3:30 pm Market Closing: Benchmark indices closed flat on Friday as investors await March quarter earnings season that will be kicked off by Infosys next week.

The 30-share BSE Sensex was up 30.17 points at 33,626.97 and the 50-share NSE Nifty rose 6.40 points to 10,331.60.

About 1,599 shares advanced against 1,062 declining shares on the BSE.

Lupin, Titan, BPCL, HPCL, Tata Steel, Sun Pharma and Bajaj Finance were top gainers among Nifty50 stocks, rising up to 3 percent.

Infosys, Vedanta, L&T, Bharti Airtel and HCL Technologies were down up to 2 percent.

3:15 pm Market Outlook: Guggenheim Chief Investment Officer Scott Minerd sees a tough road ahead for the market and economy, with a sharp recession and a 40 percent decline in stocks looming. He warned clients that the market is on a ‘collision course with disaster,’ expects the worst of the damage to start in late 2019 and into 2020. Minerd expects the Fed to intervene to stem the crisis, but says that will only make matter worse, reports CNBC.

3:05 pm Green Nod: State-run HPCL received the environment clearance for setting up of a new LPG plant with bottling and storage facilities in East Champaran, Bihar that will entail an investment of Rs 136.4 crore.

This will be the third LPG plant in the state. Currently, Hindustan Petroleum Corporation Ltd (HPCL) has only two LPG plants in Bihar at Patna and Purnia with a bottling capacity of 50,000 cylinders per day.

As per the proposal, the HPCL wants to construct mounded storage vessels with a capacity of 1,050 tonnes and bottling capacity of 120 tonnes per annum in an area of 30 acres in Panapur and Kubeya villages in East Champaran district.

2:58 pm Pump stocks rally: Shakti Pumps rallied 15 percent. Roto Pumps gained 8 percent.

2:48 pm Buzzing: Shares of Ballarpur Industries surged 12 percent intraday as the company is going to sell entire assets of its Malaysian unit, Sabah Forest Industries Sdn Bhd.

A sale and purchase agreement has been entered into between Sabah Forest Industries Sdn. Bhd. and Pelangi Prestasi Sdn. Bhd. for the sale of entire assets (including procurement of fresh timber licenses from the State Government of Sabah) of Sabah Forest Industries Sdn. Bhd for consideration of RM 1.2 billion ( approximately USD 310 million).

2:35 pm RCom allows to proceeds with asset monetisation: Reliance Communications said as directed by the Supreme Court, the company moved the NCLAT today for vacation of the stay in relation to sale of its tower and fiber assets. The SC had itself vacated the stay in relation to spectrum, MCNs and real estate yesterday.

By an interim order passed today, the NCLAT has vacated the remaining stay, and allowed execution of sale deeds and deposit of the proceeds with SBI in an escrow account.

Based on these orders, the company can now proceed with completion of its entire asset monetisation plan, covering spectrum, towers, fiber, MCNs and real estate.

RCom is now very confident of achieving overall debt reduction of approximately Rs. 25,000 crore within the next few weeks, from its asset monetisation programme.

2:25 pm Buzzing: Amtek Auto share price is locked at 5 percent upper circuit at Rs 22.25 after the Committee of Creditors (CoC) approved resolution plan submitted by Liberty House, the part of Sanjeev Gupta's global industrial group GFG Alliance.

The auto ancillary company informed exchanges on Thursday that the Committee of Creditors of Amtek Auto has approved the resolution plan submitted by Liberty House Group Pte Ltd. through e-voting process.

The e-voting process was held during April 4-5, after the meeting of Committee of Creditors held on Monday, April 2.

2:15 pm Gainers: Titan Company, BPCL, HPCL, Lupin and Sun Pharma are biggest gainers, rising up to 4 percent.

HDFC Bank, ITC, Bajaj Finance, IOC, Tata Motors and Reliance Industries were up 0.2-0.9 percent.

2:08 pm Market Update: Benchmark indices continued to consolidate around previous day's closing values amid US-China trade war. Investors await corporate earnings that will begin next week.

