Tesla sets a new delivery record, falling short of Musk's 2 million target

28 Dec 2023

In what is anticipated to be another historic quarter for electric vehicle (EV) giant Tesla, the company’s deliveries are expected to reach unprecedented levels. However, it appears that Tesla might not meet the ambitious 2 million annual delivery target proclaimed by CEO Elon Musk at the start of 2023.

Despite facing a slowdown in sales, Tesla strategically utilized its industry-leading profit margins by implementing significant price cuts on its four car models globally through 2023. The primary focus was on the Chinese market, where Tesla had been losing ground to local competitors, including BYD.

The price war, coupled with a deceleration in EV demand, has led other automakers, such as Ford Motor, to reassess and scale back their electrification plans. Consequently, Tesla emerged as the undisputed leader in the United States, causing its stock to more than double in value over the year.

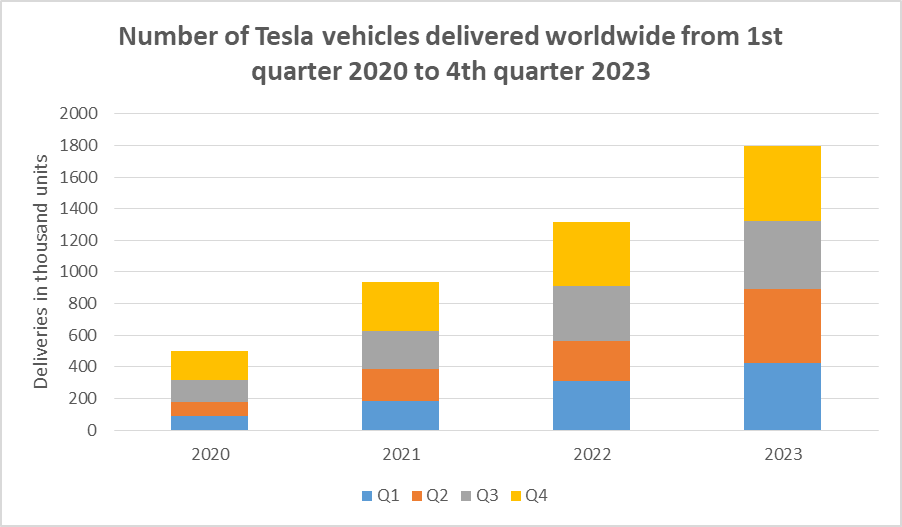

Analysts estimate that Tesla will likely deliver 1.82 million vehicles globally in 2023, reflecting a substantial 37% increase from 2022. The fourth quarter alone saw approximately 473,000 units delivered, according to a poll of 14 analysts by LSEG.

Refer to the chart below to understand the quarterly sales of Tesla vehicles from 2020 to 2023.

While Elon Musk expressed confidence in Tesla’s potential to achieve the 2 million delivery milestone early in the year, recent statements in October 2023 indicated concerns about higher borrowing costs impacting demand. In response, Tesla engaged in a year-end sales push, offering increased discounts on key models.

Looking ahead to 2024, Tesla faces challenges, including the expiration of federal tax credits for some vehicles in the United States and Germany. Despite the potential easing of interest rates and battery ingredient costs, the loss of subsidies may necessitate further price cuts.

Jairam Nathan, an analyst at Daiwa Capital Markets, adjusted his delivery estimate for Tesla in 2024 to 2.04 million, anticipating a 4% decline in average revenue per car compared to 2023.

In addition to market dynamics, Tesla contends with increased regulatory scrutiny of its self-driving systems in the United States and parts of Europe. A recent recall of nearly 2 million vehicles on U.S. roads to install new safeguards highlights the growing scrutiny.

While analysts expect 2.2 million deliveries by Tesla, there is skepticism about whether newly released models, such as the Cybertruck and a refreshed Model 3, can significantly boost demand. Tesla acknowledges being in an intermediate-low-growth period, according to Investor Relations Chief Martin Viecha.

Investors anticipate continued pressure on Tesla’s margins as the company ramps up Cybertruck production and prepares to launch a more affordable car platform. Musk’s vision of full self-driving (FSD) contributing significantly to Tesla’s value faces challenges amid the regulatory landscape.

As Tesla navigates these challenges, including the anticipated 2024 release of the Cybertruck, it remains to be seen how the company will maintain its position as a leader in the rapidly evolving EV market.