Nifty ends tad below 8950, Sensex climbs 446 points; auto, bank up

06 Sep 2016

3:30 pm Market closing: Both the Sensex and Nifty saw biggest one-day gains in last two months. The Sensex hits 29,000 for the first time since April 15, 2015. The Nifty also touched 8950. The Sensex is up 445.91 points or 1.6 percent at 28978.02 and the Nifty is up 133.35 points or 1.5 percent at 8943. About 1614 shares advanced, 1135 shares declined, and 205 shares are unchanged.

3:30 pm Market closing: Both the Sensex and Nifty saw biggest one-day gains in last two months. The Sensex hits 29,000 for the first time since April 15, 2015. The Nifty also touched 8950. The Sensex is up 445.91 points or 1.6 percent at 28978.02 and the Nifty is up 133.35 points or 1.5 percent at 8943. About 1614 shares advanced, 1135 shares declined, and 205 shares are unchanged.

Tata Motors, Axis Bank, ICICI Bank, Asian Paints and Tata Steel were top gainers while TCS, Coal India, Wipro, Sun Pharma and ITC were major losers in the Sensex.

2:55 pm J&J under scanner: Madhya Pradesh and Jharkhand have begun testing of Johnson & Johnson's baby powder and shampoo to check the presence of cancer causing agents.

Madhya Pradesh officials have collected samples from eight cities in the state. The test results will be sent to India's child rights body National Commission for Protection of Child Rights (NCPCR) by this week.

Andhra Pradesh is also in the process of forming a committee to order testing of Johnson & Johnson's products. NCPCR has been pushing states to issue test results at the earliest. It had written to chief secretaries of MP, AP, Assam, Jharkhand, Rajasthan on May 17.

2:45 pm Fund raising: Reliance Capital said it has raised Rs 2,000 crore (USD 300 million) through private placement of non-convertible debentures for expanding lending business and refinancing existing debt.

The issue size offered was Rs 1,000 crore with an option to retain oversubscription up to Rs 1,000 crore aggregating up to shelf limit of Rs 2,000 crore.The issue was fully subscribed, including the green-shoe

option, and will be listed on BSE.

"The funds will be used to refinance our existing debt and also grow our lending businesses," Reliance Capital ED and Group CEO Sam Ghosh said in a statement.

2:35 pm Market Expert: Most of the positive developments in the economy have been factored in by the markets, says Shyamsunder Bhat, Chief Investment Officer, Exide Life Insurance. Hence he advises all investors to keep to have a longer outlook at the current index levels.

Although he doesn't sense any near-term negative triggers that may affect the markets. Market is till very good and the rallies may extend due to fund inflows and positive sentiment of the investors.

Liquidity is waiting to get into the markets, he says. But a correction is bound to come sometime in the near future. However it is expected to be shortlived.

2:25 pm Talks for coal exports: India's biggest coal company Coal India is in "deep consultation" with Bangladesh to export the dry fuel, Coal Secretary Anil Swarup said today.

The development comes in the backdrop of a sharp decline in demand for coal as well as with an inventory of over 80 million tonnes (MT) of the fuel at the pitheads and power plants.

"We are already into it and they (CIL) are in very deep consultations with Bangladesh for exporting it," he told reporters on the sidelines of an event here.

Exports to Bangladesh would also aid CIL in increasing sales as India in July inked a landmark deal with Bangladesh to construct a 1,320 mw coal fired power plant, the biggest project under bilateral cooperation.

2:10 pm Gas auction for power plants: Lanco Kodapalli Power has secured the highest allocation of 3.11 mmscmd of gas followed by Dabhol project at 2.43 mmscmd for 6 months till March in an e-auction by Power Ministry.

The auction for supplying 9.93 mmscmd gas for a six-month period till March, 2017 was conducted on Saturday by the Ministry under Power System Development Fund (PSDF), an initiative to revive the stranded gas based power plants.

With secured gas supplies, the 9 plants that emerged as the lowest bidders will generate a total 8.81 billion units of electricity, which would be supplied at or below Rs 4.70 per unit for the said period.

2:00 pm Market Check

The rally in equity benchmarks as well as broader markets continued in afternoon trade as latest weaker-than-expected US jobs data indicated that further rate hike is unlikely by end of 2016.

