HDFC Bank, the country's second largest private sector lender, stands out as an exception in the country’s otherwise muddy banking sector with a big jump in profits and credit expansion even as its asset quality remained stable and gross NPAs stood flat at 1.33 per cent sequentially.

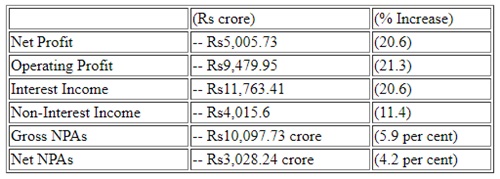

HDFC Bank has reported a 20.6 per cent year-on-year growth in its net profit for the second quarter of the current financial year to Rs5,005.73 crore, on the back of rising incomes. The bank had reported a net profit of Rs4,151 crore in year-ago period.

HDFC bank reported a 20.6 per cent growth in its net interest income to Rs11,763.41 crore during the July-September 2018-19 quarter while its loan book grew 24.1 per cent YoY to Rs7.50 lakh crore.

"NII growth was driven by average asset growth of 22.9 percent and a net interest margin of 4.3 percent," the bank said.

Deposits during the quarter grew 20.9 per cent at Rs8.33 lakh crore.

Net NPA of the bank fell to 0.4 per cent in fiscal second quarter (July-September 2018-19) against 0.41 per cent in the previous quarter.

HDFC Bank said current account-savings account (CASA) deposits, which contributed 42 per cent to total deposits, grew 18.3 per cent, with savings and current account deposits rising 18.7 per cent and 17.7 per cent, respectively. "The focus on deposits has helped us maintain liquidity coverage ratio at 118 percent, much above the regulatory requirement," the bank said in a stock exchange filing.

HDFC Bank’s gross gross non-performing assets (NPAs) stood flat at 1.33 per cent sequentially while net NPA fell to 0.4 per cent in Q2 against 0.41 per cent in the April-June quarter.

In absolute terms, gross NPAs were up 5.9 percent quarter-on-quarter at Rs 10,097.73 crore and net NPAs rose 4.2 per cent to Rs3,028.24 crore.

Provisions and contingencies increased 11.7 per cent QoQ and 23.3 per cent YoY to Rs1,819.96 crore.

Non-interest income of the bank grew 11.4 per cent during the quarter to Rs4,015.6 crore, driven by fee income. "Fees and commission income grew 26.1 per cent to Rs3,295.6 crore and constituted 82.1 per cent of other income," the bank said.

Cost-to-income ratio improved to 39.9 per cent against 41.5 per cent YoY. Operating profit rose 21.3 per cent to Rs9,479.95 crore.

The HDFC Bank stock corrected nearly 5 percent during the quarter ended September 2018 and has rallied 5 percent year-to-date.