The 30-share BSE Sensex was down 19.86 points at 33,576.94 and the 50-share NSE Nifty fell 13.80 points to 10,311.40.

About 1,405 shares advanced against 1,093 declining shares on the BSE.

2:01 pm Crude Update: Oil prices fell after US President Donald Trump's threat of new tariffs on China reignited fears of a trade war between the world's two biggest economies.

President Trump said on Thursday he had ordered US trade officials to consider tariffs on USD 100 billion more of imports from China, escalating tensions with Beijing.

Brent crude for June delivery was down 0.5 percent, at USD 67.99 per barrel while US West Texas Intermediate crude for May delivery was down 0.5 percent, at USD 63.22 a barrel.

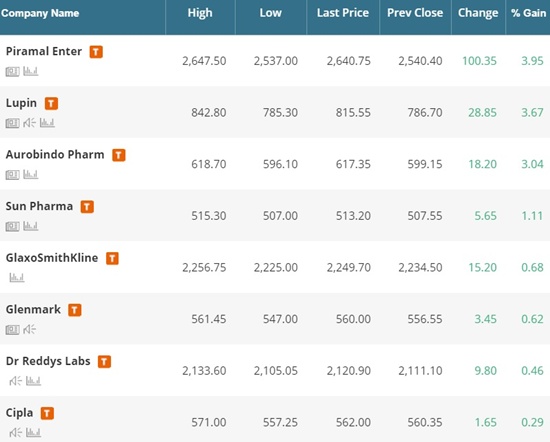

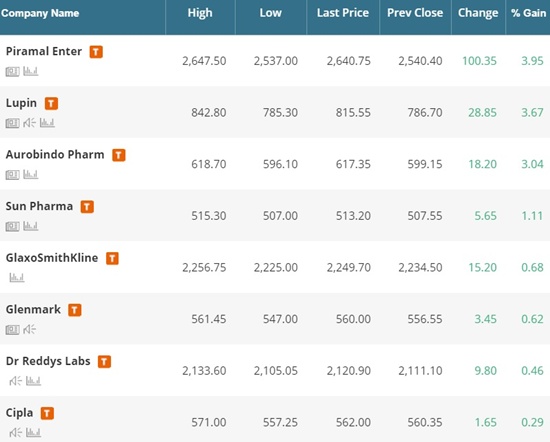

1:50 pm Pharma Stocks in Focus after USFDA approved Lupin's plant:

1:40 pm Losers: Metals, IT and select auto stocks are under pressure.

Infosys, Vedanta, L&T, Bharti Airtel, TCS, Axis Bank, HUL, Maruti Suzuki, M&M, Grasim, HCL Technologies and IndusInd Bank were negative contributors to Nifty's loss.

1:28 pm Budget Session: Disruptions led to loss of more than 127 hours of the Budget session in the Lok Sabha with just about 0.58 percent of starred questions answered during 29 sittings before the House adjourned sine die today.

Protests by members from various parties on diverse issues marred proceedings almost every day during the two-phase Budget session. The second leg of the session, that started on March 5, had 22 sittings that were mostly disrupted. In her summary report, Speaker Sumitra Mahajan said the House functioned for a total of 34 hours and 5 minutes during

the 29 sittings.

A total of 127 hours and 45 minutes were affected due to "interruptions and forced adjournments". Around 9 hours and 47 minutes went in to transact urgent government business, Mahajan said.

According to her, out of the 580 starred questions, answers were given to 17 of them in the floor of the House and this translates to "0.58" questions being answered on an average every day.

1:15 pm Videocon Case: The CBI questioned Rajiv Kochhar, ICICI Bank MD and CEO Chanda Kochhar's brother-in-law, for the second day in connection with the bank's Rs 3,250 crore loan to Videocon Group in 2012, officials here said.

Rajiv Kochhar, who was asked to appear at the CBI office in Mumbai, was examined about the loan and his links with Venugopal Dhoot, the promoter of the Videocon Group, and Videocon, they said.