The 30-share BSE Sensex surged 317.95 points or 1.11 percent to 28850.06 and the 50-share BSE Nifty jumped 93.10 points or 1.06 percent to 8902.75. The BSE Midcap gained 1.4 percent and Smallcap was up 0.9 percent on positive breadth.

About 1596 shares advanced against 1001 declining shares on the exchange.

European stocks reversed earlier gains to trade mixed as oil prices slipped and lack of drivers gave investors little to be bullish about. The pan-European STOXX 600 was flat-to-lower after initially starting the day in positive territory.

Brent crude prices dipped 0.7 percent following Monday's rally as other oil producers welcomed an agreement between Saudi Arabia and Russia to stabilize the oil market.

1:45 pm Coffee export: India's coffee exports rose by 18.15 percent to 1,63,615 tonnes in the first five months of the ongoing 2016-17 fiscal, despite lower value realisation, according to the Coffee Board.

The country had shipped 1,38,479 tonnes of coffee in the April-August period of 2015-16 fiscal.

As per the board's data, there has been an increase in the export of robust variety of coffee bean as well as instant coffee during the April-August of 2016-17 fiscal.

The overseas sale of coffee rose despite lower export realisation and likely fall in the domestic output in the 2016-17 crop year (October-September).

1:30 pm Power ministry: Lanco Kodapalli Power has secured the highest allocation of 3.11 mmscmd of gas followed by Dabhol project at 2.43 mmscmd for 6 months till March in an e-auction by Power Ministry.

The auction for supplying 9.93 mmscmd gas for a six-month period till March, 2017 was conducted on Saturday by the Ministry under Power System Development Fund (PSDF), an initiative to revive the stranded gas based power plants.

With secured gas supplies, the 9 plants that emerged as the lowest bidders will generate a total 8.81 billion units of electricity, which would be supplied at or below Rs 4.70 per unit for the said period.

The market continues to gain as the Sensex is up 291.56 points or 1 percent at 28823.67. The Nifty is up 86.90 points or 0.9 percent at 8896.55. About 1589 shares have advanced, 963 shares declined, and 178 shares are unchanged.

Axis Bank, Tata Motors, Tata Steel, Maruti amd NTPC are top gainers while Coal Inddia, TCS, Wipro, ONGC and Cipla are losers in the Sensex.

Speaking to CNBC-TV18 Madhusudan Kela, Chief Investment Strategist, Reliance Capital said that it is a no-brainer to say that the comfort isn't as high as when we were at 7000 levels. He said right now there is so much liquidity in the world and a lot of money is being pumped in by the central bankers.

He believes that a small shift from bond to equity is keeping equity valuations elevated. Two things have to be monitored, he said. One, does the world get into any deeper recession than where we are today? and 2) does inflation come back into the world? Kela doesn't see inflation as an imminent risk. ''Inflation might not come back because of vibrant demand.''

1:45 pm Coffee export: India's coffee exports rose by 18.15 percent to 1,63,615 tonnes in the first five months of the ongoing 2016-17 fiscal, despite lower value realisation, according to the Coffee Board.

The country had shipped 1,38,479 tonnes of coffee in the April-August period of 2015-16 fiscal.

As per the board's data, there has been an increase in the export of robust variety of coffee bean as well as instant coffee during the April-August of 2016-17 fiscal.

The overseas sale of coffee rose despite lower export realisation and likely fall in the domestic output in the 2016-17 crop year (October-September).

1:30 pm Power ministry: Lanco Kodapalli Power has secured the highest allocation of 3.11 mmscmd of gas followed by Dabhol project at 2.43 mmscmd for 6 months till March in an e-auction by Power Ministry.

The auction for supplying 9.93 mmscmd gas for a six-month period till March, 2017 was conducted on Saturday by the Ministry under Power System Development Fund (PSDF), an initiative to revive the stranded gas based power plants.

With secured gas supplies, the 9 plants that emerged as the lowest bidders will generate a total 8.81 billion units of electricity, which would be supplied at or below Rs 4.70 per unit for the said period.

The market continues to gain as the Sensex is up 291.56 points or 1 percent at 28823.67. The Nifty is up 86.90 points or 0.9 percent at 8896.55. About 1589 shares have advanced, 963 shares declined, and 178 shares are unchanged.

Axis Bank, Tata Motors, Tata Steel, Maruti amd NTPC are top gainers while Coal Inddia, TCS, Wipro, ONGC and Cipla are losers in the Sensex.

