India: a market of paradoxes

17 Oct 2008

Undeniably, we are a large country; in terms of area, 3 million sq. kms and 1.1 billion people. That's more than the combined area and population of of Indonesia, Malaysia, Thailand, Hongkong and Singapore.

We are a young country with 31 per cent below 14 years and 95 per cent below 64 years. We are an inclusive country. All religions co-exist. Hindus whilst they are in majority and account for 84 per cent, we have 13 per cent Muslims and then Sikhs, Christians and a small group following numerous other religions at 2 per cent each.

We are a young country with 31 per cent below 14 years and 95 per cent below 64 years. We are an inclusive country. All religions co-exist. Hindus whilst they are in majority and account for 84 per cent, we have 13 per cent Muslims and then Sikhs, Christians and a small group following numerous other religions at 2 per cent each.

We are a poor country with per capita GDP of only about $703. We are a rural country; 70 per cent of the population live in rural area. We have multiplicity of languages, as many as 15 official languages and hundreds of dialects. Hindi, the national language is spoken by only 30 per cent of the people.

We are a country of contrasts. Even today almost 25 per cent of Indians live below the poverty line and in the same breath our presence in the Forbes global billionaire list is fast rising.

Our GDP has been growing at 8 per cent plus, yet if you travel 50km out of most cities in most parts of India you get the feeling that life in India is frozen in time.

You hear of starvation deaths, poor primary health care on the one hand and on the other consumer activists hanker for regulation of advertising that encourages over indulgence of food like colas, chips, burgers, chocolates, etc. We are a nuclear power but trying to improve infrastructure continues to pose a huge challenge to us.

Sometimes I feel, it is not just money, but democracy that holds us back. In a recent quarter, mergers and acquisitions are supposed to have crossed a staggering $42 billion. At market price this works out to 18 per cent of our quarterly GDP!

Last year 8.3 million Indians travelled abroad spending a whopping $7.5 billion, shopping for confectionery, perfumes, fashion accessories and alcohol in that order.

And yet we are steeped in ancient tradition, rituals bound by family ties and even our scientists are superstitious. Regular and huge salary hikes have been visible in corporate India for the last three years on the one hand, but rural incomes on the other are dependent completely on nature and monsoons.

We are building a sea link in Mumbai, yet potholes on arterial roads in metropolitan Mumbai are a common sight. We can grin and bear it all and yet you can argue that we are an intolerant lot; communal riots that destroy life and properties can spark-off with little provocation.

We are building a sea link in Mumbai, yet potholes on arterial roads in metropolitan Mumbai are a common sight. We can grin and bear it all and yet you can argue that we are an intolerant lot; communal riots that destroy life and properties can spark-off with little provocation.

Population, which was considered a noose around our necks is now our biggest asset. From a marketing point of view, we could safely consider India as a country of at least 200 million who have the purchasing power and disposable income. The most perceptible change is taking place amongst these consumers. What is accelerating the pace of change in this group are several factors.

Thanks to our age old belief that children are God-given and sex being the favourite pastime of our forefathers, we have today the youngest population in the world. So you can argue they are more open to change.

Easy accessibility of finance, not just for home loans but for cars and consumer durables with little or no security; phenomenal increase in credit cards, organized Retail boom, BPO and IT sector boom; And a media explosion, are all putting more money in people's hands accelerating, virtually forcing the consumer to change, spend more money and upgrade to a better lifestyle.

Cable and satellite TV, showing western style soaps in upmarket settings is promoting a liberal lifestyle. MTV has introduced the pop culture to the young and Discovery Travel & Living has introduced society to the finer things in life. All these are stimuli that the upper middle and higher class Indian consumer is fast responding to. Not to forget the glossy magazines which are getting launched in hordes from Marie Claire to Cosmopolitan and Vogue.

Cable and satellite TV, showing western style soaps in upmarket settings is promoting a liberal lifestyle. MTV has introduced the pop culture to the young and Discovery Travel & Living has introduced society to the finer things in life. All these are stimuli that the upper middle and higher class Indian consumer is fast responding to. Not to forget the glossy magazines which are getting launched in hordes from Marie Claire to Cosmopolitan and Vogue.

