2026 Global Tech & Industry Outlook: How AI Is Moving Into the Physical Economy

By Cygnus | 05 Jan 2026

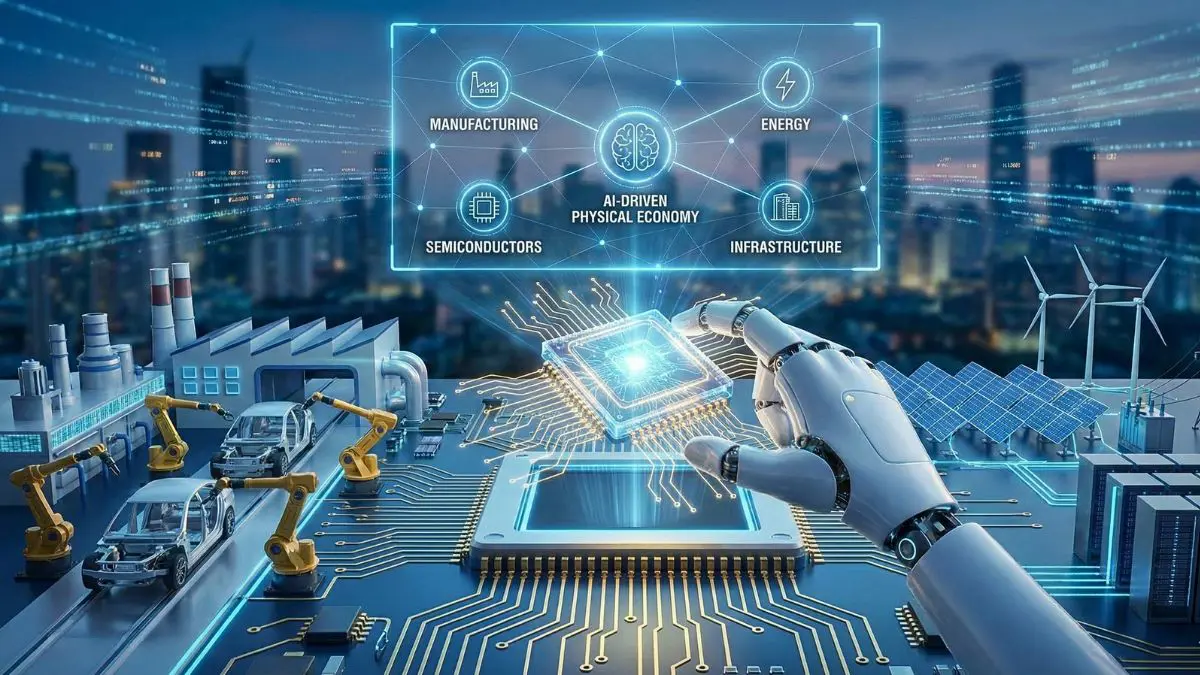

As the world’s business leaders return to work in the opening days of 2026, a subtle but decisive shift is taking shape. Artificial intelligence, long associated with cloud platforms and software services, is now moving deeper into the physical economy—into machines, factories, energy systems, and supply chains.

This transition marks a clear turning point. AI is no longer viewed simply as an efficiency layer added to existing operations. Instead, it is emerging as a core industrial capability, influencing how products are designed, manufactured, powered, and delivered. For companies across automotive, technology, manufacturing, and energy, the implications are as economic as they are technological.

One of the strongest signals of this change is coming from manufacturing-led industries, where scale and execution still matter as much as innovation.

Physical AI and the Emerging Hardware Moat

Large industrial groups are increasingly framing AI as something that must be developed internally and embedded directly into physical systems, rather than sourced entirely from external platforms. Companies such as Hyundai have publicly emphasized that future competitiveness will depend on how deeply intelligence is integrated into vehicles, robotics, and production environments.

The logic is straightforward. As AI becomes inseparable from hardware and automation, competitive advantage shifts toward organizations that control both software intelligence and industrial execution. Experience in mass production, engineering reliability, and supply-chain coordination is once again becoming a strategic asset—on par with advances in algorithms.

