3:30 pm Market Closing: Benchmark indices closed sharply higher on Thursday, with the Sensex rising 577.73 points or 1.75 percent to 33,596.80, and the Nifty gaining 196.80 points or 1.94 percent at 10,325.20.

More than three shares advanced for every share falling on the BSE.

Nifty Midcap index was up 380 points or 2 percent.

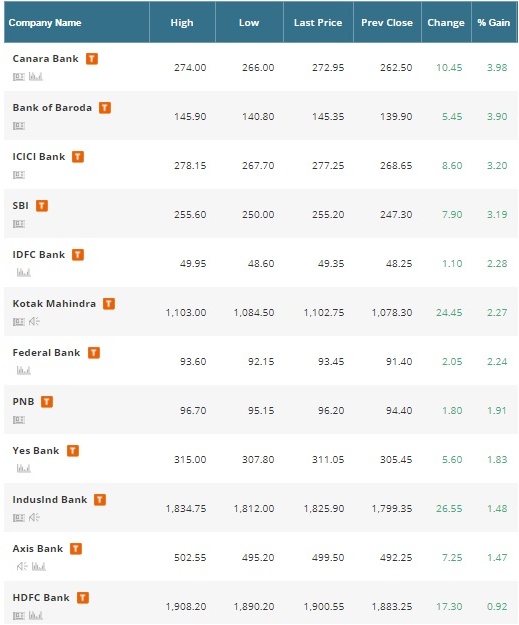

All sectoral indices ended in the green, with PSU Bank index rising 5 percent. Metal was up 4 percent while Nifty Bank, Realty and Financial Services indices rallied more than 2 percent.

Canara Bank, Bank of India, Ujjivan Financial and L&T Finance Holdings rallied 6-10 percent.

Strides Shasun, Kwality and Adani Enterprises were down up to 4 percent.

3:26 pm Stock Advise: Ajay Srivastava of Dimensions Consulting advised selling only PSU banks on every rally

3:22 pm Expert View: Garima Kapoor, Economist, Elara Capital said in line with expectation, MPC maintained status quo in monetary policy. The recent softening in retail inflation that had firmed up during early months of winter, supported RBI’s decision to maintain status-quo. The recent moderation also supported a downward revision to RBI’s forecasts for FY19 CPI inflation.

"However, we expect headline CPI inflation to overshoot RBI’s forecast. We expect retail inflation to remain in the range of 4.7-5.6 percent in H1 FY19 (versus RBI's forecast of 4.7-5.1 percent) and 3.7-5.0 percent in H2 FY19 (versus RBI’s forecast of 4.4 percent)."

She said Elara believes factors such as the expected trajectory of food prices (following new formula for MSP revision), trend in crude oil and other commodity prices and outlook for South West Monsoon will remain key in determining policy trajectory.

It expects one rate hike of 25 bps towards second half of FY19.

3:20 pm PSU banks extend rally: Nifty PSU Bank index is up 3.7 percent.

3:17 pm Market Update: The 30-share BSE Sensex was up 605.55 points or 1.83 percent at 33,624.62 and the 50-share NSE Nifty rose 196.90 points or 1.94 percent to 10,325.30.

3:15 pm Bond Yields decline: 7.17% 2028 government 10-year bond yield fell 1.36 percent to 7.195 percent after RBI Policy. Last month

3:12 pm Total turnover for the market stood at Rs 11.98 lakh crore.

3:09 pm Market Outlook: Motilal Oswal said markets have corrected very well and now awaiting there bounces in the corporate earnings momentum.

He thinks 10,000 on Nifty and 33,000 on Sensex are good levels to invest in the equity markets from the long-term perspective. "We will witness some turbulence, thanks to global trade fight, but subject to that volatility, these are good levels for retail investors to commit some money," he said.

3:07 pm Expert View: Motilal Oswal, Chairman & MD, Motilal Oswal Financial Services said as expected RBI Governor Urjit Patel left all key rates unchanged. It is imperative in the global scenario to hold the horses of reaction to rates.

