CPT wants Kerala to take up project

By James Paul | 18 Feb 2002

Kochi:

The Cochin Port Trust (CPT), through its staff association,

has expressed its desire to the Kerala state government

to take over the Goshree project for the overall development

of the region.

The poser has come in view of the financial difficulties

of the state government, which reportedly is not in a

position to stand back as a guarantor for the loan that

the Goshree Island Development Authority (GIDA) had proposed

to take from banks or a consortium for the completion

of the construction of bridges from the Ernakulam mainland

to the Vypeen Islands.

The poser has come in view of the financial difficulties

of the state government, which reportedly is not in a

position to stand back as a guarantor for the loan that

the Goshree Island Development Authority (GIDA) had proposed

to take from banks or a consortium for the completion

of the construction of bridges from the Ernakulam mainland

to the Vypeen Islands.

The staff association feels it will be viable if the entire

project is handed over to the CPT, reserving the right

to sell the reclaimed land at Marine Drive with the port.

The association has called for a discussion at the appropriate

level so that a favourable decision could be arrived at

the earliest.

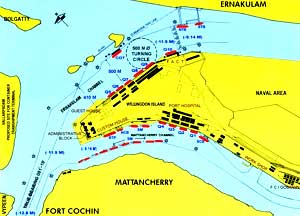

The Goshree project is envisaged to establish road links

from the Ernakulam mainland to the thickly-populated Vypeen

Island. The project comprises construction of three bridges,

which together would connect Vypeen and the isolated islands

like Vallarpadam and Bolghatty, to the mainland.

Since these bridges connect one island to another, the

other islands in the Kochi backwaters will also get the

benefit of connectivity. The total length of these bridges

will be about 1,380 metres. Since the cost of these bridges

could not be met through government funding, ways and

means to make the project self-financing is thought of.

It was proposed to reclaim an area of about 25 ha (62

acres) from the backwaters. The sale proceeds of this

land should pay for the project and this would make the

project self-supporting. As per the proposal, 25 ha of

land has been reclaimed at the northern tip of Marine

Drive from where the connection from the mainland begins.

This area was selected for the reason that the reclaimed

area would form an extension of the existing Marine Drive,

deriving all its commercial advantages. The unit price

of land will be high, reducing the total area required

for reclamation. The total construction cost of the entire

project, including construction of bridges and road network,

was estimated to be around Rs 75 crore.

The land available through reclamation can be sold at

the market price. Plots, after laying the network of road,

will be available for sale at the end of three years from

now. But the initial finance has to be mobilised from

suitable sources.

This amount will accrue interest. Considering the financing

cost of the projects as well, the total cost of the project

at the end of three years from now has been estimated

to be about Rs 115 crore. Out of the 25 ha of land reclaimed,

the area available for sale is approximately 40 acres.

Considering an optimistic value of Rs 4 lakh for every

cent, the total sale proceeds from the land should amount

to Rs 160 crore.

Now, the state governments main role for this project

is to stand back as a guarantor for the banks or a consortium

which funds the project and later on realise the cost

plus interest by selling the projected area of about 40

acres out of the 62 acres already reclaimed.

There have been apprehensions at some quarters due to

the delay on the part of the government to stand guarantor.

There is also the ticklish issue of the credibility of

the government. It is in this context that the staff association

feels that if the port tried for a soft loan the banks

or a consortium will respond favourably.

Association president P M Mohammed Haneef, who has already

wrote a letter describing all these to Chief Minister

A K Antony, says this fund can be even released from the

CPTs reserve fund. In the light of these facts, and since

the state government had already entrusted the implementation

and execution of this particular project to the CPT and

also because the port is an organisation having technical

expertise with an operational surplus to the tune of Rs

30 crore, this is the time to reconsider the decisions

already taken and to implement this Rs 75-crore project

as a project of the CPT.

The

main benefits that could be derived out of this project

once the whole project is taken up by the port are: this

would be a major breakthrough for the fulfilment of the

proposed Container Transhipment Terminal at Vallarpadam;

value-addition to the 400 acres of land which the port

possesses at Vallarpadam; speedy implementation of the

LNG-LPG terminal project proposed at Puthuvypeen; value-addition

to the 600 acres of land (including the 110 acres of land

handed over to the CPT by the state government), which

the port is having at Puthuvypeen area; speedy implementation

of the proposed bunkering terminal for which tenders have

already been invited; and if the port is allowed to sell

the reclaimed land at Ernakulam Marine Drive for funding

this project, the ports financial position would improve

or could cope without budgetary support.

Latest articles

Featured articles

Server CPU Shortages Grip China as AI Boom Strains Intel and AMD Supply Chains

By Cygnus | 06 Feb 2026

Intel and AMD server CPU shortages are hitting China as AI data center demand surges, pushing lead times to six months and driving prices higher.

Budget 2026-27 Seeks Fiscal Balance Amid Rupee Volatility and Industrial Stagnation

By Cygnus | 02 Feb 2026

India's Budget 2026-27 targets fiscal discipline with record capex as markets tumble, the rupee weakens and manufacturing struggles to regain momentum.

The Thirsty Cloud: Why 2026 Is the Year AI Bottlenecks Shift From Chips to Water

By Axel Miller | 28 Jan 2026

As AI server density surges in 2026, data centers face a new bottleneck deeper than chips — the massive water demand required for cooling next-generation infrastructure.

The New Airspace Economy: How Geopolitics Is Rewriting Aviation Costs in 2026

By Axel Miller | 22 Jan 2026

Airspace bans, sanctions and corridor risk are forcing airlines into costly detours in 2026, raising fuel burn, reducing aircraft utilisation and pushing airfares higher worldwide.

India’s Data Center Arms Race: The Battle for Power, Cooling, and AI Real Estate

By Cygnus | 22 Jan 2026

India’s data centre boom is turning into an AI arms race where power contracts, liquid cooling and fast commissioning decide the winners across Mumbai, Chennai and Hyderabad.

India’s Oil Balancing Act: Refiners Rebuild Middle East Supply Lines as Russia Flows Disrupt

By Axel Miller | 21 Jan 2026

India’s refiners are rebalancing crude sourcing as Russian imports fell to a two-year low in December 2025, lifting OPEC’s share and raising geopolitical risk concerns.

Arctic Fever: How ‘Greenland Tariff’ Politics Sparked a Global Flight to Safety

By Axel Miller | 20 Jan 2026

Greenland-linked tariff threats have injected fresh uncertainty into transatlantic trade, triggering a risk-off shift in markets and reshaping global supply chain planning.

The New Oil (Part 5): Friend-Shoring, Supply Chain Fragmentation and the Cost of Resilience

By Cygnus | 19 Jan 2026

Friend-shoring is reshaping lithium, rare earth and graphite supply chains, creating a resilience premium and new winners and losers in clean tech.

The New Oil (Part 4): Can Technology Break the Dependency?

By Cygnus | 16 Jan 2026

Can magnet recycling and rare-earth-free motors reduce global dependence on strategic minerals? Part 4 explores breakthroughs, limits and timelines.