SBI reports Rs2,416-cr Q3 net loss as gross NPAs rise to Rs1,99,000 cr

10 Feb 2018

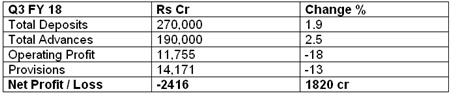

State Bank of India (SBI), the country's largest lender, has reported a net loss of Rs2,416 crore for fiscal third quarter ended 31 December - its first quarterly loss in nearly two decades. The state-run lender had reported a net profit of Rs2,610 crore during the same period last year.

SBI which was already mauled by the RBI directive to classify loans worth Rs23,000 crore, largely in the power sector, as non-performing asset, This led to the bank making a provision for Rs5,720.6 crore against these accounts, taking its overall bad loans to Rs25,830 crore for the quarter ended December 2018.

SBI is now sitting on a huge pile of illiquid assets worth over Rs1,99,000 crore.

"Due to hardening of bond yields the bank had to provide Rs3,400 crore as mark-to-market losses, treasury income was also impacted as there was no major sale of investment, we also had to make higher loan loss and Rs700 crore of wage related provisions," said Rajnish Kumar, SBI chairman said while speaking to the media.

"This has been a challenging year for the bank, but every cloud has a silver lining. In 2019 our estimate is that we will be able to contain fresh slippages and credit costs within 2 per cent."

The bank also said that the RBI has pointed out certain divergences in the bank's asset classification and provisioning as on 31 March, subsequent to the annual Risk Based Supervision (RBS) exercise conducted for fiscal 2017.

SBI said almost 90 per cent of the fresh slippages came from the watch list which now stands at Rs1,0341 crore.

"SBI has posted very weak set of results, slippages are much higher than expected and even the quantum of divergence is on a higher side," said Siddharth Purohit, research analyst with SMC Institutional Equities. "But large part of the slippages has been from the watch list so the watch list should get narrowed down now."

Provisions and contingencies figures increased to Rs 18,876.21 crore for the quarter under review against Rs 8,942.83 crore in the same period last year. Gross bad loans as a percentage of total loans stood at 10.35per cent at the end of the December quarter compared with 7.23per cent during the same period a year ago and 9.83per cent in the previous quarter.

The rise in bond yields saw the value of bonds dip by Rs2,000 crore, requiring provisioning, while profits from trading in securities dipped to Rs1,026 crore from Rs4,900 crore in Q3FY17.

Overall, Rs25,830 crore of fresh loans slipped into the NPA category. "We have done an account-by-account assessment and NPA provisions have peaked and will be coming down in subsequent quarters," said Kumar.

According to Kumar, the large loan accounts against which the bank has initiated insolvency proceedings have advances amounting to Rs78,000 crore. The bank has already made all the statutory provisioning in respect of these loans and most of these were expected to get resolved in the first quarter of FY19.

"We are at the end of the stressed asset cycle we have had enough of it in the last two years, but the next year looks very good to us," Kumar said. "I don't want to sound very optimistic on Q4FY18 but I am not pessimistic about it either. Today I am sitting in February; in 45 days no miracle is going to happen but we can hope for a much better performance next fiscal."

The bank also registered a tepid advances growth of 2.52 per cent. While corporate book continued to post losses the retail advances grew at a strong 13.59 per cent