Two continents are going to tighten the economy, in that situation to keep status quo is the best way, and observe the changes.

From the Indian context, we are at a reasonably good base rate and financial sector is now passing on the benefits of lower rates slowly, in the economy.

3:04 pm Market Update: Benchmark indices rallied further in last hour of trade, with the Sensex rising 571.31 points or 1.73 percent to 33,590.38 and the Nifty gaining 185.90 points or 1.84 percent at 10,314.30.

3:01 pm PE Investments: Investments by private equity and venture capital funds surged 60 per cent to a record high of USD 26 billion in 2017, while the bull markets helped register highest ever exits in a year, a report said.

The exits grew 60 percent to USD 15.7 billion with the public market being the preferred mode, consultant Bain & Company said.

Terming the year as a "strong year" for the private equity market, its partner Arpan Sheth attributed the rise to improving economic indicators, formalisation of the economy, and steps like passage of the bankruptcy law to address the non performing assets issue.

From a fund raising perspective, there was a 48 percent increase with India-focussed funds raising USD 5.7 billion, it said, with a bulk USD 5.1 billion being raised by alternate investment funds like those looking for assets in distress.

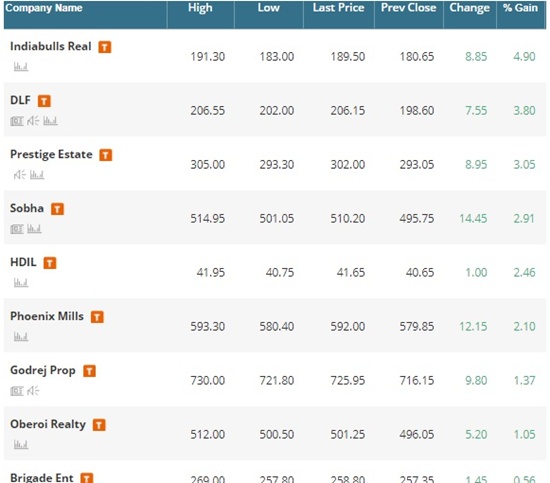

2:57 pm Realty Stocks on Buyers' radar:

2:54 pm Market Update: The market extended rally after the RBI kept policy rates unchanged and cut inflation forecast.

The 30-share BSE Sensex was up 532.34 points or 1.61 percent at 33,551.41, while the 50-share NSE Nifty reclaimed 10,300 levels, rising 177 points or 1.75 percent to 10,305.40.

About four shares advanced for every share falling on the BSE.

All sectoral indices were in the green. Nifty Bank, Auto, Metal and Realty were up 2-4 percent.

2:50 pm The next meeting of the MPC is scheduled on June 5 and 6, 2018.

2:47 pm Economic Growth: RBI said several factors are expected to accelerate the pace of economic activity in 2018-19.

"First, there are now clearer signs of revival in investment activity as reflected in the sustained expansion in capital goods production and still rising imports, albeit at a slower pace than in January. Second, global demand has been improving, which should encourage exports and boost fresh investment."

On the whole, GDP growth is projected to strengthen from 6.6 percent in 2017-18 to 7.4 percent in 2018-19 – in the range of 7.3-7.4 percent in first half and 7.3-7.6 percent in second half – with risks evenly balanced (Chart 2).

2:43 pm RBI said projected CPI inflation for 2018-19 is revised to 4.7-5.1 percent in first half of 2018-19 and 4.4 percent in second half, including the HRA impact for central government employees, with risks tilted to the upside (Chart 1).

2:41 pm Nifty Bank index gains nearly 2%:

2:38 pm Inflation Forecast: RBI said the 6th bi-monthly resolution of 2017-18 in February projected CPI inflation at 5.1 percent in Q4:2017-18; and in the range of 5.1-5.6 per cent in first half of 2018-19 and 4.5-4.6 percent in

second half of FY19, including the HRA impact, with risks tilted to the upside.