Speaking to CNBC-TV18 Madhusudan Kela, Chief Investment Strategist, Reliance Capital said that it is a no-brainer to say that the comfort isn't as high as when we were at 7000 levels. He said right now there is so much liquidity in the world and a lot of money is being pumped in by the central bankers.

He believes that a small shift from bond to equity is keeping equity valuations elevated. Two things have to be monitored, he said. One, does the world get into any deeper recession than where we are today? and 2) does inflation come back into the world? Kela doesn't see inflation as an imminent risk. ''Inflation might not come back because of vibrant demand.''

12:58 pm Market Update: Equity benchmarks remained strong in afternoon trade. The Sensex was up 312.85 points or 1.10 percent at 28844.96 and the Nifty up 93.85 points or 1.07 percent at 8903.50.

About 1590 shares advanced against 917 declining shares on the BSE.

12:50 pm Buzzing: Lupin shares gained over a percent intraday on approval from the US health regulator for anti-bacterial drug.

"US subsidiary Gavis Pharmaceuticals has received tentative approval for its Moxifloxacin hydrochloride tablets 400 mg from the United States Food and Drug Administration to market in the US," the Mumbai-based pharma company said in its filing.

This drug is a generic version of Bayer Healthcare Pharmaceuticals Inc's Avelox tablets 400 mg.

It is fluoroquinolone anti-bacterial indicated for treating infections in adults 18 years of age and older caused by designated susceptible bacteria in certain conditions.

12:40 pm Europe opens: European stocks opened higher with oil prices holding firm following gains in the previous session.

The pan-European STOXX 600 was up 0.21 percent.

Brent crude prices were steady today following Monday's rally as other oil producers welcomed an agreement between Saudi Arabia and Russia to stabilize the oil market.

Oil prices rallied after the major producers confirmed they had agreed to cooperate to stabilize the oil market and limit output, although experts largely dismissed the statement from the two major oil producers as "lip service."

12:35 pm Fitch on telecom: The entry of Reliance Jio into the market will prove negative for incumbents, especially smaller telecom operators, believes Fitch Ratings.

Speaking to CNBC-TV18, Nitin Soni of Fitch Ratings said the revenue growth of telecom companies is likely to be flat. The agency has a negative outlook on the sector.

Expected blended tariff is expected to fall by 10-15 percent in next year, Soni said.

With the new entrant, the earnings before interest, tax, depreciation and amortisation (EBITDA) margin could see contraction of 200-250 basis points in case of larger companies and 300-350 basis points fall in case of small telcos.

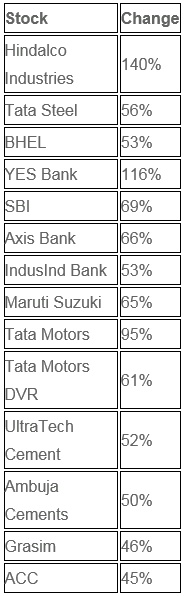

12:20 pm Gains from Budget day lows:

12:20 pm Gains from Budget day lows:

12:00 pm Market Check: Bulls have complete control over Dalal Street as the Nifty touched 8900 level for the first time since March 5, 2015, rising 30 percent from Budget day lows of 6825.80.

The Sensex surged 289.97 points or 1.02 percent to 28822.08 and the Nifty gained 87.65 points or 0.99 percent at 8897.30. About two shares advanced for every share declining on the BSE.

The Nifty Bank gained more than 50 percent and the Sensex 28 percent from Budget day lows of 13,407.25 and 22,494.61, respectively.

Axis Bank, Tata Motors, Infosys, ICICI Bank were top contributors to Sensex's gains.

The liquidity-driven global markets are pricey at current levels, but the uptick is expected to continue for a while longer, believes Andrew Holland, CEO of Ambit Investment Advisors.

''Nifty could try testing previous highs of 9,100 because the global environment is the backdrop there,'' Holland told CNBC-TV18. Fundamentals in India are still looking good, which is not the case globally.