He was detained at the Mumbai airport yesterday, as he was trying to board a flight for a South East Asian country, on the basis of a look out circular issued by the CBI, they said.

He was questioned by the CBI yesterday as well after his detention at the airport.

1:05 pm Record High: Jubilant Foodworks, the master franchise for Domino's Pizza in India, Nepal, Sri Lanka and Bangladesh, and also for Dunkin' Donuts in India, hit fresh record high of Rs 2,428.40, rising as much as 4 percent.

12:55 pm Trading in Illiquid stocks: With an aim to safeguard investors' interest, leading stock exchanges -- BSE and NSE -- have advised their members to take extra caution while trading in as many as 194 illiquid stocks.

Illiquid stocks are the ones which cannot be sold easily because they see limited trading. These stocks pose higher risks to investors because it is difficult to find buyers for them as compared to frequently traded shares.

In similar-worded circulars, both the exchanges advised their trading members "to exercise additional due diligence while trading in these securities either on own account or on behalf of their clients."

BSE and NSE have listed out 186 and 8 illiquid stocks, respectively, where additional due diligence is required.

Illiquid scrips listed by both the exchanges, include Bilpower, Creative Eye, Euro Multivision, GI Engineering Solutions, Jaihind Projects, Usha Martin Education & Solutions, Quintegra Solutions and Radaan Mediaworks India Ltd.

These scrips will be traded in periodic call auction mechanism from April 9, the exchanges noted.

12:45 pm Market Update: The market remained in a tight range, with the Nifty hovering around 10,300 levels amid ongoing US-China trade war.

The 30-share BSE Sensex was down 14.92 points at 33,581.88 and the 50-share NSE Nifty fell 12.20 points to 10,313.

The market breadth remained positive as about 1,410 shares advanced against 992 declining shares on the BSE.

Pharma index extended gains, rising over a percent as Lupin gained 4 percent after receiving an establishment inspection report for Pithampur unit from the US drug regulator.

12:35 pm Europe Update: European markets opened lower, as an escalating trade standoff between the world's biggest economies appeared to rattle investors.

The pan-European Stoxx 600 was 0.5 percent lower shortly after the opening bell, with almost all sectors and major bourses in negative territory.

12:29 pm Results Date: Mindtree said the meeting of the board of directors will be held on Wednesday, April 18 to consider the audited financial results of the company for the quarter and year ended March 31, 2018, and to consider declaration of interim dividend, if any and also the recommendation of final dividend, if any, amongst other matters.

The record date for payment of interim dividend, if approved, will be April 26, 2018.

12:15 pm PNB Fraud: The Delhi High Court sought the Enforcement Directorate's response on a plea by diamantaire Mehul Choksi's firm Gitanjali Gems in a money laundering case in connection with the over Rs 11,000 crore Punjab National Bank (PNB) fraud case.

Justices S Muralidhar and I S Mehta issued notice to the ED, which was represented through advocate Amit Mahajan, on the plea challenging the alleged illegal seizure of documents and articles by the probe agency.

The court said it will hear the matter along with a similar pending plea of billionaire Nirav Modi's firm Firestar Diamond on April 11.

Advocate Sanjay Abott, appearing for Gitanjali Gems, sought direction to quash the ED's move of seizing the firm's moveable properties.

12:05 pm Asia Update: Asian stocks traded mixed, as the overnight rally on Wall Street failed to translate after President Donald Trump indicated that more tariffs against China could be in the works.

Trump said late on Thursday during US hours that he has told US trade officials to consider USD 100 billion in extra tariffs against China. The president added that the move would be appropriate given China's "unfair retaliation," although he left the door open for negotiation.

US Trade Representative Robert Lighthizer said those additional tariffs would not be implemented until a public comment process was concluded.

11:55 am Buzzing: Shares of Sona Koyo Steering Systems plunged as much as 9 percent after the company set Rs 85 as the floor price for the offer of sale of its equity shares that began today.

