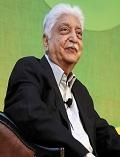

Azim Premji joins with Prudential of US to bid for Star Health

06 Mar 2018

US insurer Prudential and Indian billionaire Azim Premji are joining forces to challenge a consortium of WestBridge Capital and Kedaara Capital, besides others, in the fight for a controlling stake in Star Health and Allied Insurance, The Economic Times reports.

| |

| Azim Premji |

Competition for Star assets may intensify in the wake of the National Health Protection Scheme (NHPS) proposed in the budget. The Indian health insurance market is expected to quadruple to Rs50,000 crore thanks to the social welfare scheme, experts said.

This could drive up the valuation of the insurer beyond the Rs6,000 crore initially estimated, when the sale process was kicked off about six months ago, drawing about a dozen bidders, people aware of the matter told ET.

Star is the largest standalone health insurer in the country, with a 2.36-per cent market share.

''We have formed a consortium with Prudential and are involved in the process,'' said Rahul Garg, partner, PremjiInvest, confirming the development. ''However, it is too early to comment on a deal as a lot of other bidders are also there.'' Prudential is said to have been scouting for an Indian partner to bid for the health insurer.

Garg said Star Health offered an attractive investment prospect in the fastest-growing segment of health insurance with a wide agency distribution network. ''It can easily grow at 20-25 per cent for the next four-five years with significant operating leverage and can deliver great investment returns for the buyer,'' he said.

PremjiInvest, which manages assets worth $3 billion, has been picking up stakes in financial services firms including Aditya Birla Capital, HDFC Life Insurance, ICICI Prudential Life Insurance and Policybazaar.

Prudential manages $1.3-trillion in assets with a presence in 40 countries. It has two joint ventures in India with the Dewan group - DHFL Pramerica Life Insurance Co and DHFL Pramerica Asset Managers.

Private equity funds, including the WestBridge-Kedaara consortium and ICICI Lombard, are said to be among those eyeing Star Health. Other possible bidders are said to include PE giants Bain Capital and Warburg Pincus, apart from private sector insurers including HDFC Ergo.

Kotak Mahindra Capital was appointed by PE fund investors to manage the sale of their stakes in Star Health.

Investors in Star Health include Sequoia Capital, ICICI Venture, Tata Capital and Apis. They, along with Oman Insurance Co, own about 70 per cent of Star Health, while the rest is held by Dubai-based investor ETA Trading.

Star Health managing director V Jagannathan, who founded the company, holds a 3.5-per cent stake in the company. Jagannathan said he was not aware of the bidders and had no comment to offer.

Founded in 2006, Star Health has delivered strong growth in gross premium income and has maintained its leadership position amongst the standalone health insurance companies.