-share NSE Nifty shot up 29 percent, which was largely in line with global trend, but it was despite growth slowdown due to twin disruptions - demonetisation and GST implementation.

The stupendous rally was driven not only by liquidity, but also by hope of earnings and economic recovery (due to reforms by Modi government) going ahead, which had been lagging for many quarters in the past.

That kind of returns seem unlikely in 2018 though earnings and economic recovery look possible, is the word coming from Aditya Birla Capital.

What it expects is 12-15 percent return in the current year and the similar kind of uptrend is likely to continue in 2019 & 2020 as well.

10:40 am Tejas Networks in focus: Tejas Networks today announced that it has successfully completed GPON equipment installations in over 40,000 gram panchayats in India as part of the BharatNet Phase-1 project.

BharatNet is an ambitious Government of India project to bring high-speed broadband connectivity to 250,000 gram panchayats of the country.

10:28 am Gold Update: Gold futures today fell 0.09 percent to Rs 29,130 per 10 grams as participants cut bets amid weak global sentiment. Besides, profit-booking by speculators also weighed on prices.

At Multi Commodity Exchange, prices for delivery in February contracts fell Rs 26, or 0.09 percent, to Rs 29,130 per 10 grams in a business turnover of 94 lots.

Also, the metal for delivery in far-month April declined Rs 18, or 0.06 percent, to Rs 29,104 per 10 grams in 4 lots.

10:15 am Buzzing: Shares of Whirlpool of India added more than 3 percent in morning as company is going to increase its capacity.

The company is proposing to enhance its single door refrigerator existing capacity of 21 lakh by 6 lakh per annum from internal sources at an estimated cost of Rs 182 crore to be spent over next two years.

The setting up of additional capacity is being undertaken in line with company's focus strategy and to meet the increasing demand of its products since the present capacity utilization of single door refrigerator is around 94 percent.

10:02 am Market Check: Benchmark indices remained volatile in morning, after hitting a record high on the Sensex.

The 30-share BSE Sensex was up 14.47 points at 34,457.66 and the 50-share NSE Nifty rose 3.80 points to 10,640.80.

The market breadth remained positive as about 1,349 shares advanced against 875 declining shares on the BSE.

9:55 am World Bank on India: With an "ambitious government undertaking comprehensive reforms", India has "enormous growth potential" compared to other emerging economies, the World Bank said today, as it projected country's growth rate to 7.3 percent in 2018 and 7.5 for the next two years.

India, despite initial setbacks from demonetisation and Goods and Services Tax (GST), is estimated to have grown at 6.7 percent in 2017, according to the 2018 Global Economics Prospect released by the World Bank here today.

"In all likelihood India is going to register higher growth rate than other major emerging market economies in the next decade. So, I wouldn't focus on the short-term numbers. I would look at the big picture for India and big picture is telling us that it has enormous potential," Ayhan Kose, Director, Development Prospects Group, World Bank, told PTI in an interview.

9:45 am Rupee Trade: The rupee recovered by 5 paise to 63.66 against the dollar in morning today on mild selling of the US currency by exporters amid a higher opening in domestic equity markets.

Currency traders said weakness in the dollar against major global currencies overseas supported the rupee.

Yesterday, the rupee had dropped sharply by 20 paise to end at a fresh one-week low of 63.71 against the US currency following steady uptick in dollar demand from importers and banks amid surging crude prices.

9:35 am IPO opens: Apollo Micro Systems, which raised nearly Rs 47 crore from anchor investors yesterday, has opened its Rs 156-crore initial share-sale for subscription today.

The company has allotted 16,96,050 shares to four anchor investors at a price of Rs 275 per scrip, garnering Rs 46.64 crore, the company said in a statement.

Among the anchor, investors are Sundaram Mutual Fund A/C Sundaram Infrastructure Advantage Fund and Jupiter South Asia Investment Company Ltd - South Asia Access Fund.

The price band for the offer, which will close on January 12, has been fixed at Rs 270-275 per equity share.

Proceeds of the initial public offer (IPO), through which Apollo Micro Systems is estimated to raise Rs 156 crore, will be used to meet additional working capital and other general corporate purposes.

9:21 am Buzzing: Share price of Balasore Alloys gained nearly 6 percent in the early trade as the company will acquire 70 percent of Zimbabwe Alloys.

The company will acquire either by itself and/or through its nominees and affiliates, 70 percent shares of Zimbabwe Alloys (ZAL).

ZAL holds 19,780 hectares of mining areas in different parts of Zimbabwe, which has proven resources of 72.25 million tonnes of chrome ore.

Zimbabwe Alloys Chrome is a wholly owned subsidiary of ZAL has a ferro chrome plant.

The scheme is subject to fulfilment of certain conditions precedent contained in the scheme of arrangement.

9:15 am Market Check: Benchmark indices opened flat on Wednesday, continuing previous day's consolidation further as investors await December quarter earnings.

The 30-share BSE Sensex was up 36.20 points at 34,479.39 and the 50-share NSE Nifty gained 2.40 points at 10,639.40.

Bharti Airtel, ONGC, Coal India, ITC, Infosys, Sun Pharma, Reliance Industries, Vedanta, Tech Mahindra and HCL Technologies were early gainers.

HPCL, BPCL, Eicher Motors, Asian Paints, Kotak Mahindra Bank, Axis Bank and IndusInd Bank were early losers.

The Nifty Midcap Index was up 40 points. About three shares advanced for every two shares falling on the NSE.

Shalby fell 4 percent after weak earnings for December quarter.

Jubilant Foodworks, Future Retail, Infinite Computer Solutions, V-Mart Retail, Idea Cellular, Glenmark Pharma and Punj Lloyd gained 1-4 percent.