The company in a regulatory filing said, JTEKT Corporation proposes to sell up to an aggregate of 35,14,879 equity shares representing 1.77 percent of the total paid up equity share capital of the company on April 6, (for non-retail investors) and on April 9 (for retail investors).

The floor price of the offer stood at Rs 85 per equity share, the filing added.

The issue will be opened for non-retail investors today and for retail investors on April 9. The floor price was 13.39 percent discount to the closing price of April 5 at Rs 98.15 on the BSE.

11:45 am Market Update: The market continued to consolidate as investors after digesting RBI policy await corporate earnings that will start next week.

The 30-share BSE Sensex was up 5.86 points at 33,602.66 and the 50-share NSE Nifty fell 6.30 points to 10,318.90.

About 1,315 shares advanced against 1,001 declining shares on the BSE.

Pharma stocks outperformed, with the Nifty Pharma index rising a percent led by Lupin that gained 4 percent on establishment inspection report for Pithampur unit-I from US FDA.

11:30 am Workers' Strike: TTK Prestige informed exchanges that the workmen at Roorkee unit in Uttarakhan have gone on strike which is considered illegal as the conciliation proceedings are still going on.

It may be noted that this disruption is not likely to have any material impact on the company's business in the short run as the company is carrying adequate stocks and has alternative manufacturing options, it said.

11:20 am Foray into Defence: Himachal Futuristic Communications (HFCL), a telecom solutions provider, announced its entry into defence manufacturing in 2016, to participate in the Government's "Make in India" initiative.

Since then, the company has obtained several industrial licences for manufacturing defence products such as electronic fuses, electro optical devices, UAVs, radars, electronic warfare and communication equipment.

The company is collaborating with leading global original equipment manufacturers (OEMs) to indigenously manufacture the above mentioned equipment.

11:10 am Market Update: Benchmark indices were mildly lower amid consolidation as investors after pricing in RBI policy await corporate earnings that will start next week.

The 30-share BSE Sensex was down 63.06 points at 33,533.74 and the 50-share NSE Nifty fell 27 points to 10,298.20.

About 1,305 shares advanced against 933 declining shares on the BSE.

11:01 am Buzzing: Shares of Lupin advanced 7 percent as company received the EIR from USFDA.

The company has received the establishment investigation report (EIR) from USFDA for the successful inspection of its Pithampur, Unit 1.

The inspection was conducted in July 2017.

Nilesh Gupta, Managing Director, Lupin said, "The successful outcome of this inspection is encouraging, and further validates our commitment to meeting global manufacturing standards.”

10:50 am Rupee Trade: The rupee fell 5 paise to 65.01 against the US dollar at the Interbank Foreign Exchange market.

Yesterday, the rupee had ended higher by 18 paise at 64.97 against the US dollar after the Reserve Bank lowered its inflation forecast and revised up its growth outlook.

10:38 am Acquisition: Datamatics Global Services Corp said its step down subsidiary has acquired 75 percent stake in RJ Globus Solutions Inc, a voice based BPO company headquartered in Manila, Philippines.

The balance 25 percent shares will be acquired in the year 2019 and 2020 based on the financial performance of the target company, it added.

10:25 am Market Outlook: The valuations appear much reasonable and many stocks are providing opportunities for investors to buy in the midcap space, S Krishna Kumar, CIO-Equity at Sundaram Mutual Fund said in an interview with CNBC-TV18.

Commenting on the valuations, Kumar said that valuations have become reasonable compared to levels what we were trading back in November and December.

While valuations have corrected with price, the economic fundamentals have become better and corporate earnings have been rising led by various small & midcaps which have been doing consistently well for the past 1 year, he said.

“We are seeing sharp rebound in earnings growth and most of the stocks are back to decent valuation and provide good entry opportunity with a medium-term perspective in mind,” explains Kumar.

10:15 am Listing on Monday: Hospitality chain Lemon Tree Hotels is set to debut on bourses on April 9, 2018.

The issue was subscribed 1.19 times during March 26-28, 2018.

