Zimbabwe phases out its dollars, pays $5 for Z$175,000,000,000,000,000

13 Jun 2015

Zimbabwe is phasing out its local currency and formalising a multi-currency system introduced during hyper-inflation. Foreign currencies like the US dollar and South African rand, which have been used for most transactions since 2009, is legal tender now, the country's central bank said.

The central bank is now exchanging its old currency notes against foreign currency notes at so high a premium that ordinary people will not have anything to exchange for.

Beginning Monday, the central bank allowed Zimbabweans to exchange of up to 175 quadrillion (175,000,000,000,000,000) Zimbabwean dollars for five US dollars through their bank accounts.

However, a generous government may offer $5 even if you have less than that.

Higher balances will be exchanged at a rate of Z$35 quadrillion to US$1.

The Zimbabwe dollar went down after inflation in the country peaked in 2008, when prices doubled every 25 hours - the second-worst hyperinflation in history, after postwar Hungary's.

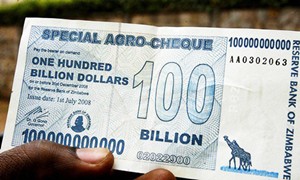

This saw Zimbabwe print the hundred-trillion-dollar banknotes that are still floating around amid a shrinking economy.

Six years after the central bank allowed the US dollar to replace its old currency it has now decided to retire the old currency as the hyperinflation ended, although nobody uses it anymore.

The US dollar replaced it as Zimbabwe's official currency back in 2009, which ended the inflation. Zimbabwe dollars are little more than souvenirs now, and, commentators say, once could probably get a better price for them on eBay than the $5 the government is offering for them.

Zimbabwe's problems began with the Mugabe regime that seized what were mostly white-owned farms to distribute to the country's majority black population. The dole-out went awry when Mugabe handed over the land to cronies who had no idea how to run large-scale commercial farms.

Agricultural exports, which were a big part of the economy, crumbled. Mugabe tried to boost spirits by increasing salaries for soldiers and other friends of the regime. He printed money for this. But, with tax revenues drying up, the government's deficit got bigger.

The more money it printed was chasing what were now very few goods. Inflation soared from the merely ridiculous to absurd levels - something like 80,000,000,000 per cent on a monthly basis.