Sotheby's adopts poison pill to ward off hedge fund Third Point

05 Oct 2013

The board of auction house Sotheby's yesterday adopted a shareholder rights plan or ''poison pill'', in order to stop activist investor Daniel Loeb's Third Point from increasing its stake in the company.

The move comes just two days after Third Point said that it has raised its stake in Sotheby's from 5.7 per cent to 9.3 per cent and called for the resignation of Bill Ruprecht, the auction house chairman and CEO.

The move comes just two days after Third Point said that it has raised its stake in Sotheby's from 5.7 per cent to 9.3 per cent and called for the resignation of Bill Ruprecht, the auction house chairman and CEO.

Sotheby's shareholder-rights plan will block a single activist investor from buying more than 10 per cent of the company's stock.

Although Sotheby's has not named any specific investor, it is clear that it plans to block Third Point – its largest shareholder, from raising its stake in the company. The poison pill expires in 12 months unless approved by shareholders.

Third Point's broadside against the centuries-old auction house is similar to the move it had initiated in May against Japanese electronics and entertainment giant Sony Corp. (See: US hedge fund Third Point urges IPO for Sony entertainment business)

Calling the management team ''a relic from the 1980's,'' Loeb blasted by saying, ''Given their personal interests and miniscule shareholdings of Sotheby's, the Board's actions – disenfranchising its owners who may wish to acquire a more significant stake – come as no surprise. We hope this will be the Ruprecht Board's final snub to its shareholders. It would be unfortunate if they instead refuse to undertake a fresh start until one is imposed upon them during proxy season.''

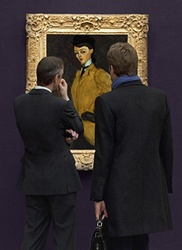

"Sotheby's is like an old master painting in desperate need of restoration," Third Point had said in its letter.

Defending its action, Ruprecht, who has headed Sotheby's since 2000, said, ''This action is designed to protect the interests of all of our shareholders. We look forward to continuing to engage in constructive dialogue with our investors regarding our plans for the business, our comprehensive capital allocation and financial review currently underway, and avenues for enhancing and delivering value to our shareholders.

Loeb has demanded a change in the management by saying that Ruprecht has no control over costs by spending lavishly on his team, a ''perquisite package that invokes the long-gone era of imperial CEOs: a car allowance, coverage of tax planning costs, and reimbursement for membership fees and dues to elite country clubs.''

Loeb noted that since Ruprecht and his team own marginal stock in the company, their interests are not aligned with shareholders.

In its fight with Sotheby's management, Loeb is backed by other US activist funds, including Marcato Management, which holds 6.6 per cent stake and Trian Partners, with 3 per cent holding.

But despite losing smaller sales to arch-rival Christie's, Sotheby's share price has doubled since 2010 and is up by more than 40 per cent in 2013 alone. Sotheby's reported net income of $91.7 million for the second quarter, up 7 per cent from the same period a year earlier.

The New York-based auctioneer has said that Third Point's allegations were "incendiary and baseless," and added that Loeb's move is trying to get control of the company without paying a premium to other shareholders.

It also said that the shareholders rights plan does not stop Third Point from making an offer for the whole company.