The Thirsty Cloud: Why 2026 Is the Year AI Bottlenecks Shift From Chips to Water

By Axel Miller | 28 Jan 2026

Executive Summary: At a Glance

- The Paradigm Shift: As silicon supply chains begin to stabilize, the primary bottleneck for the AI boom in 2026 has moved to physical infrastructure — specifically, water for cooling.

- The High-Density Challenge: Modern AI racks generate up to 10x more heat than traditional servers, rendering legacy air-cooled systems and evaporative cooling towers unsustainable.

- Regulatory Friction: In water-stressed hubs like Chennai and Navi Mumbai, Water Usage Effectiveness (WUE) is now a mandatory legal metric for new data center approvals.

- The Liquid Pivot: To survive, the industry is transitioning from air cooling to direct-to-chip and immersion cooling, turning thermal management into a strategic competitive advantage.

MUMBAI / NAVI MUMBAI — For the past week, the global financial narrative has focused on a single industrial bottleneck: silicon. Intel’s warning that it cannot meet surging demand for AI data-center chips sent a clear signal that the digital boom is outpacing manufacturing capacity.

But while investors track wafer yields and semiconductor supply chains, a more primal constraint is emerging on the ground in hubs like Navi Mumbai and Chennai.

In 2026, the story of the artificial intelligence revolution is shifting from the digital to the physical.

We have entered the era of the “Thirsty Cloud” — where the decisive factor for the next trillion dollars of infrastructure isn’t just who has the fastest GPU, but who can cool it without draining local reservoirs.

The Thermodynamics of Intelligence

The challenge is rooted in physics.

Generative AI models are trained on massive clusters of high-density GPUs that operate at maximum intensity for weeks at a time, converting enormous amounts of electricity into concentrated heat.

For decades, data centers relied on evaporative cooling towers, using millions of litres of potable water to chill air circulated through server halls. During the era of traditional cloud computing, this model was manageable.

In 2026, it is breaking.

With rack densities jumping from 10 kilowatts to well over 100 kilowatts, a single large-scale AI campus can now consume as much water per day as a city of 30,000 people.

The New “Hydro-Geopolitics” of Data Centers

This physical reality is creating fresh friction in high-growth markets.

In India, the data-center boom is concentrated in regions already facing chronic water stress. Hubs such as Chennai and the Mahape corridor in Navi Mumbai are increasingly competing for the same resources required by agriculture and expanding urban populations.

Regulators Turn Water Use Into a Legal Gatekeeper

In 2026, environmental clearance for hyperscale facilities is increasingly tied to Water Usage Effectiveness (WUE) metrics.

The message from policymakers is clear: digital infrastructure cannot grow at the expense of local water tables.

Developers now face a stark choice — secure expensive long-term water access or engineer the problem away.

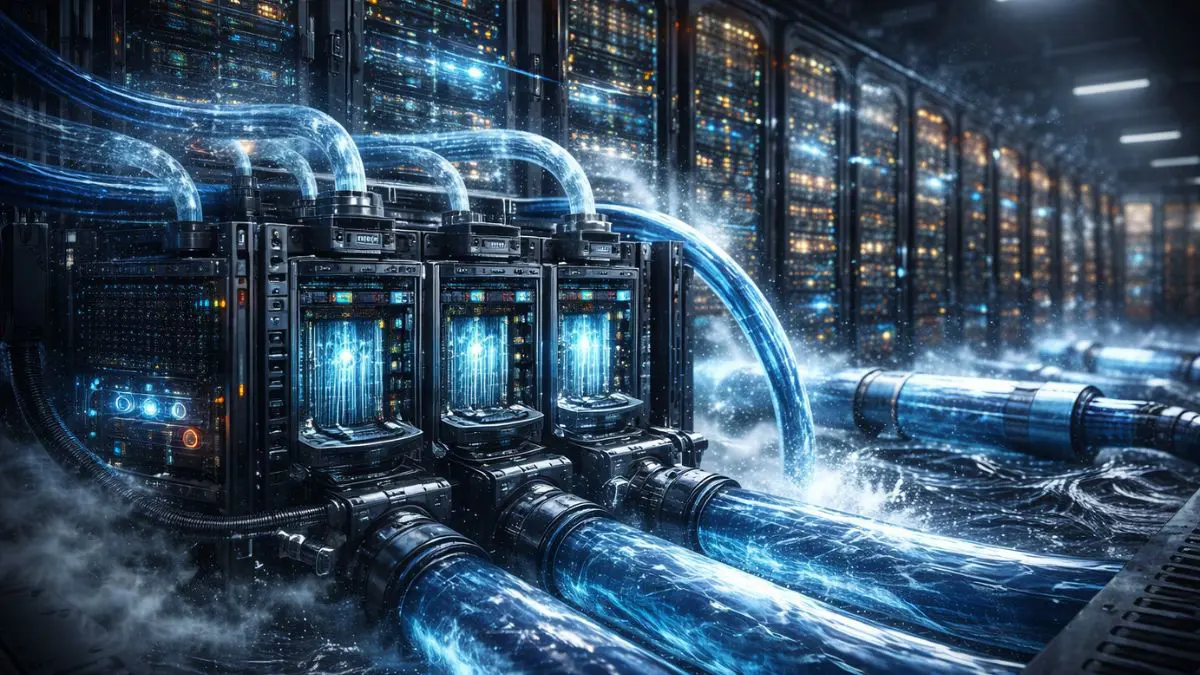

The Great Liquid Pivot: Cooling as a Competitive Moat

The industry’s response is triggering the largest redesign of data-center architecture in two decades.

The era of pushing cold air through massive halls is ending, replaced by liquid-based systems that remove heat directly at the source.

Throughout early 2026, operators have rapidly scaled two key technologies:

- Direct-to-chip cooling: Circulates liquid through cold plates attached directly to high-heat processors

- Immersion cooling: Submerges entire servers in non-conductive fluid, virtually eliminating evaporative water loss

A Fundamental Redesign of Data Center Infrastructure

This is not a marginal upgrade.

It requires entirely new plumbing-centric campus designs and costly retrofits — turning thermal engineering into a core strategic investment rather than a background utility.

Why This Matters

- The resource ceiling: AI growth is increasingly constrained by water and cooling capacity — not just chips and electricity

- Regulatory power: Sustainability (specifically WUE) is becoming a legal gatekeeper for new data-center approvals

- Rising infrastructure costs: Liquid-cooled facilities demand higher capital spending, pushing premium pricing for AI-ready capacity

- Always-on AI: Autonomous “agentic” systems run continuously, intensifying thermal loads year-round without traditional cooldown cycles

FAQs

Q1. Why do AI data centers consume so much more water?

AI workloads generate far higher heat density than traditional servers. Conventional cooling towers evaporate vast volumes of water to remove this heat, which becomes unsustainable at modern AI scales.

Q2. Is this a serious constraint for India’s digital expansion?

Yes. Major hubs like Mumbai and Chennai already face seasonal shortages. Growth increasingly depends on water-neutral cooling designs to maintain regulatory and community approval.

Q3. How is liquid cooling different from air cooling?

Liquid systems remove heat directly from processors far more efficiently. Because they operate in closed loops, they drastically reduce evaporation and water loss.

Q4. Will this increase the cost of AI services?

Likely. Liquid-cooled infrastructure is significantly more capital-intensive, pushing up the pricing floor for high-performance AI data-center capacity.