S&P lowers 2012 China GDP forecasts to 7.5 %, India to 5.5 %

24 Sep 2012

A slowdown in China coupled with ongoing troubles in the Eurozone, and a weaker recovery in the US has led Standard & Poor's Ratings Services to forecast lower economic growth rates for Asia Pacific.

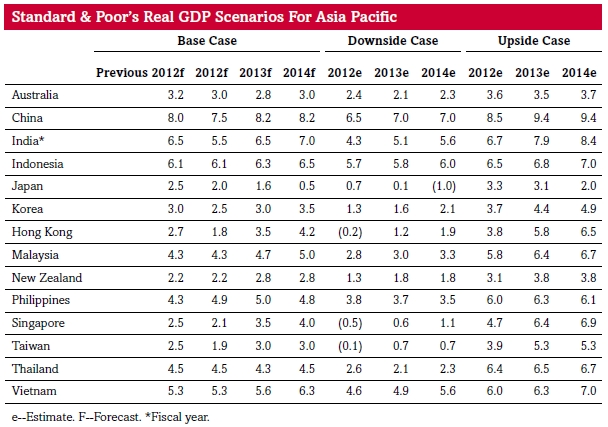

S&P credit analyst Andrew Palmer said the ratings agency had already lowered its base case forecasts of 2012 real GDP growth by about half a percentage point for China to 7.5 per cent; Japan to 2.0 per cent; S Korea to 2.5 per cent; Singapore to 2.1 per cent; and Taiwan to 1.9 per cent.

S&P credit analyst Andrew Palmer said the ratings agency had already lowered its base case forecasts of 2012 real GDP growth by about half a percentage point for China to 7.5 per cent; Japan to 2.0 per cent; S Korea to 2.5 per cent; Singapore to 2.1 per cent; and Taiwan to 1.9 per cent.

Palmer said in a report published today by Standard & Poor's titled, Asia-Pacific Feels the Pressure of Ongoing Global Economic Uncertainty, S&P had also revised its forecast down by about one percentage point each for Hong Kong, to 1.8 per cent; and India, to 5.5 per cent.

For Australia, the forecast is marginally down to 3.0 per cent from 3.2 per cent.

The forecasts for other Asian economies remain unchanged except for the Philippines, which was raised to 4.9 per cent from 4.3 per cent,

reflecting the ongoing strength of its domestic economy.

Palmer said, "Our lower forecast for China recognises that the central government had elected not to inject an economic stimulus of a size and speed necessary for an 8 per cent growth rate.

"It appears that the approach by the Chinese authorities remains influenced by the unpleasant experience of the inflationary effect, particularly on real estate prices, of the stimulus they initiated in 2008-2009."

In turn, the China slowdown has a flow-on effect to the export-oriented Asian economies of Japan, Korea and Taiwan, and the trading port cities of Hong Kong

(in particular) and Singapore. The slowdown in China and the economies in the Eurozone and US have also resulted in lower commodity prices.

It appears that the approach by the Chinese authorities remains influenced by the unpleasant experience of the inflationary effect, particularly on real estate prices, of the stimulus they initiated in late 2008-2009 to counter the global economic slowdown following the Lehman's collapse.

In turn, the China slowdown has a flow-on effect to the export-oriented Asian economies of Japan, Korea and Taiwan, and the trading port cities of Hong Kong (in particular) and Singapore. The slowdown in China and the economies inthe Eurozone and U.S. has also resulted in lower commodity prices.

The lack of monsoon rains has affected India, for which agriculture still forms a substantial part of the economy.Additionally, the more cautious investor sentiment globally has seen potential investors become more critical of India's policy and infrastructure shortcomings.

This was recently highlighted by the power outage in early August that affected 20 of India's 28 states.

Asia Pacific feels the pressure of ongoing global economic uncertainty

"Naturally, any worsening of the economic conditions in the Eurozone will increase contagion risk for Asia Pacific, given the region's - particularly the open economies' - sensitivity to capital flows and trade," concludes Palmer.

The report noted continued pressures in the European Economic and Monetary Union (Eurozone) and the US are being felt across the world, including Asia Pacific.

Although Asia Pacific has recorded strong GDP growth relative to other global economies, Standard & Poor's has observed a continued change in the region's economic barometer.

"A trifecta featuring a slowdown in China, ongoing troubles in the Eurozone, and a weaker recovery in the US leads us to forecast slower economic growth rates for Asia Pacific (see table).

"Our base case scenario for Asia Pacific moving into 2013 reflects cautious growth conditions. Any worsening of the economic conditions in the Eurozone will, in our view, increase contagion risk for Asia Pacific, given the region's--particularly the open economies'--sensitivity to capital flows and trade. Within that context, the credit conditions for rated portfolios in Asia Pacific remains mixed.

"We have factored our base case GDP scenarios into our current ratings on Asia-Pacific issuers and issues. The upside and downside scenarios--together with other relevant underlying credit fundamentals and economic trends--contribute to our ongoing analytical assessment of the overall likelihood that a rating may be raised or lowered.

"At this stage, the short-term impact of the greater-than-anticipated slowdown on Asia-Pacific credit ratings is likely to be limited to the more leveraged entities."