The IPO to mop-up Rs 1,038.68 crore received bids for 15.49 crore shares against the total issue size of 12,98,35,580 shares.

The segment meant for qualified institutional buyers (QIBs) was subscribed 3.89 times while non-institutional investors and retail investors subscribed 12 percent each.

The company's IPO is of up to 185,479,400 shares (including anchor portion of 55,643,820 shares). Price band for the issue was at Rs 54-56 per share.

Lemon Tree Hotels has raised Rs 311 crore from anchor investors.

10:05 am Buzzing: Share price of Kridhan Infra rose 5 percent as company won order worth Rs 1,340 million in Singapore.

The company's subsidiary KH Foges Pte has been awarded a new piling contract, in Singapore, worth Rs 1,340 million (SGD 27 million).

The contract period for the project is approximately 4 months.

9:57 am Order Win: On top of the orderbook of Rs 17,653 crore as of December'17, Simplex Infra has procured further orders worth Rs 2,595 crore in the fourth quarter from January to March'18.

With this the total order inflow during FY18 amounts to Rs 7,666 crore.

The new orders have emanated 87 percent from public sector and 13 percent from private sector, 98 percent from Domestic territories and 2 percent from abroad.

The construction verticals that have contributed to the new order inflow during FY18 are urban infrastructures 29 percent, power generation 13 percent, power transmission 6 percent, institutional buildings 10 percent residential buildings 8 percent, roads and bridges 18 percent, marine construction 9 percent, piling 5 percent and industrial construction 3 percent.

9:52 am Market Update: The market is mildly lower amid consolidation, with the Nifty hovering around 10,300 levels following muted Asian cues.

Sectoral trend is also mixed, with Nifty PSU Bank index falling over a percent after banking fraud reported in Diamond Power Infrastructure.

9:42 am Buzzing: Share price of Binani Industries gained 8 percent as the company filed an application to terminate CIRP of its subsidiary.

The company filed an application for termination of the company insolvency and resolution proceedings (CIRP) of its subsidiary Binani Cement.

Binani Industries has received an offer from the Aditya Birla group firm UltraTech to transfer its 98.43 percent stake in Binani Cement (BCL) for Rs 7,266 crore.

However, the deal was subject to ending the insolvency proceedings against BCL, whose Credit of Creditors (CoC) led by Bank of Baroda has approved Rs 6,350 crore bid from Dalmia Bharat group's wholly-owned subsidiary, Rajputana Properties.

9:32 am Acquisition: HCL Technologies announced the acquisition of C3i Solutions, a leader in multi-channel customer engagement services for the life sciences and consumer packaged goods (CPG) industries, from Merck & Co., Inc., Kenilworth, New Jersey, USA (known as MSD outside of the United States and Canada).

With this acquisition, HCL will complement its broad-based IT and business services capability with the additional depth that C3i has in the life sciences and CPG verticals.

9:22 am Sobha in Focus: Sobha has registered new sales volume of 3.63 million square feet, total valued at around Rs 2,861 crore at an average price realisation of around Rs 7,892 per square feet at the close of financial year 2017-18 (Sobha Share of sales value at around Rs 2,422 crore, at an average price realisation of Rs 6,680 per square feet .

Annual sales volume and values are up by 21 percent and 42 percent respectively.

For the fourth quarter, the Company has achieved new sales volume of 1.02 million square feet, total valued at Rs 812 crore at an average price realisation of Rs 7,993 per square feet (Sobha Share of sales value at Rs

656 crore, at an average price realisation of Rs 6,457 per square feet). Sales volume and values are up by 40 percent and 31 percent respectively as compared to corresponding quarter of last year and are up by 9 percent and 7.5 percent as compared to preceding quarter.

Image2642018

9:18 am Coal Production Target: With an assessment suggesting the current trend may not warrant pursuing the projected coal output target of 1 billion tonnes by 2020, the government today gave indication of revising the production target of the dry fuel.