Actual inflation outcomes in January-February averaged 4.8 percent, largely reflecting the sharp decline in vegetable prices and significant moderation in fuel group inflation. The available information suggests that

vegetable prices continued to moderate in March as well. Accordingly, inflation in Q4FY18 is now projected at 4.5 percent.

2:35 pm Monetary Policy committee's five members Chetan Ghate, Pami Dua, Ravindra H Dholakia, Viral V Acharya and Urjit R Patel voted in favour of the monetary policy decision.

Michael Debabrata Patra voted for an increase in the policy rate of 25 basis points. The minutes of the MPC’s meeting will be published by April 19, 2018.

2:33 pm Market Update: Benchmark indices remained strong after the Reserve Bank cut inflation forecast, indicating no rate hike for at least a year.

The 30-share BSE Sensex was up 479.56 points or 1.45 percent at 33,498.63 and the 50-share NSE Nifty rose 154.90 points or 1.53 percent to 10,283.30.

2:31 pm The Reserve Bank of India expectedly kept repo rate unchanged at 6 percent but cut inflation forecast.

"On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.0 percent. Consequently, the reverse repo rate under the LAF remains at 5.75 percent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.25 percent," the RBI said.

2:20 pm Earnings Expectations: Edelweiss expects Q4FY18 earnings to broadly mirror Q3FY18 trend of earnings improvement.

"We estimate our universe (235 companies) to post 12 percent earnings growth (9 percent in Q3FY18) during the quarter. While overall earnings are improving, the quality leaves much to be desired as commodities account for >80 percent of the profit growth. Core earnings (universe, ex-banks, commodities and telecom) are expected to inch up mere 6 percent on a low base (Q4FY17 profit had contracted 5 percent)."

Edelweiss expects: a) The good-commodities, consumer discretionary, retail lending banks & NBFCs to post >20 percent earnings growth; b) Bad-domestic investment and export-oriented companies (IT, pharma, Tata Motors) to post flat growth; and c) Ugly-corporate lending banks & telecom to report losses.

Key monitorables are: a) banks’ asset quality; b) impact of commodity prices on gross margins; c) commentary on E-way bill implementation; and d) capex outlook.

2:15 pm World Stocks Update: World stocks edged higher as investors used signs of an easing of Sino-US trade tensions to dip back into riskier assets.

The MSCI world equity index, which tracks shares in 47 countries, climbed 0.4 percent, while shares in Europe jumped 1.6 percent to a two-week high.

2:05 pm Crude Oil Update: Oil prices rose, buoyed by the US government data showing a surprise drawdown in crude stockpiles and an easing of tensions over a trade row between the United States and China.

US West Texas Intermediate crude for May delivery was up 0.25 percent, at USD 63.53 a barrel.

Front-month London Brent crude for June delivery was up 0.34 percent, at USD 68.25.

1:55 pm Record Date for Dividend: Godrej Consumer Products has fixed May 16, 2018 as the record date for the purpose of payment of interim dividend.

The said interim dividend, if declared, will be paid on May 30, 2018.

1:45 pm Market Update: Bulls are in power at Dalal Street as the Sensex is up more than 450 points and the Nifty is inching towards 10,300 levels following positive lead from global stocks on easing of trade war tensions.

All sectoral indices are in the green ahead of the outcome of monetary policy committee meeting due later today wherein analysts largely expect status quo on policy rates.

1:35 pm Europe Update: European equities rose sharply higher as trade tensions eased.

The pan-European Stoxx 600 was 1.5 percent higher with every sector rising.

Overall, market sentiment was driven by news that the US is willing to sit down with the Chinese authorities and fix their trade divergences. China presented Wednesday a list of retaliatory measures against recent proposals for US tariffs on a range of Chinese products.

