Sensex ends over 350 points lower, Nifty closes below 9850; ITC, RIL fall

18 Jul 2017

3:30 pm Market at Close: Benchmark indices ended the session on a weaker note, with the Nifty closing below 9900-mark.

The Sensex closed down 363.79 points at 31710.99, while the Nifty ended 86.95 points down at 9829.00. The market breadth was negative as 1,006 shares advanced against a decline of 1,677 shares, while 143 shares were unchanged.

ITC, Reliance and GAIL lost the most on both indices, while Asian Paints, BHEL and Eicher Motors gained the most.

Midcaps had a weak session, with the Nifty Midcap index fell over half a percent, but FMCG index fell over 6 percent.

3:19 pm FII View: Sakthi Siva of Credit Suisse said July so far is associated with a further 0.9 percent upgrade to 2017 consensus EPS. This is now the 13th consecutive month of upgrades to 2017 consensus EPS, she added.

"If we assume upgrades continue and we track MSCI Asia Ex-Japan's performance in 2004, there appears to be a further 14 percent potential upside," she said.

Siva further said, "While the last 5 years has been associated with slowing return on equities and a de-rating of price-to-book value, our third blue sky scenario assumes a re-rating of P/B to 10 percent above its historical average as RoE rises towards its longer-term historical average which suggests 15 percent upside potential."

3:10 pm Buzzing: VST Industries shares tumbled nearly 8 percent intraday after the GST Council headed by Finance Minister Arun Jaitley raised the specific cess on cigarettes in all categories below 75 mm.

While downgrading the stock to hold with a target price of Rs 3,430, ICICI Securities said it believes this would increase the blended tax incidence per stick from Rs 2.3 to Rs 2.9.

The government, on Monday, has kept the GST rate of 28 percent and cess of 5 percent for the below 75 mm category and raised the specific cess per stick from Rs 1.59 to Rs 2.17 on below 65 mm category, from Rs 2.12 to Rs 2.84 for regular size category.

The research house believes the change will increase the indirect tax incidence on the company significantly by 29 percent.

2:58 pm Market Update: Equity benchmarks extended losses in last hour of trade, with the Sensex down 358.11 points or 1.12 percent at 31,716.67 and the Nifty down 90.60 points or 0.91 percent at 9,825.35.

2:50 pm Earnings: HT Media today reported a 47.21 percent jump in consolidated net profit at Rs 57.78 crore for the first quarter ended June 30.

The company had posted a net profit of Rs 39.25 crore in the April-June quarter of the previous fiscal.

Total income during the quarter under review went down by 1.54 percent to Rs 652.18 crore from Rs 662.43 crore a year- ago, the company said in a BSE filing.

HT Media's total expenses in the first quarter of the current fiscal were at Rs 570.52 crore, down 5.62 per cent, as against Rs 604.54 crore in the same quarter a year-ago.

2:35 pm Market Check: Equity benchmarks continued to reel under selling pressure, weighed by index heavyweights ITC and Reliance Industries.

The 30-share BSE Sensex was down 245.56 points or 0.77 percent at 31,829.22 and the 50-share NSE Nifty fell 55.20 points or 0.56 percent to 9,860.75 on weak market breadth.

About three shares declined for every share rising on the BSE.

ITC, Jubilant Foodworks, Grasim Industries, Reliance Industries, Axis Bank and Power Grid were most active shares.

2:20 pm Market Outlook: According to Ashwini Agarwal, Co-Founder & Partner of Ashmore Investment Management India LLP, valuations are challenging in many areas of the market so one has to be cautious and careful.

In fiscal 2019 and 2020, he expects to see much better earnings growth. Maybe not in fiscal 2018 itself because Q1 of FY18 will see a lot of upheavals because of de-stocking from goods and services tax (GST), he further mentioned.

2:05 pm Earnings: UltraTech Cement said its profit on standalone basis in June quarter grew by 14.9 percent to Rs 890.6 crore, driven by operational income and lower finance cost.

Revenue during the quarter increased 6 percent to Rs 7,520.3 crore compared with Rs 7,095.2 crore in same quarter last fiscal.

According to the cement firm, government spending on infrastructure, rural and affordable housing will be key demand drivers.

Operating profit grew by 9.7 percent year-on-year to Rs 1,560 crore and margin expanded by 70 basis points to 23.5 percent in the quarter ended June 2017.

1:47 pm Buzzing: Shares of Balaji Telefilms gained over 4 percent intraday as investors cheered the likely fundraising activity by the firm.

In a late evening exchange notification, the company informed the exchanges that a meeting of the Board of Directors will be held on July 20, 2017, to consider various fund raising options including raising funds through issue of securities on preferential basis, subject to approval from the shareholders of the Company and other necessary approvals, if any.

The company was in the news recently after one of its top executives exited the firm. It announced the stepping down of its Group CEO Sameer Nair from an executive capacity.

