Sensex ends over 300 points lower, Nifty ends above 9700; metals crack

11 Aug 2017

3:30 pm Market at Close: Benchmark indices ended the session and the week on a negative note, with indices seeing big cuts in the day's trade.

The Sensex closed down 317.74 points at 31213.59, while the Nifty ended lower by 109.45 points at 9710.80. The market breadth was negative as 1,003 shares advanced against a decline of 1,525 shares, while 135 shares were unchanged.

Dr Reddy's Labs, Tata Motors DVR and Aurobindo Pharma gained the most on both indices, while State Bank of India, M&M, Hindalco and Vedanta were the top losers.

2:58 pm Earnings: TVS Motor Company missed analysts' expectations on profit and operational front but revenue beat estimates on Friday. Profit grew by 6.8 percent year-on-year to Rs 129.5 crore due to higher revenue but weak margin limited growth.

Revenue during the quarter increased 19 percent to Rs 3,743 crore compared with same quarter last year.

Operating profit was up 5.5 percent year-on-year at Rs 211.4 crore but margin contracted by 70 basis points to 6.2 percent in the quarter ended June 2017.

Profit was estimated at Rs 183 crore and operating profit was expected at Rs 281 crore with margin at 8 percent for the quarter, according to average of estimates of analysts polled by CNBC-TV18.

2:45 pm Black Friday: Benchmark indices remained under pressure as the Sensex was down 345.85 points or 1.10 percent at 31,185.48 and the Nifty fell 119.05 points or 1.21 percent to 9,701.20.

The broader markets outperformed benchmarks as the BSE Midcap and Smallcap indices declined 0.7 percent each.

About 1,689 shares declined against 732 advancing shares on the BSE.

2:30 pm Interview: United Breweries saw a stable set of earnings in Q1.

Q4 was impacted by demonetisation and anticipation of the highway ban on liquor. Highway ban has had a severe impact in a few states, Shekhar Ramamurthy, MD said in an interview to CNBC-TV18.

Our shares are very strong, our premium brands are doing well that initiated very measures to control our cost so all that is coming together, that is why you are seeing growth in both revenues and margins, he added.

25 percent of outlets across the country are still closed. It will become clearer in the next three-six months, which way the margins will go, said Ramamurthy.

Talking about the impact of highway ban on volumes, he said he needs to assess the impact going ahead.

According to him, industry will start seeing mid-single digit growth. 5-6 percent of industry growth is expected going forward. ''We hope to grow a little bit ahead of that,'' he added.

The company had launched a lot of brands in Q1FY18.

2:15 pm Earnings: Aluminium major, Hindalco reported a fall of 1.6 percent in its June quarter net profit at Rs 290 crore against Rs 294 crore reported during the same period last year. The company reported one-time loss of Rs 104.4 crore for the quarter as well. The profit figure came in lower than the analysts' poll number of Rs 383 crore.

The standalone revenue was higher by 27.5 percent at Rs 10,407 crore against Rs 8,159 crore in the previous year.

On an operating level, the company reported a profit fall of 2 percent at Rs 1,148 crore against Rs 1,125 crore in the June quarter of 2016. Meanwhile, the operating margin came in at 11.75 percent against 14.8 percent year on year.

2:02 pm Market Check: Benchmark indices extended losses in afternoon following further fall in European peers.

The 30-share BSE Sensex was down 347.46 points or 1.10 percent at 31,183.87 and the 50-share NSE Nifty tanked 118.75 points or 1.21 percent to 9,701.50.

About two shares declined for every share rising on the BSE.

European stocks moved sharply lower as geopolitical tensions over North Korea intensified. France's CAC and Britain's FTSE were down over 1 percent.

1:35 pm Buzzing: Shares of MEP Infrastructure Developers gained 9 percent intraday as it has received letter of acceptance from NHAI.

The company has received the letter of acceptance (LOA) from National Highways Authority of India (NHAI) as the company has been appointed as the contractor for the project of collection of user fee through user fee collecting agency at Paduna fee plaza at NH-8 in the state of Rajasthan.

The company has received user fee collection rights at Paduna fee plaza for the period of 3 months.

The operations will commence on August 17, 2017 after complying the statutory formalities viz. submission of performance security, signing of contract as per the LOA.

The company has to remit on a daily basis Rs 29,70,000 to NHAI for a period of 3 months towards user fee collection for the said project.

1:12 pm Earnings: State Bank of India's first quarter profit jumped three-fold to Rs 3,032 crore from Rs 1,046 crore on year-on-year basis.

Numbers were better than analysts' expectations. Profit was estimated at Rs 2,485.3 crore for the quarter, according to average of estimates of analysts polled by CNBC-TV18.