1:21 pm RBI Policy Expectations: Kunal Shah, CFA, Fund Manager - Debt, Kotak Mahindra Life Insurance said the MPC policy statement should continue to be on a neutral side as inflation has surprised on the lower side with average Q4 CPI Inflation seen at 4.5 percent compared to RBIs projection of 5.1 percent. On the other hand growth prospects are improving and monetary supports for growth are not vehemently called for.

MPC committee will highlight risks of inflation inching towards 5 percenet mark in FY19 specially due to MSP hikes and gradual closing of output gap. Having said that, MPC members could take some comfort if monsoon performance is good and prices are seen at moderate levels.

We think MPC will only be able to adopt hawkish stance if inflation surprises towards 5.5 percent by year end and likelihood of which are minimal today.

RBI will also announce the roadmap for FPI limit hikes and its specifications. Currently, markets are expecting FPI limit hikes of 1-2 percent with government calling for 2 percent hike and RBI favouring 1 percent (percent of outstanding government bonds).”

1:09 pm Dilip Buildcon in focus: The road developer informed exchanges that the project WCP-5 -design, build, finance, operate, maintain and transfer (DBFOMT) of Hirekerur-Ranibennur in Karnataka, Hybrid Annuity Basis, has been completed.

The provisional completion certificate has been issued and declared fit for entry into commercial operation as on February 24, 2018 and consequently the company is entitled to maximum bonus of one annuity payment of Rs 19.62 crore in lieu of earlier completion of the said project, it added.

The trading window for dealing in the securities of the Company by its designated employees, directors and promoters is already closed till April 06, 2018 and shall continue to remain close till to April 09, 2018.

12:55 pm Increase in Shareholding: US-based SmallCap World Fund has hiked its stake in e-commerce firm Infibeam Incorporation by almost 2 percent through an open market transaction for an estimated sum of Rs 168.94 crore.

According to a regulatory filing, SmallCap, which held 3.54 percent stake in Infibeam earlier, bought 1.07 crore shares representing 1.97 percent of equity stake.

Post the acquisition, SmallCap's stake in the company stands at 5.51 percent.

12:42 pm Lok Sabha Disruption: Congress and BJP members traded charges over the near washout of the Budget session as the proceedings of the Lok Sabha were disrupted for the 21st consecutive day.

Noisy protests by AIADMK members seeking early constitution of the Cauvery water management board saw the House being adjourned for the day.

Congress leader Sonia Gandhi was also seen agitated over certain names being taken by Parliamentary Affairs minister Ananth Kumar holding them and her party responsible for the disruptions in the House.

Soon after the House met to take up the day's business, AIADMK members trooped into the Well and raised slogans seeking immediate constitution of the board.

12:32 pm Expansion of broadband internet services: DEN Broadband, India’s fastest growing fixed broadband internet service provider (ISP) announced expansion of it’s hi-speed internet services to 100 cities across India.

After an encouraging response to the pilot project in five cities, Den has already started its first phase of expansion in 15 cities. After the completion of this phase, DEN Broadband will enable 1.1 crore Indian households with high-speed broadband services by 2020.

12:20 pm Buzzing: Share price of Dilip Buildcon advanced more than 5 percent as the company completed highway project and entitled to maximum bonus of Rs 177,300,000.

The company has informed that project WCP-6 DBFOMT of existing state highway Mundargi-Hadagali-Harapanhalli in the state of Karnataka, on annuity basis, has been completed.

The provisional completion certificate has been issued and declared fit for entry into commercial operation as on February 5, 2018.

With this the company is entitled to maximum bonus of one annuity payment of Rs 177,300,000 in lieu of earlier completion of the said project.

12:10 pm Market Update: Equity benchmarks stayed strong in noon on positive global cues, driven by rate sensitive stocks - auto, banks and realty. Investors await the outcome of monetary policy committee meeting due later today.

The 30-share BSE Sensex was up 446.75 points or 1.35 percent at 33,465.82 and the 50-share NSE Nifty rose 147 points or 1.45 percent to 10,275.40.

