Gold ETFs witness record Rs230-crore monthly outflows

09 Jul 2012

Gold exchange traded funds (ETFs) recorded monthly outflows of Rs230 crore in June 2012, the highest in the category, rating agency CRISIL Ltd said in a study released today.

According to the Association of Mutual Funds in India (AMFI), assets under Gold ETFs fell by 2.2 per cent over the month to Rs10,100 crore in June. The outflows from this category could be primarily because of profit booking after the price of the underlying metal rose sharply in the past one year due to global risk aversion and domestic buying.

Gold prices represented by the Crisil Gold Index have risen 34 per cent in the one-year period ended 29 June 2012.

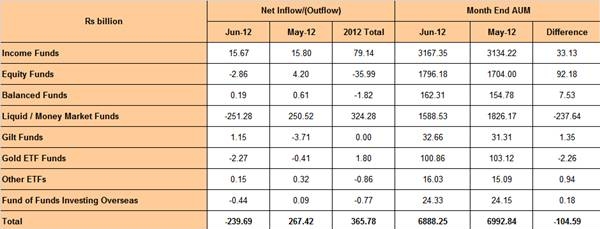

Month-end assets under management (AUM) of the mutual fund industry fell 1.5 per cent (Rs10,500 crore) to Rs6,89,000 crore in June 2012, primarily due to outflows in money market funds, which witnessed cyclical end-quarter outflows due to withdrawals by corporates.

Money market funds witnessed outflows of Rs25,100 crore, mainly because of corporates withdrawing their short-term mutual fund investments to meet advance tax requirements of Rs25,000 crore to Rs30,000 crore.

Equity fund assets rose 5.4 per cent (or Rs9200 crore) to Rs1,80,000 crore in June, compared with a fall of 5.1 per cent (or Rs9,200 crore) in May. The rise in month-end assets of equity funds was primarily due to mark-to-market gains from the underlying equity markets despite the category witnessing marginal outflows (Rs300 crore) in the month.

The domestic equity market, as represented by the S&P CNX Nifty, rose 7 per cent in the month led by positive domestic and global cues.

Income funds (including ultra short-term debt funds and fixed maturity plans) saw inflows for the third consecutive month in June. The category logged steady inflows of Rs1,570 crore in the month, almost the same witnessed in the previous month.

The inflows were largely on account of fixed maturity plan new fund offers (NFOs) where investors are able to lock into higher yields.

FMPs continued to garner majority of the NFOs in the month. Out of the 61 NFOs in the month, 55 were FMPs and garnered Rs4,000 crore. The month-end assets of income funds rose 1.06 per cent (or Rs3,300 crore) to Rs3,17,000 crore at the end of June 2012.

Table 1 – Month-on-Month Mutual Fund Flows and AUM distribution

In a bid to cash in on the spurt in gold prices, a number of Indian companies and mutual funds have been working on plans to launch new gold ETFs.

India's first gold savings fund, Reliance Gold Fund, opened for subscription on 14 February 2011 and closed on 28 February. In the process, it generated a record of Rs4,000 crore NFO. Reliance received applications in excess of two lakh.

Meanwhile, Kotak Mahindra Asset Management Company also launched its Kotak Gold Fund last year. The unique open-ended fund allows investors to take exposure to gold without holding demat account.

India had 10 funds selling gold-backed securities, with combined assets of Rs4,400 crore as of 31 March 2011, according to data from the Association of Mutual Funds in India.