This convergence is also reshaping sustainability strategies. Energy efficiency, alternative fuels, and long-duration storage are no longer treated as separate initiatives, but as part of the same industrial transformation driven by intelligent systems.

Semiconductors and the Emerging “AI Memory Effect”

The semiconductor industry is already feeling the financial consequences of AI’s rapid expansion.

After several years of heavy investment in AI infrastructure, demand for advanced memory—particularly high-bandwidth memory used in data centers and accelerators—has surged. Major manufacturers such as Samsung, SK Hynix, and Micron are prioritizing a significant share of their advanced memory output to meet AI-related demand in 2026.

As a result, growth in supply for standard memory components has tightened. Industry analysts warn that this reallocation is contributing to pricing pressure across consumer electronics. Rather than dramatic price hikes, the impact is expected to show up gradually, through mid-single-digit to double-digit cost pressure on smartphones, laptops, and gaming devices.

For manufacturers, the challenge this year is margin management. Many are expected to respond by adjusting specifications or pacing feature upgrades, rather than passing higher costs directly to consumers. While the changes may appear modest at the product level, they reflect a broader restructuring of how silicon capacity is distributed in an AI-driven economy.

CES 2026 and the Shift Toward Intelligence at the Edge

The same structural shift is visible at CES 2026 in Las Vegas, where attention has moved decisively away from cloud-centric software toward “AI at the edge.”

Rather than emphasizing remote inference, chipmakers are positioning next-generation processors designed to run AI workloads directly on devices. Qualcomm, Intel, and AMD are each using CES to signal how on-device intelligence will define the next phase of personal computing, with performance increasingly measured by efficiency, responsiveness, and local processing capability.

This move carries meaningful business implications. Running AI locally reduces dependence on cloud infrastructure, improves response times, and addresses growing concerns around privacy and energy consumption. For enterprises, it opens new use cases where real-time intelligence is essential and connectivity cannot be assumed.

Energy and Infrastructure: Scaling for Stability

Beyond consumer technology, energy and infrastructure sectors are entering a more mature phase of AI adoption.

According to recent industry analysis from Wood Mackenzie, procurement decisions in solar manufacturing are increasingly influenced by long-term financial resilience and supply-chain reliability, rather than shipment volume alone. This trend reflects a broader shift toward stability as clean energy deployment accelerates.

At the same time, countries such as India are expanding domestic manufacturing capacity to support both energy security and industrial growth. India-based manufacturers, including Avaada Electro, have announced major capacity expansions in regions like Nagpur as part of a wider push to strengthen local solar production.

In digital infrastructure, large, multi-year contracts focused on cybersecurity and AI-enhanced public services signal that adoption has moved beyond experimentation. Governments and cities are now focused on how AI systems can be scaled responsibly and maintained over time.

Execution Becomes the Differentiator

Taken together, these developments suggest that 2026 will be defined less by breakthrough announcements and more by execution. The next stage of growth belongs to companies that can integrate intelligence into physical systems at scale—making AI work reliably in factories, devices, and infrastructure.

In this environment, the competitive question is no longer who builds the most advanced models. It is who can deploy them efficiently, sustainably, and profitably in the real world.

Summary

As 2026 begins, artificial intelligence is shifting from cloud platforms into the physical economy. From manufacturing and semiconductors to energy and infrastructure, companies are embedding AI directly into products and systems. The competitive edge now lies in execution—those that can scale intelligent hardware and industrial processes stand to define the next phase of global growth.

Frequently Asked Questions (FAQs)

Q1: Why is AI moving into physical industries in 2026?

As AI models mature, companies are shifting focus toward real-world applications such as robotics, vehicles, and energy systems—areas where embedding intelligence directly into hardware creates durable economic value.

Q2: How will AI affect consumer technology prices this year?

Rising demand for AI-grade memory is tightening supply for standard components, which may place upward pressure on costs for smartphones, laptops, and gaming devices over time.

Q3: What does “AI at the edge” mean?

It refers to running AI directly on devices rather than relying entirely on cloud servers, improving response times, data privacy, and energy efficiency.