Integration may thwart disintegration

By Beginning with textiles, | 26 Nov 2004

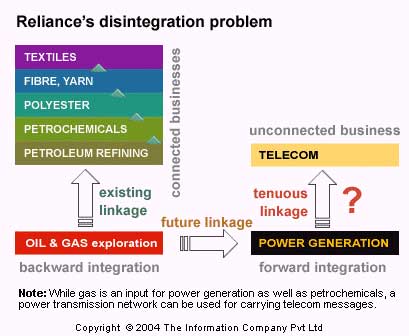

Beginning with textiles, then yarn, then polyester, and then petrochemicals, followed by petroleum refining, and finally oil and gas exploration and production, the group has relentlessly integrated backwards, keeping very, very close to its knitting — until it ventured into telecommunications. () Even the power generation business, which the group entered with the acquisition of BSES, now Reliance Energy, is a downstream activity for a gas producer.

The main petrochemicals and petroleum refining operations are not like any other business in India. They are not even remotely like the Reliance group's telecom or power generation and distribution businesses. That's because in petrochemicals the group has built a monopoly that will be difficult for any rival to match. The potential for cash generation from the petrochemicals and refining businesses is far greater than from telecom or power.

By acquiring its main petrochemicals rival, the public sector Indian Petrochemicals Corporation Ltd, besides gobbling up smaller private sector rivals, such as NOCIL's plastics business and ICI's fibres business, Reliance has become a virtual monopoly in the petrochemicals industry in India. The only serious competition that Reliance can expect is from imports.

The vertical integration, which has brought Reliance enormous economies of scale, makes it difficult to split the businesses. Nobody expects elder brother Mukesh Ambani to cede control of the petrochemicals business. Control of this business is linked inextricably with calling the shots in the massive petroleum refining operations.

That leaves two other major businesses — power generation and telecommunications. For some reason, not very clear, the group combined power generation and the exploration and production of oil and gas in the same company (BSES, which was acquired and renamed as Reliance Energy). Oil and gas should, rightfully, have gone with the refining and petrochemicals businesses, as oil and gas are key inputs for them.

The existence of oil and gas under the Reliance Energy Ltd umbrella may be one of the key hurdles to desegregation of the various Ambani businesses, assuming that the two brothers, Mukesh and Anil, arrive at an amicable settlement to divide the businesses between them.

Oil is essentially an input for petroleum refining; and one of the products of refining (naphtha) can also be used to make petrochemicals, including the raw materials of synthetics textiles, plastics and a host of other products. Gas, on the hand, can be used both as a feedstock for petrochemicals plants and as fuel for power generation.

The value addition from the use of gas in petrochemicals production is greater than the value addition from power generation. Yet gas is an efficient and relatively more environmentally friendly fuel for power plants (compared to coal — especially Indian coal). Anil Ambani's plans to build large power plants in Uttar Pradesh and elsewhere depend crucially on utilising the gas that the group has found in the Godavari basin in south India.

So, assuming that Anil Ambani is to retain control of Reliance Energy, retention of the oil and gas operations will be vital for the rapid growth of its power generation and distribution business. On the other hand, there is bound to be unrelenting pressure from the Reliance Industries side to integrate the oil and gas business with the petroleum refining and petrochemicals operations. So, will Anil Ambani have to be satisfied with only the power operations?

The only other large business that is unconnected with any of these other businesses is the telecommunications business. From its start that business has been firmly under the control of Mukesh Ambani who is unlikely to want to hand it over to his younger brother. Will Mukesh oblige in order to retain the integrity of the petrochemicals and refining operations?

The combined market capitalisation of Reliance Industries and IPCL is over Rs.76,000 crore. Compare that with the market cap of Reliance Energy, which is less than Rs.11,000 crore. If you spin off oil and gas from Reliance Energy, the market cap is sure to get reduced drastically, even though oil and gas are relatively new ventures in this company. The valuation of the group's telecommunications business is not known.

In short, there seems to be little choice for Anil but to be satisfied with taking control of around five to ten per cent of the current businesses in terms of their market valuation. The rest of his share will have to come through holding shares in the bigger business, which his elder brother is almost certain to continue controlling.