11:55 am FII view: The liquidity-driven global markets are pricey at current levels, but the uptick is expected to continue for a while longer, believes Andrew Holland, CEO of Ambit Investment Advisors. ''Nifty could try testing previous highs of 9,100 because the global environment is the backdrop there,'' Holland told CNBC-TV18. Fundamentals in India are still looking good, which is not the case globally. ''We (Ambit) are playing a lot through the put options to buy protection for when this day of liquidity ends,'' he says, adding that global events too are closely watched. For now, nothing is scare-worthy in global markets, he adds.

11:30 am Buzzing: Shares of Mindtree lost 8 percent, hitting one year low at Rs 507 per share intraday. Investors are busy offloading the midcap IT stock after it issued Q2 guidance warning.

In a statement to the exchanges, it stated that the Q2 revenue decline is expected due to cross-currency movements, project cancellations and slower ramp-ups in a few large clients across different verticals and continued weakness in its UK-based subsidiary Bluefin.

Mindtree is also cautious that its Q2 margins are going to be lower than planned with a decline in EBITDA margins in Q2 FY17 compared to Q1 FY17. It added that business of Bluefin, which it had acquired in 2015, is expected to report an EBITDA loss for the quarter.

The market is still continuing its uptrend with the Nifty trying hard to hit 8900. The 50-share index is up 84.25 points or 0.9 percent at 8893.90 while the Sensex is up 279.37 points or 0.9 percent at 28811.48.

Auto, banks, FMCG, infra and metal stocks are rallying. Axis Bank, Tata Motors, GAIl, Maruti and ICICI Bank are gainers while Bharti Airtel, TCS, Coal India and Wipro are losers in the Sensex.

Gold prices fell by Rs 34 to Rs 31,110 per 10 gram in futures trade today as participants indulged in profit-booking at prevailing levels amid a weak trend overseas.

In futures trade at the Multi Commodity Exchange, gold for delivery in December shed Rs 34 or 0.11 percent to Rs 31,110 per 10 gram in a business turnover of just one lot. Analysts attributed the fall in gold futures to profit-booking by traders at existing levels and weakness in the precious metals in global market.

Globally, gold was trading a shade lower at USD 1,326.60 an ounce in Singapore today.

10:58 am Market Update: Equity benchmarks hit fresh 18-month high with the Nifty moving closer to 8900.

The Sensex surged 294.66 points or 1.03 percent to 28826.77 and the Nifty was up 85.85 points or 0.97 percent at 8895.50.

About 1527 shares advanced against 696 declining shares on the BSE.

10:45 am Investors' wealth in 2016: Dalal Street investors have become richer by Rs 10.70 lakh crore so far in 2016, mainly helped by new listings and robust stock market trend where the BSE Sensex has surged over 9 percent.

The total market valuation of all listed firms at BSE rose by Rs 10,70,320 crore to Rs 1,11,08,054 crore from Rs 1,00,37,734 crore at the end of 2015.

Riding on a strong stock market sentiment, the total market capitalisation (m-cap) of BSE-listed companies surged to a lifetime high of Rs 1,11,22,815 crore on August 31.

The market valuation of all listed firms on BSE had first hit a record high of Rs 100 lakh crore in November 2014.

Last year, the total m-cap of BSE firms had risen by Rs 2,02,493 crore to Rs 1,00,37,734 crore.

10:31 am Buzzing: SPML Infra shares rallied further, rising more than 14 percent intraday as company's debt will reduce substantially with Cabinet decision on arbitration awards. The stock also surged 13 percent last Friday.

"The Union Cabinet decision that requires government agencies to pay 75 percent of arbitral awards will result in SPML's debt being reduced significantly," the Delhi-based infrastructure company said in its filing.

It has arbitration awards of Rs 250 crore. Hence, the company is expected to get Rs 187.5 crore (representing 75 percent of Rs 250 crore) subsequently.

Its claims worth Rs 500 crore are in advanced arbitration stage. "The cabinet decision will further help SPML to secure these awards within 12 months," the company said.

It has standalone debt currently of Rs 540 crore.

10:19 am FII View: Abhay Laijawala of Deutsche Bank says the brokerage house continues to maintain cautious view on the market, primarily driven by its belief that the negative/historically low interest rate environment induced risk rally across global assets might not sustain as strongly.

In the near term, the commentary/actions of Federal Open Market Committee (FOMC) in the upcoming meeting on September 21 will likely set the tone for global capital flows, he feels.

He says while the domestic environment for India appears to be improving, earnings have not yet responded commensurately to a better macro environment.