About four shares advanced for every share falling on the BSE.

Vedanta and Tata Motors were biggest gainers among Nifty50 stocks, rising 4.5 percent each. Reliance Industries, ICICI Bank, L&T, Bajaj Finance and Infosys gained 1-3 percent.

12:01 pm Buzzing: Shares of interest rate-sensitive stocks like auto, banking and realty rallied in morning trade on the bourses ahead of the Reserve Bank of India's monetary policy decision today.

The Monetary Policy Committee (MPC), headed by RBI Governor Urjit Patel, will announce the resolution of the MPC on its first bi-monthly monetary policy for financial year 2018-19 later in the day.

Among banking stocks, Kotak Mahindra Bank rose as much as 1.6 percent, while Yes Bank jumped 1.64 percent, State Bank of India 1.9 percent, Federal Bank 1.26 percent, Punjab National Bank 1.64 percent and Bank of Baroda 2.32 percent.

The outcome of the MPC meeting is being keenly awaited by stakeholders amidst pressure on RBI to cut interest rates in the wake of declining retail inflation and the need to fuel growth momentum.

11:50 am Binani Industries gains 5%: National Company Law Appellate Tribunal has refused to stay out-of-court settlement process for Binani Cement.

The NCLAT has rejected Dalmia's plea to stay out-of-court settlement for the cement company.

11:40 am Rupee Trade: The rupee strengthened by 6 paise to 65.08 against the dollar at the interbank forex market on fresh selling of the greenback by exporters and banks ahead of the RBI's monetary policy outcome later in the day.

Dealers said dollar's weakness against some other currencies overseas and early gains in domestic equity markets supported the rupee.

Yesterday, the rupee fell 14 paise to end at 65.15 against the US dollar.

11:30 am Order Win: Ashoka Buildcon emerged as the lowest bidder for for the electrification work worth Rs 320.92 crore in Etah and Kashiram Nagar (Kasganj) district and Rs 438.92 crore in Kannoj, Farrukhabad and Etawa district.

11:20 am Expansion: Varun Beverages announced its plans to set-up a greenfield production facility (subject to receipt of necessary approvals)

to create in-house production capacity for Tropicana fruit juices, Quaker Oats Milk based beverages and Gatorade.

Spread over around 41 acres in Pathankot district of Punjab, it will be the first fully backward integrated facility in India to manufacture the complete range of above products including CSD at a single location, the company said.

11:10 am Collaboration: Cyient has announced collaboration with the India2022 Coalition to develop solutions in the diagnostic healthcare space.

11:01 am IPO: Crystal Crop Protection, an R&D based crop protection manufacturing, and marketing company, filed its draft red herring prospectus (DRHP) with market regulator SEBI seeking permission for its initial public offering (IPO).

The company is planning to raise Rs 1,000 crore via IPO.

The IPO comprises of a fresh issue of up to Rs 545 crore and an offer for sale of upto Rs 455 crore, from promoter, selling shareholders (Kanak Aggarwal, Komal Aggarwal, Nand Kishore Aggarwal and Ankur Aggarwal) and investor selling shareholder by Everstone Capital Partners II LLC.

The net proceeds from the issue will be utilised towards repayment of certain working capital facilities; funding acquisitions and other strategic initiatives; and general corporate purposes.

10:50 am Board Meeting: ICICI Securities said the board of directors will consider approval of the audited annual accounts & financial results of the company for the financial year ended March 2018 and consider the recommendation of dividend, if any, on the equity shares for the financial year ended March 31, 2018 at its meeting to be held on April 14, 2018.

10:40 am Buzzing: Bhansali Engineering Polymers share price is locked at 5 percent upper circuit at Rs 201.35 on the BSE following successful ABS capacity expansion.

