Tata Power to Finalize ₹6,500 Crore Wafer-Ingot Plant by January, Deepening Solar Push

By Axel Miller | 16 Dec 2025

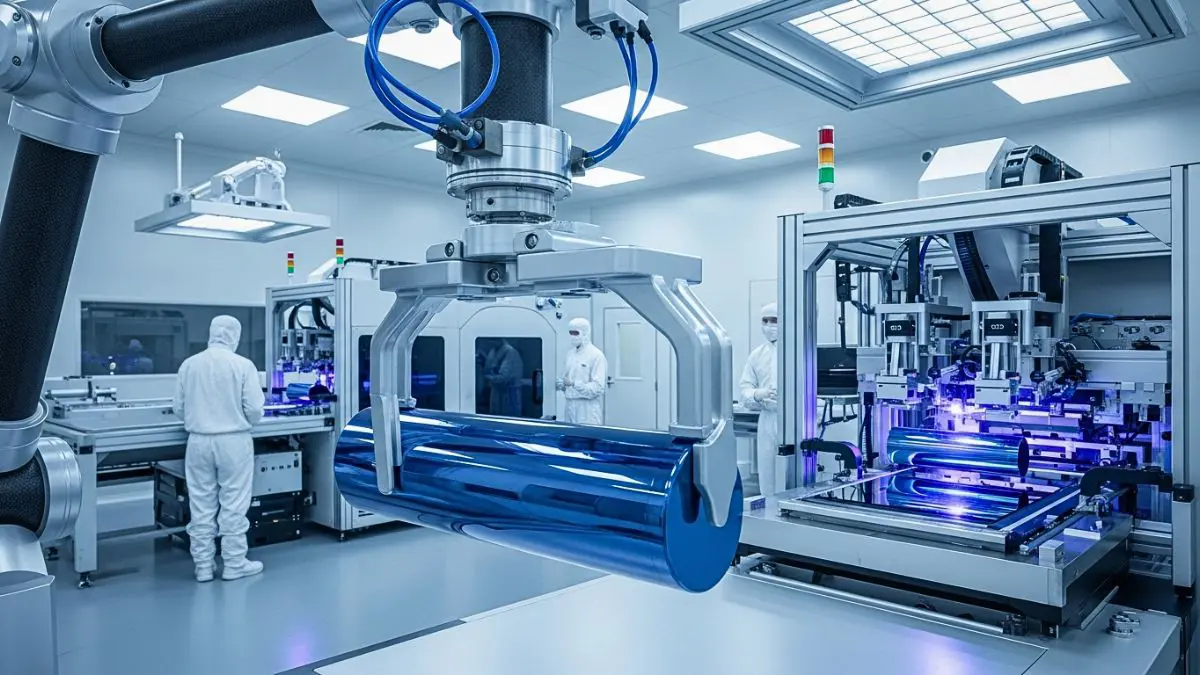

Tata Power Co. aims to finalize the location for a massive ₹6,500 crore solar manufacturing facility by January, marking a decisive step toward full backward integration in India’s renewable supply chain.

The proposed plant will have a capacity of 10 gigawatts (GW) and will manufacture solar wafers and ingots—critical upstream components currently imported largely from China.

Speaking on the sidelines of an industry event in Odisha, Tata Power CEO and Managing Director Praveer Sinha confirmed that the company is in advanced talks with multiple state governments. A formal announcement regarding the site is expected early next year.

State-level Bidding War The company is currently evaluating incentive packages from Odisha, Tamil Nadu, and Andhra Pradesh. “We are closely studying state-level manufacturing policies to ensure long-term viability,” Sinha said. The decision will hinge on land availability, power subsidies, and logistical connectivity.

Once operational, the wafer-ingot unit will make Tata Power one of the few fully integrated solar manufacturers in India, capable of producing everything from raw silicon ingots to finished modules. This vertical integration is seen as essential for cost control and shielding the company from global supply chain volatility.

Nuclear Ambitions on Horizon Beyond solar, Sinha signaled strong interest in the emerging small modular reactor (SMR) segment. He stated that Tata Power plans to explore SMR projects in the 20–50 megawatt range, contingent upon the passing of the SHANTI Bill (Sustainable Harnessing and Advancement of Nuclear Energy for Transforming India), which proposes opening India’s nuclear sector to private players.

Tata Power currently operates a generation portfolio of approximately 15.9 GW, with a rapidly growing share of renewables.

Brief Summary

Tata Power plans to decide on a ₹6,500 crore solar wafer and ingot manufacturing plant by January 2026. The 10 GW facility is part of a backward integration strategy to reduce import dependence. The company is evaluating sites in Odisha, Tamil Nadu, and Andhra Pradesh, while also eyeing future opportunities in private nuclear energy.

Frequently Asked Questions (FAQs)

Q1: What is Tata Power planning to build?

A 10-gigawatt (GW) manufacturing facility for solar wafers and ingots. These are the raw materials used to make solar cells, which are then assembled into solar panels (modules).

Q2: Why is this important?

Currently, most Indian solar companies import wafers and ingots. By manufacturing them domestically (“backward integration”), Tata Power reduces its reliance on imports (primarily from China) and gains better control over costs and supply chains.

Q3: How much is the investment?

The estimated investment is ₹6,500 crore ($770 million).

Q4: Which states are competing for the project?

Tata Power is in talks with Odisha, Tamil Nadu, and Andhra Pradesh. The final decision will depend on which state offers the best infrastructure and financial incentives.

Q5: What about the nuclear energy plans?

CEO Praveer Sinha mentioned that Tata Power is ready to invest in Small Modular Reactors (SMRs) for nuclear energy, but this depends on the Indian government passing new laws (like the SHANTI Bill) to allow private companies into the nuclear sector.