The brokerage house has maintained a December 2016 Sensex target of 27,000.

10:00 am Market Check

Equity benchmarks extended rally in morning trade with the Nifty gradually inching towards 8900 on hopes of further delay in rate hike after weaker-than-expected US jobs data. Auto and banking & financials were key drivers.

The 30-share BSE Sensex was up 277.36 points or 0.97 percent at 28809.47 and the 50-share NSE Nifty rose 78.55 points or 0.89 percent to 8888.20. The broader markets also traded in line with benchmarks as the BSE Midcap gained 1 percent on positive breadth.

About 1411 shares advanced against 559 declining shares on the exchange.

Nifty Bank crossed the 20000 level for the first time since March 4, 2015.

Tata Motors and Axis Bank topped the buying list on Sensex, up 3 percent each followed by HDFC Bank, Infosys, HDFC, ICICI Bank, L&T and Maruti.

9:50 am FII call: Abhay Laijawala of Deutsche Bank says the brokerage house continues to maintain cautious view on the market, primarily driven by its belief that the negative/historically low interest rate environment induced risk rally across global assets might not sustain as strongly.

In the near term, the commentary/actions of Federal Open Market Committee (FOMC) in the upcoming meeting on September 21 will likely set the tone for global capital flows, he feels.

He says while the domestic environment for India appears to be improving, earnings have not yet responded commensurately to a better macro environment.

The brokerage house has maintained a December 2016 Sensex target of 27,000.

9:45 am Market outlook: Consulting Editor Udayan Mukherjee said that there is nothing one can do but to participate in this rally. The Nifty is close to its all-time high.

''There is no point in second-guessing the market because that is not how it works."

He said domestic investors were sitting out the rally for the past 4-5 weeks. But now they have entered the party. ''Markets will twist your hand and force you to participate.''

The markets, he said, are running on two engines: financials and consumers. Anything related to these two sectors are doing well, he said. But if one were to look outside these two, the market is beginning to struggle for ideas, he maintained. One fallout of this trend is that these two sectors will get expensive with every passing week. ''Retail traders should dismiss notions of expensive [market] for now and stay with these two pockets.''

9:30 am Rate cute in Sept? The US jobs data was weaker than expected at 151,000. This has pushed back the expectation of Fed rate hike and so world shares rose on Monday but did not spark a huge rally. Ian Hui, JP Morgan AMC said the market is still pricing in a 30 percent possibility of a hike in September. So, the house does not entirely rule out a September rate hike by Fed. However, chances of December rate hike have enhanced because the Fed will have to maintain its credibility.

Although emerging markets (EMs) could continue to see a relief rally on back of a Fed rate hike being pushed forward and weakness in the dollar, the US people could be disappointed that their economy has not shown growth in jobs. Therefore, the cues are mixed and it may not be a straight positive for EMs, although near-term fears of dollar strengthening and hike expectations have eased off, said Hui.

The market has opened on a strong note. The Sensex is up 244.63 points or 0.9 percent at 28776.74, and the Nifty up 64.30 points or 0.7 percent at 8873.95.About 730 shares have advanced, 208 shares declined, and 57 shares are unchanged.

Tata Motors, Maruti, Axis Bank, Infosys and HDFC are top gainers while Bharti, Wipro and Bajaj Auto.

The Indian rupee started off trade at four-month high after fall in US dollar due to weaker-than-expected jobs data. The currency has opened at 66.53 a dollar, up 29 paise compared with Friday's closing value of 66.82 a dollar.

Ashutosh Raina of HDFC Bank says the probability of a US rate hike in September has diminished after the recent weaker-than-expected jobs report. The USD traded heavy against most of the currencies.

Among global peers, Asian shares edged up but were mostly in a holding pattern after Monday's US holiday, as investors awaited a policy decision from the Reserve Bank of Australia. European stocks touched an eight-month high in choppy trading. MSCI's broadest index of Asia-Pacific shares outside Japan. Australian shares slipped 0.3 percent ahead of the RBA's announcement.

Asian shares edged up but were mostly in a holding pattern after Monday's US holiday, as investors awaited a policy decision from the Reserve Bank of Australia. European stocks touched an eight-month high in choppy trading. MSCI's broadest index of Asia-Pacific shares outside Japan. Australian shares slipped 0.3 percent ahead of the RBA's announcement.