The market With this as the backdrop in which marketers and advertisers in India must operate, let us look at the market, estimated at $28.1 billion. The FMCG market is placed at $18.6 billion with food segment at 47 per cent and growing the fastest at 21 per cent. The urban market which contributes to 30 per cent of the population, contributes 67 per cent to the FMCG market and is growing at 17 per cent, bit higher than rural which is growing at 14 per cent.

With this as the backdrop in which marketers and advertisers in India must operate, let us look at the market, estimated at $28.1 billion. The FMCG market is placed at $18.6 billion with food segment at 47 per cent and growing the fastest at 21 per cent. The urban market which contributes to 30 per cent of the population, contributes 67 per cent to the FMCG market and is growing at 17 per cent, bit higher than rural which is growing at 14 per cent.

The single largest segment is biscuits at 9 per cent growing at 17 per cent followed by toilet soaps and washing powder at 8 per cent and 6 per cent growing at approximately 8 per cent.

In almost all four categories, brand choice is exploding and in many large categories from biscuits and tea to toilet soaps and toothpaste the increase in number of brands over three years is anywhere from 40 per cent to 125 per cent.

There are now 600 brands of biscuits, 500 brands of toilet soaps and 350 brands of package tea. And along with brands the brand variants, in terms of flavour, fragrance or colours is also increasing.

In biscuits the number of variants has gone up from 66 to 110. In toilet soaps from 72 to 142. Modern trade, now rapidly emerging is still minuscule with 4,650 stores, but toilet soap is available in 6 million outlets and so are biscuits.

The consumer durables market is placed at $9.5 billion. Mobile accounts for 47 per cent and growing at 21 per cent. Growth in colour television sets which was phenomenal in '80s and '90s has now petered out. But air-conditioners have taken their place, now growing at 59 per cent followed by microwave ovens at 38 percent.

Indians who were starved of choice in '60s and '70s are now, if not killed, confused by overwhelming choices available to them. If our growth rates are making the marketers' mouth water, I have a word of caution for prospective new entrants into India.

- Almost all multinationals who launched in India, have had to reorchestrate their India plans because their initial plans, conceptualised on global learnings, did not quite work in India - P&G, Coke, Kellogg's, Revlon, all learnt the hard way. You need to have your global strategies altered by intelligent local inputs.

- Distribution has turned out to be the Waterloo of most new entrants in the early years. The virtual absence of modern retail in India today makes the task extremely complex and challenging.

- To benefit from the gold mine that India is or atleast soon will be, with its billion people, you need to intelligently exploit the concept of value pricing.

- And finally India is not one country, but atleast four in terms of consumer attitudes, beliefs, habits, superstitions and spending outlook.

The media market

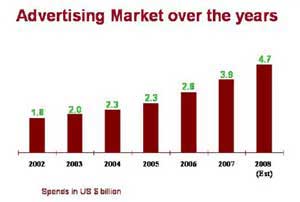

Let us peep into the Indian media world where change has been even more dramatic. Total mass media spend in 2007 was estimated at nearly $4 billion, which is less than 1 per cent of the global advertising market.

But look at our growth rates. From 10 and 12 per cent in early 2002, we are now growing at over 20 per cent and even amongst much talk about slowing down of the economy, our firm estimate is a 20 per cent further growth in 2008.

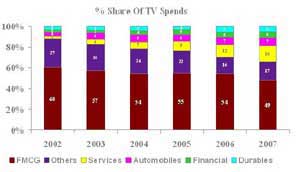

The composition of the advertising market is also rapidly changing. Television grew from virtually zero per cent in the mid-80s to almost 50 per cent of the market in 2002. But then thanks to proliferation of channels and fragmentation of viewership, has started declining and now stands at about 40 per cent.

Wonder if there is any market in the world that has as vibrant a print market as India. It contributes to as much as 48 per cent of the market - more than TV's share and in the last 5 years has infact increased its share from 43 per cent to 48 per cent. We don't have much of a story to tell in internet as yet; but in its second coming it now stands at just over 1 percent, but threatening to explode .