1:23 pm Market Check: Equity benchmarks extended losses in afternoon trade, with the Sensex down 298.79 points at 31,775.99, dragged by ITC (down 12.2 percent) and Reliance Industries (down 2 percent). HDFC Bank also turned lower.

The 50-share NSE Nifty has broken the 9850 level, down 71 points at 9,844.95.

The market breadth was negative as about 1,465 shares declined against 1,039 advancing shares on the BSE.

ITC continued to reel under heavy selling pressure on hike in cess on cigarettes by the government.

1:05 pm Buzzing: Hindustan Unilever shares touched a fresh record high of Rs 1,190, up 3.2 percent intraday ahead of earnings for the quarter ended June 2017.

The FMCG major is expected to report flat growth in profit at Rs 1,175 crore against Rs 1,174 crore in same quarter last fiscal, according to analysts polled by CNBC-TV18.

Revenue is seen rising 2.7 percent year-on-year to Rs 9,040 crore while operating profit may increase 4 percent to Rs 1,700 crore and margin may expand 20 basis points to 18.8 percent compared with year-ago quarter.

Underlying volume growth is seen in the range of 2 percent degrowth to 2 percent growth against 4 percent each in year-ago quarter and previous quarter.

12:48 pm Bad loans: Indian banks need to provide a bare minimum Rs18000 crore additionally towards the 12 accounts identified by the Reserve Bank of India (RBI) for reference to the National Company Law Tribunal under the Insolvency and Bankruptcy Code in FY18, estimates India Ratings and Research (Ind-Ra).

Ind-Ra's analysis pegs the weighted average provisioning currently at 42 percent by banks towards the 12 identified accounts. Ind-Ra forecasts the additional provisioning to eat into banks' profits by around 25 percent in FY18. This indicates a shave-off in return on assets of 12bp in FY18.

The agency notes that the new minimum required provisioning stands at 50 percent towards each of the 12 identified accounts, which indicates that banks with average provisioning of 50 percent on these accounts may also need to provide additional provisions to reach 50 percent towards each of the 12 accounts.

12:40 pm Europe opening: Bourses in Europe opened lower with global sentiment dampened by a gridlock in US politics over healthcare reform.

The pan-European Stoxx 600 was 0.3 percent lower with most sectors moving south.

Markets in Asia fell from their two-year highs as the US dollar sank overnight. The greenback took another hit on Tuesday after the Trump health-care bill failed to get enough backing to proceed to a debate.

12:35 pm Buzzing: Transformers and Rectifiers (India) shares rallied as much as 7.5 percent in afternoon trade ahead of board meeting to consider fundraising plan.

The company informed exchanges that the meeting of board of directors will be held on August 3 to consider raising funds through issue of securities through qualified institutional placement (QIP) or preferential allotment.

The board will consider and approve subdivision of equity share from the face value of Rs 10 per share to Re 1 per share.

12:16 pm Interview: Vinod Aggarwal, MD & CEO-VE, Commercial Vehicles, Eicher Motors, said the benefits of effect rate post GST were passed on to the consumers to the tune of 1.5 to 5 percent on all the models. Prior to GST the effective rates were from 26 to 31 percent. The company also has some benefits on input purchase prices, he said.

With regards to sales, he said the industry in the last 9-12 months went through many challenges be it demonetisation, move from BS III to BS IV, then GST. So, the sales are expected to go up from the festive month of September. However, in July and August volumes could remain muted and not negative, he said.

The CV sales for the company in the month of June dropped 20 percent.

12:00 pm Earnings Estimates: HT Media is expected to report a whopping 56 percent growth in profit at Rs 40 crore in June quarter against Rs 35 crore in year-ago quarter, backed by operational income.

According to average of estimates of analysts polled by CNBC-TV18, however, revenue may fall 1 percent to Rs 606 crore from Rs 614 crore YoY.

Operating profit may increase 21 percent year-on-year to Rs 77.6 crore and margin may expand 300 basis points to 13 percent in the quarter gone by.

11.35 am Market Check: Equity benchmarks remained under pressure in late morning trade, with the Sensex falling 238 points to 31,836.78 and the Nifty down 54.90 points at 9,861.05.

The broader markets continued to outperform, with the BSE Midcap trading flat.

Infosys, L&T, Asian Paints, Kotak Mahindra Bank, SBI, HDFC, TCS, Sun Pharma and Tata Motors gained up to 1.5 percent whereas ITC tanked 11.6 percent and Reliance Industries was down 1.9 percent.

11:05 pm IPO: Bharat Road Networks plan to raise Rs 600-650 crore via IPO. SREI Infra had invested Rs 341 crore for a 30.43 percent stake in Bharat Road Networks in FY17.

Talking on the above development, Hemant Kanoria, CMD, SREI Infra, he said the IPO is expected to come through in the next one month or so and they expect some money to flow into SREI through the IPO.

