The importance of sector rotation – which focuses on broad industry trends rather than the performance of specific stocks - has increased sharply in the recent years owing to the rise in exchange-traded funds, says Gagan Singla CMO of Angel Broking

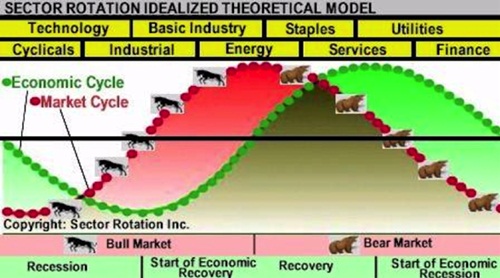

Sector rotation strategies have been in existence for a number of years in the stock market. However, their popularity has increased sharply in the recent years owing to the rise in exchange-traded funds or ETFs. This strategy is unique in a way because it aims to do away with concepts like stock picking and instead focuses on exploiting the broad industry trends. In many cases, economic data or valuation is utilised for proper distribution among different sectors. However, using momentum for the analysis of sectors has often proved to be the most effective and popular choice.

Sector Rotation in Modern Market

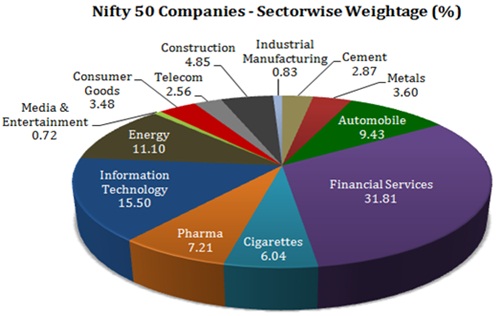

Sector rotation strategy is highly relevant today as it is crucial that the investor invests in the best possible class of assets which positions the money in such a way that it maximises gains. Hence, it pays to stay up-to-date with the latest movements in the market, while tracking the different sectors or areas and their performance.

In the sector rotation strategy, an investor picks out the specific areas that he or she thinks have the capability to outperform the rest of the market. Over the course of time, the perception of sectors has changed. While earlier, people more often had a narrow approach to the sectors of the share market, now the realm has been broadened to the sectors of the world.

ETF allows investors to move out of the stock market and enter commodities like oil, gold and treasury bonds. All these mean that now an investor can choose the best asset class and subsequently move on to another class of asset when the time is right.

Using Momentum for Sector Rotation Strategy

Many investors make the mistake of using a simple moving price window, typically between six to twelve months, to rank potential investments over a particular time period, from best to worst. However, empirical studies have proved that such an approach is highly objective and does not necessarily need a thorough knowledge of all the sectors involved. It has been noticed that there is major momentum at the industry group levels which allows the momentum-based strategies to perform better.

The outperformance of sector rotation strategy can be remarkable when considered over a long time. As momentum is a highly objective factor, one may realise high returns, but at the other end of the spectrum, there is a significant amount of risk involved too. However, the returns can be so exceptional that the added volatility is worth it from a performance point of view.

Analysis of Performance

It is true that over a long period of time outperformance can be expected, but it is also a reality that there is a strong possibility of brief periods of underperformance. This can be quite a prominent difference when compared to the broad market. The investors though should not be overly concerned with brief spells of underperformance. This is normal as during these periods the market rewards some other factors.

Under such circumstances, the investors should not panic and be patient. Apart from that, there is also a need to be disciplined in approach. The investors must understand patches of underperformance is normal when adopting a sector rotation strategy. In fact, there is perhaps no strategy in the stock market which guarantees outperformance all the time. Investors who panic in such a situation and sell may end up hampering long-term returns, as it has been noted that some of the best performances usually comes at the back of large under performances. When an individual has invested in a robust strategy such as momentum, in a systematic and a well-disciplined manner by continually focussing on capitalisation of strong sector moves, it is a safe move to hold and wait for subsequent relative rebound which is part and parcel of the strategy as whole.

If an individual has the time, interest, money and the will to outperform the market then sector rotation is perhaps the best way to do so. While approaches like factor based stock selection and market time based avoidance of economic recession are also effective methods, sector rotation is perhaps the most bankable option out of the lot that is available at this moment.