"ABS capacity expansion plan of the company from 80 KTPA to 100 KTPA at its Abu Road Unit has been successfully implemented within the envisagd cost and time frame i.e. Rs 20 crore and March 31, 2018, respectively," the company said.

The cost of this expansion has been financed through internal accruals of the company while it continued to maintain its status as a zero debt entity, it added.

10:30 am Services PMI Data: Following a modest contraction in February, Indian service activity stabilised in March, underpinned by greater inflows of new work. As business sentiment was at the strongest level since July, firms raised their staffing levels at the fastest pace since June 2011. On the price front, input cost inflation was marked but softened from February’s three-month high. Subsequently, output charge inflation eased to the weakest in 2018 so far, Nikkei IHS Markit said.

The seasonally adjusted Nikkei India Services Business Activity Index rose from 47.8 in February to 50.3. This signalled that business activity stabilised at the end of the quarter, following the decline seen in February.

10:24 am Order Win: ITI said it has been declared as L1 in the 'MAHANET tender of Maharashtra State for connecting Gram Panchayats to block level through fibre under Bharat Net Phase II Project'.

The approximate value of the tender is Rs 3,200 crore. The stock gained 3 percent.

10:20 am Market Update: Benchmark indices rallied further, with the Sensex rising 473.44 points or 1.43 percent to 33,492.51 and the Nifty gaining 150.90 points or 1.49 percent at 10,279.30.

About six shares advanced for every share falling on the BSE.

10:10 am Order Win: The construction arm of Larsen & Toubro has won orders worth Rs 3,376 crore.

Power transmission & distribution business segment has secured orders worth Rs 1,226 crore while water & effluent treatment segment secured an order worth Rs 1,200 crore.

Buildings & factories business has bagged orders in health and automobile sector worth Rs 950 crore from two prestigious clients.

10:07 am Market Update: Benchmark indices remained strong as the Sensex was up 400.97 points or 1.21 percent at 33,420.04 and the Nifty gained 131.30 points or 1.30 percent at 10,259.70.

About 1,731 shares advanced against 292 declining shares on the BSE.

10:04 am Market Outlook: "We believe market is currently in consolidation phase and will look on development on trade tariffs and earning results of Q4 FY18 to take momentum from here. Having said that we believe, markets have strong resistance around current levels and valuation parameters for quality stocks look reasonable," Abhinav Gupta - President, Capital Markets - Share India Securities Ltd said in an interview to Moneycontrol.

9:57 am RBI Policy Expectations: Lakshmi Iyer, CIO- Debt & Head of Products, Kotak Mutual Fund said the upcoming MPC meeting holds significance in terms of the guidance the RBI has to offer. General market view is that of an extended pause. Market would also want to see the MPCs reaction to the recent axe in government borrowing program and its view on the fisc thereof.

Lastly, though our view is that of status quo, it would be interesting to see the MPCs accompanying stance in the light of moderation in CPI domestically and its reaction to the recent global developments.

9:52 am Buzzing: Indian Hotels Company share price rallied as much as 3.7 percent in morning after receiving extraordinary income from Newbury Owner LLC.

The international chain of hotels and resorts informed exchanges on Wednesday that pursuant to the Amendment Agreement entered into with Newbury Owner LLC, the IHMS (USA) LLC has received fees of about USD 6.91 million as an extraordinary income.

The extraordinary income is for modification of certain contractual terms.

9:42 am ICICI Securities falls further:

9:40 am Market Update: Dalal Street is on a strong footing as benchmark indices are up more than 1 percent following positive lead from global stocks and ahead of monetary policy committee meet outcome due later today.

The Sensex was up 353.42 points or 1.07 percent at 33,372.49 and the Nifty gained 116.40 points or 1.15 percent at 10,244.80.

Midcaps outperformed frontliners, with the Nifty Midcap index rising 1.5 percent on strong market breadth. About 8 shares advanced for every share falling on the NSE.

All sectoral indices are in the green, with the Metal, Realty rising more than 2 percent.