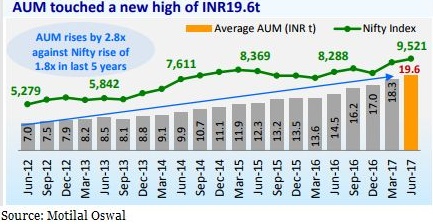

10:41 am Chart of the Day:

10:35 am MF AUM performance: Overall, fund manager remains upbeat on markets as domestic mutual fund (MF) industry average AUM increased for the 15th consecutive quarter in 2QCY17 to a new high of Rs 19.6 lakh crore.

On a YoY basis, average AUM saw a 35 percent rise, primarily on account of inflows in growth (equity), income and liquid funds, backed by increased participation of domestic investors in equity schemes, said a Motilal Oswal report.

Equity AUM rose for the seventh consecutive month in June scaled to a new high of Rs 5.9 lakh crore (+1.3% MoM and +38% YoY). The increase in equity AUM was led by a rise in equity scheme sales while redemptions rose 38 percent on a MoM basis to Rs183 bn, it said.

10.15 am Market Check: The market continued to fall in morning trade, with the Nifty struggling below 9900 due to correction only in Reliance Industries and ITC.

The 30-share BSE Sensex was down 200.73 points at 31,874.05 and the 50-share NSE Nifty fell 42.95 points to 9,873 but the broader markets outperformed benchmarks, rising 0.2 percent on recovery in market breadth.

About 1039 shares advanced against 965 declining shares on the BSE.

Reliance Industries slipped 1.5 percent on profit booking after rising more than 12 percent in previous 11 consecutive sessions.

ITC shares lost 11 percent after the GST Council hiked cess on cigarettes that contributed more than 45 percent to total revenue. ITC alone contributed 335 points to Sensex' fall followed by Reliance Industries with 47 points.

However, other stocks, including index heavyweights continued to support the market and helped benchmark indices trim losses.

10:00 am Earnings Estimates: FMCG major Hindustan Unilever, which is set to declare its June quarter earnings today, is expected to report flat growth in profit at Rs 1,175 crore against Rs 1,174 crore in same quarter last fiscal.

In June quarter 2016, the company had reported an exceptional gain of Rs 70.8 crore.

Topline and operational performance will be key to watch out for while the Street is divided on volume growth given uncertainty post GST rollout.

According to analysts polled by CNBC-TV18, revenue is seen rising 2.7 percent year-on-year to Rs 9,040 crore while operating profit may increase 4 percent to Rs 1,700 crore and margin may expand 20 basis points to 18.8 percent compared with year-ago quarter.

Underlying volume growth is seen in the range of 2 percent degrowth to 2 percent growth against 4 percent each in year-ago quarter and previous quarter.

9:45 am Buzzing: Share price of cement maker ACC touched 52-week high of Rs 1,798.85, rising nearly 3 percent intraday on robust numbers declared by the company for the quarter ended June 2017.

The company's consolidated profit grew by 32.6 percent year-on-year to Rs 326.2 crore despite higher tax expenses. The growth was driven by strong operating income and revenue.

Revenue during the quarter increased 20.5 percent to Rs 3,959 crore compared with Rs 3,286 crore in same quarter last fiscal as cement sales volume increased 10.1 percent to 6.74 mt from 6.12 mt on year-on-year basis.

9:35 am MS downgrades ITC: Morgan Stanley downgraded the stock to equal-weight from overweight and reduced target price to Rs 285 from Rs 395.

According to the research house, the company will need 12-13 percent weighted average cigarette price hike hereon and will need 20 percent price increase in KSFT segment to offset tax increase.

Morgan Stanley expects 3 percent volume decline in FY18 versus earlier estimate of 5 percent growth and expects 6 percent cigarette business EBIT growth versus 20 percent earlier.

9:15 am Market Check: Equity benchmarks opened sharply lower on Tuesday, with the Nifty falling below 9900 level, dragged by ITC after cess on cigarette hiked by the GST Council.

The 30-share BSE Sensex was down 239.02 points at 31,835.76 and the 50-share NSE Nifty fell 56.55 points to 9,859.40.

ITC crumbled nearly 14 percent as brokerage houses downgraded the stock after the Goods and Services Tax (GST) Council decided to increase the cess on cigarettes. Other stocks like Godfrey Phillips (down 10 percent) and VST Industries (down 5 percent) also caught in bear grip.

HDFC, Infosys, TCS, Wipro and ACC gained up to 1.5 percent while Bharti Airtel surged 5 percent.

About two shares declined for every share rising on the NSE.

Shree Digvijay Cement, Linde India, Max Financial and Jubilant Foodwors lost up to 5 percent while Fortis Healthcare and Aditya Birla Nuvo gained up to 5 percent.