SBI has reported NPA figures on standalone basis.

Gross NPA increased to Rs 1.88 lakh crore from Rs 1.12 lakh crore and net NPA jumped to Rs 1.07 lakh crore from Rs 58,277 crore on sequential basis.

Gross NPAs rose to 9.97 percent from and net NPA jumped to 5.97 3.71

State Bank of India earnings included numbers of associate banks that merged from April 1, 2017.

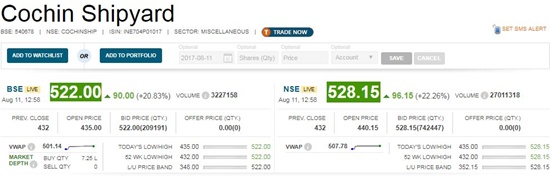

12:58 pm Cochin Shipyard update:

12:44 pm All sectoral indices barring PSU Bank traded lower in afternoon trade.

PSU Bank index gained 0.5 percent ahead of earnings from country's largest lender SBI due later today.

All eyes are its asset quality of the bank.

12:37 pm Market Update: Benchmark indices extended losses due to weak Europe opening.

The Sensex was down 244.73 points at 31,286.60 and the Nifty declined 75.80 points to 9,744.45 but the broader markets outperformed after 3-day fall.

The BSE Midcap index was up 0.4 percent and the advance:decline ratio also improved. About three shares declined for every share rising on the BSE against the ratio of 8:1 in early trade.

European markets opened lower as France's CAC and Germany's DAX fell 0.6 percent each.

12:25 pm Buzzing: MEP Infra rallied 7 percent on letter of acceptance from NHAI to collect user fee at NH-8.

12:14 pm Earnings Estimates: Healthcare major Sun Pharmaceutical Industries is expected to post weak set of earnings on Friday for the quarter quarter ended June 2017, due to pricing pressure in US (that contributes 45 percent to total revenue), Halol remediation and GST implementation in India (accounted for 26 percent of sales).

Profit is seen falling 44 percent year-on-year to Rs 1,144 crore and revenue may drop 14 percent to Rs 7,096 crore in Q1, according to average of estimates of analysts polled by CNBC-TV18.

Operating profit is likely to crash 40 percent to Rs 1,744.5 crore and margin may contract 1,080 basis points to 24.6 percent compared with same quarter last year.

12:00 pm Results: TTK Prestige has posted a consolidated profit of Rs 135.6 crore in Q1 against Rs 21.7 crore in same quarter last year, driven by one-time gain of Rs 129 crore.

Revenue increased 1.2 percent to Rs 384 crore while operating profit was up 0.3 percent at Rs 47.1 crore and margin contracted to 12.3 percent from 12.4 percent YoY.

11:48 am Poll: Aluminium major Hindalco Industries' standalone profit is expected to increase 30 percent year-on-year to Rs 383 crore in the quarter ended June 2017. It may be partly supported by lower interest cost.

Revenue from operations may jump 32 percent to Rs 10,030 crore in April-June quarter compared with Rs 7,597.35 crore in same quarter last fiscal.

However, operating profit is seen falling at Rs 1,215 crore from Rs 1,231.7 crore and margin may shrink to 12.1 percent from 16.2 percent on year-on-year basis, according to average of estimates of analysts polled by CNBC-TV18.

Hindalco results will be supported by the LME rally. LME aluminum and copper prices increased 20 percent YoY. Aluminum physical premiums also increased during the quarter.

11:40 am Earnings: Cadila Healthcare's Q1 numbers missed analysts' expectations as profit plunged 65.3 percent year-on-year to Rs 138.4 crore and revenue was down 4.5 percent at Rs 2,229 crore.

Profit was estimated at Rs 340 crore for the quarter, according to analysts polled by CNBC-TV18.

Operating profit was at Rs 277.3 crore and margin at 12.6 percent against estimates of Rs 499 crore and 19.4 percent, respectively.

11:30 am Market Expert: Rahul Shah, VP- Equity Advisory at MOSL believes markets look good in near term, recent correction of 2.5 percent on Nifty augurs well for investors.

Good monsoon, improving macroeconomics and GST all augurs well for the market . It's Just a small break in the party , but party is still on!, he feels.

11:10 am Market Check: Market Check: Benchmark indices recouped some early losses, led by technology and pharma stocks.

The 30-share BSE Sensex was down 205.93 points or 0.65 percent at 31,325.40 and the 50-share NSE Nifty fell 71.20 points or 0.73 percent to 9,749.05.

Infosys gained further, up 0.6 percent while SBI rebounded from early losses, up 0.5 percent ahead of earnings due later today.