"We have hired KPMG for this study. The moment recommendations come we will see whether it (one billion production target) is needed by 2020. ...it appears that much coal is not needed. Why should Coal India produce it?" Coal Secretary Susheel Kumar told reporters here.

The government had earlier set a target of 1 billion tonnes of coal output by FY2019-20 for Coal India (CIL).

"So we will have to see when the country needs that much (of coal) ...when Coal India needs to produce that much and that will be the year in which this (production target) will be re calibrated," the secretary stressed.

CIL accounts for over 80 percent of domestic coal production.

9:15 am Market Update: Benchmark indices started off last day of the week on a flat note, following tepid Asian cues.

The 30-share BSE Sensex was down 7.48 points at 33,589.32 and the 50-share NSE Nifty fell 8.20 points to 10,317.

IOC, Indiabulls Housing, HCL Technologies, ONGC, Bajaj Finserv, GAIL and Yes Bank gained up to 1 percent.

SBI, Tata Steel, Vedanta and Tata Motors were under pressure.

The Nifty Midcap index was down 0.1 percent.

Sobha surged 7.6 percent on pre-sales data. Kridhan Infra, GM Breweries, Ballarpur Industries, Tilaknagar Industries, United Spirits, McDowell Holdings, Smartlink Network, Reliance Communications, Binani Industries and DB Realty up 8 percent.

Sona Koyo, Magma Fincorp and D-Link fell up to 7 percent.

9:10 am Pre-Opening trade settled: The Sensex was up 11.79 points at 33,608.59 while the Nifty fell 2.40 points to 10,322.80.

9:07 am Technical Recommendations: Moneycontrol spoke to IIFL and here’s what they have to recommend:

Exide Industries Ltd: BUY| Target 260| Stop Loss 224| Returns 10%

Kotak Mahindra Bank Ltd: BUY| Target 1240| Stop Loss 1057| Returns 11%

Bajaj Finserv Ltd: BUY| Target 6098| Stop Loss 5125| Returns 12%

9:05 am Bond Yield: The 7.17 percent 2028 10-year bond yield opened higher at 7.18 percent on Friday.

It increased 5 basis points compared to previous day's closing of 7.13 percent.

9:03 am Stocks In News: Reliance Communications: The company hopes to cut debt by Rs 25,000 crore after SC allows asset sale

Eros International: The company has partnered Royal Challengers Bangalore as title sponsor

Also Watch: Markets@Moneycontrol: Nifty likely to open flat; 3 stocks which can give up to 12% return

Tata Motors: the company launched three CVs in Malaysia

Glenmark Pharma: The pharma major has recalled over 1 lakh bottles of anti-inflammatory drug in US

Larsen & Toubro: SFIO has received a complaint against L&T Group of financial irregularities, ET Now reported.

Indian Oil Corporation: Acquires 17 percent participating interest in the Mukhaizna Oil Field, Oman from Shell

HCL Technologies acquires life sciences and consumer services provider C3i solutions

9:01 am Market Check: Benchmark indices were flat in pre-opening trade, which was in line with muted Asian cues and the trend indicated by SGX Nifty futures.

The 30-share BSE Sensex was down 0.48 points at 33,596.32 and the 50-share NSE Nifty rose 6 points to 10,331.20.

The SGX Nifty futures were trading down 16 points at 10,340-level on the Singapore Stock Exchange.

The Dow and the S&P 500 posted gains for a third day in a row on Thursday, the longest streak in about a month, as investors’ worries of an escalating trade conflict between the United States and China eased and their focus on upcoming earnings grew.

The Dow Jones Industrial Average rose 240.92 points, or 0.99 percent, to 24,505.22, the S&P 500 gained 18.15 points, or 0.69 percent, to 2,662.84 and the Nasdaq Composite added 34.45 points, or 0.49 percent, to 7,076.55, Reuters reported.

Asian markets were trading mixed after US President Donald Trump proposed additional tariffs on China, aggravating trade tensions and smothering a revival in broader investor risk appetite. MSCI’s broadest index of Asia-Pacific shares outside Japan lost 0.25 percent, said a report.