In terms of reach, television reaches 53 per cent, cable and satellite 32 per cent, print 20 per cent. TV homes have increased in the last five years from 82 million to 134 million and C&S as a per cent of total TV homes is at about 60 per cent and DTH at about 5 per cent.

The clutter in TV is now beginning to pose a serious challenge to advertisers. In 2007 advertisers beamed 362 million seconds of advertising, a six-fold increase over six years; mercifully the average duration of the commercial has remained more or less the same over the last six years; 20 - 23 seconds, having come down from 30 seconds in the early 90s.

At an average you have 4.5 minutes of advertising per hour across genres, but for certain genres like news and movies, the figure goes up to 9 - 15 minutes. Here is a chart that is the darling of the production community - actors, directors, broadcasting equipment manufacturers and what not, but a nightmare for the advertiser community and media agencies. At last count there were 405 channels beaming 24 x 7 in India. And to think, that in 1990 we had only five channels.

Because of this proliferation of TV channels, viewership at a programme level is declining and the rating of the topmost programme has declined from 11.45 to 4.29 and the average of top 10 from 8.34 to 2.94 over five years.

New categories are entering the advertising market, notably financial and automobiles and durables, reducing staple FMCG share of total advertising time on television from 60 per cent to 49 per cent.

In terms of print, whilst the number of titles in English are limited and so is their reach, they are expensive relative to their language counterparts and garner a major share of the print advertising pie. Mobiles are breeding faster than rabbits and the current mobile base is estimated at 296 million up from 115 million two years ago and estimated to reach a staggering figure of 500 million by 2010.

This phenomenal increase has been achieved on the back of lowering of cost of airtime to 1 ½ cents per minute and telcos are now working towards bringing it down to 1 cent per minute to reach the magical figure of 500 million. It is a matter of time, before Mobile becomes a very powerful medium for advertising, if not The Most Powerful.

Multinationals have conventionally been believers in the power of advertising. 28 per cent of the top 500 advertisers are multinationals, accounting for 48 per cent of the spend. It is significant to note that not only is the advertising pie growing but the total number of advertisers are also growing. The total number recorded has grown from 78,000 to 111,000 over two years, with the majority of them coming into print. We have observed that when a new advertiser gets in, he enters the market through print and then moves on to television.

The number of advertisers in television has also gone up, but not dramatically but one can expect that the number of 8,900 will shoot up, given the large additions coming into the print category, some of whom will graduate to TV.

The consumer

We are only just waking up to the new Indian consumer that western marketers are familiar with, who has:

- Less time

- More money

- Is more demanding

- Is more fickle

- Has a mind of his own

- Is more difficult to reach

- Is more individualistic

- Is willing to spend more money on himself

- Is more selfish and

- Is a spendthrift.

Such sweeping changes in the consumer, his outlook, his attitude and his wallet and dramatic changes in the media environment call for a major change in our approach to media planning.

At Madison, the agency I work for, our mantra for brands to beat and exploit the new environment is four-pronged:

- Use Multimedia. We have enough evidence to show that multimedia works better than single media. Yet 70 per cent of big brands in India still use single media

- Engage your consumer. Forget how many millions you are exposing your message to. Use both passive mass media and active contact media

- Reward your media partner who helps you engage rather than just expose, and

- Build media plans based on the concept of media insight which is an extension of the concept of Consumer insight.

We believe it is wasteful for media agencies to spend time and money on consumer insight which is the domain of marketing people and creative agencies.

Instead media agencies could spend time and money to unearth media insights so that the message developed based on consumer insight can be delivered at a time, and in a place and manner that is more conducive to making a brand choice decision, if not actually a purchase. I look forward to welcoming you all to India. Namaste!

Sam Balsara is currently the head of the completely Indian-owned Madison World, a Rs1,800-crore company with clients like Procter & Gamble, Coca Cola, General Motors, Cadbury's and Airtel amongst others.