Healthcare stocks, the most beaten down in recent correction, saw some short covering as Dr Reddy's Labs, Sun Pharma and Lupin gained nearly 1 percent.

Selling continued in HDFC Bank, Reliance Industries, Asian Paints, L&T, Maruti Suzuki, Adani Ports and ONGC fell up to 2 percent.

10:55 am Earnings Estimates: Country's largest lender State Bank of India is set to announce its consolidated earnings (along with other banking subsidiaries) today. Profit is expected to grow a whopping 394.2 percent to Rs 2,485.3 crore in the quarter ended June 2017, compared with Rs 502.9 crore in same quarter last year.

Net interest income, the difference between interest earned and interest expended, is likely to increase 3.7 percent year-on-year to Rs 18,767.2 crore in Q1.

Analysts feel lower trend of slippages (Rs 10,368 crore in Q4FY17) will be seen positive. If net interest margin comes above 2.8 percent then that will also be positive.

10:45 am Market Outlook: The market has been falling sharply for the fourth consecutive session, which was warranted after one-way rally seen since February.

Geopolitical tensions and the release of list of 331 shell companies by SEBI caused selling pressure.

The market has been waiting for this correction for long time, especially after one-way rally but it is very difficult to figure out the bottom, Hiren Ved, Director & CIO, Alchemy Capital Management said in an interview with CNBC-TV18.

He sees lot of opportunities in current correction.

Geopolitical tensions surrounding around North Korea is not expected to escalate further, he feels. It will be short term impact on markets, according to him.

10:30 am Market Check: Equity benchmarks recouped some losses from day's low, though it continued to see selling pressure for fourth day.

The 30-share BSE Sensex was down 220.24 points at 31,311.09 while the 50-share NSE Nifty fell 71.30 points at 9,748.95.

10:15 am Earnings Estimates: Public sector lender Bank of Baroda's first quarter profit is expected to increase 8.4 percent year-on-year to Rs 459.3 crore compared with Rs 423.6 crore in same quarter last year.

Net interest income is likely to rise 4.4 percent to Rs 3,519.6 crore from Rs 3,371.1 crore on year-on-year basis.

Slippages and operating profit growth will be key factors to watch out for. Slippages from restructured book will be seen closely. At the end of March 2017, restructured book was at Rs 10,785 crore.

Analysts said if slippages fall below Rs 3,500 crore (against Rs 4,077 crore in Q4FY17) and gross non-performing assets come below 10.7 percent (10.46 percent) then that will be positive.

Low cost deposit flow may remain strong in June quarter.

10:00 am New listing: Cochin Shipyard started off trade at Rs 466 today, higher by 8 percent over issue price.

The stock immediately crossed Rs 500 level, which was on expected lines after strong subscription of 76 times.

It was trading at Rs 528, up 22 percent.

9:50 am Pre-opening for new entrant: Cochin Shipyard share price settled at Rs 440 on the National Stock Exchange, up 1.85 percent over its issue price of Rs 432.

9:38 am Buzzing: Shares of J Kumar Infraprojects and Prakash Industries were locked at 20 percent lower circuit in the opening trade on Friday.

These shares traded for the first time today after they were banned for trading on SEBI order since Tuesday.

On Thursday evening, the Securities and Appellate Tribunal (SAT) has stayed SEBI's order against J Kumar Infra & Prakash Industries, which were among the 331 companies that the market regulator had suspected as 'shell' companies.

9:30 am Nifty Bank dropped 200 points as Federal Bank, PNB, IDFC Bank, ICICI Bank, Canara Bank, IndusInd Bank and Bank of Baroda were down 1-3 percent.

9:25 am Stocks at Day's low: Syndicate Bank, L&T Finance Holdings, M&M Financial, Bajaj Finance and Manappuram Finance fell up to 5 percent.

9:15 am Market Check: Equity benchmarks fell sharply in opening trade, with the Sensex losing more than 300 points and the Nifty trading near 9,700 level.

The 30-share BSE Sensex was down 287.79 points or 0.91 percent at 31,243.54 and the 50-share NSE dropped 93.55 points or 0.95 percent at 9,726.70.

Power Grid, Tech Mahindra and Wipro were only gainers among Nifty stocks.

The broader markets fell more than benchmarks as the BSE Midcap and Smallcap indices were down nearly 2 percent each.

About 11 stocks declined for every share rising on the NSE.

J Kumar Infra and Prakash Industries fell 20 percent each after beginning of trade for first time in last four consecutive sessions.

JP Associates, Indo Count, Balaji Telefilms, SCI and Indo Amines fell up to 6 percent. However, Gujarat Gas and MOIL rallied 4 percent after earnings.