9:32 am Plant Approval: Shares of Indoco Remedies added 4.5 percent on accreditation renewal from Japanese regulatory authorities.

The company’s API plant at Patalganga has received accreditation renewal from the Japanese regulatory authorities.

The said accreditation is valid until May 21, 2023.

ICRA has revised the rating from AA- to A+ for the long term borrowing programme of the company.

9:23 am Market Update: Frontline indices extended gains, with the Sensex rising 383.96 points or 1.16 percent to 33,403.03 and the Nifty gaining 124.10 points or 1.23 percent at 10,252.50.

Apollo Tyres rallied 4.5 percent while Balkrishna Industries and MRF gained 3 percent.

The market breadth is very strong as about 8 shares advanced for every share falling on the BSE.

9:20 am Buzzing: Smartlink Network Systems share price rallied 14 percent as a meeting of the board of directors of the company will be held on April 07 to consider the proposal to buy-back the fully paid-up equity shares of face value Rs 2.

9:18 am Trade Deficit between India and US: The trade deficit between India and the US dropped by almost six per cent in 2017 compared to the previous year, the US Trade Representative (USTR) has said, even as it continued to harp on issues such as market access and high tariffs on several American products being imported into India.

"The US goods trade deficit with India was USD 22.9 billion in 2017, a 5.9 per cent decrease (USD 1.4 billion) over 2016," said the National Trade Estimate 2018 released by the USTR. India is one of the few countries with which US' trade deficit has decreased in the last one year.

9:15 am Market Opening: Benchmark indices bounced back sharply, tracking strong lead from global stocks and ahead of RBI monetary policy outcome.

The 30-share BSE Sensex was up 345.45 points or 1.05 percent at 33,364.52, and the 50-share NSE Nifty rose 112.80 points or 1.11 percent to 10,241.20.

Tata Steel, UPL, Yes Bank, Tata Motors, Bajaj Finserv, M&M, Eicher Motors, Grasim, Adani Power, Kotak Mahindra Bank, L&T, IndusInd Bank, ITC and SBI gained up to 3 percent.

Nifty Midcap index rallied 1.6 percent. Nifty IT was up 1.3 percent and PSU Bank rose 1.6 percent.

Future Consumer, Delta Corp, Edelweiss Financial, Jet Airways, Voltas, Natco Pharma, InterGlobe Aviation, Dilip Buildcon and Bhansali Engineering rallied up to 5 percent.

9:10 am Rupee Trade: The Indian rupee opened higher by 12 paise at 65.03 per dollar on Thursday versus previous close of 65.15.

According to ICICIdirect, the near-month dollar-rupee April contract on the NSE was at 65.33. The April contract open interest declined 5.99% from the previous day.

The research house expects USD-INR to meet supply resistance at higher levels. Utilise upsides in the pair to go short in USD-INR.

9:07 am Market Update: Benchmark indices extended rally in pre-opening trade, with the Sensex rising 270.49 points to 33,289.56 and the Nifty gaining 98 points at 10,226.40.

Jain Irrigation and Future Consumer gained more than 3 percent.

9:06 am Technical Recommendations: Moneycontrol spoke to ICICIDirect.com and here’s what they have to recommend:

Eicher Motors: BUY CMP – 28900.00 Target – 32200.00 Stop Loss – 27110.00 Upside – 11% Time Frame 6 months

Indian Hotel: BUY CMP – 136.00 Target – 166.00 Stop Loss – 124.00 Upside – 21% Time Frame 6 months

9:03 am Stocks in news: Adani Enterprises: The company has won an award from National Highways Authority of India (NHAI) for an infrastructure project in Chhattisgarh.

Natco Pharma: The firm has launched first generic version of oral tablets for multiple scerlosis in India.

Binani Industries: The company has offered to pay Rs 7,229 crore to lenders, creditors of Binani Cement, CNBC-TV18 reported.

Bharat Heavy Electricals: The company has begun 330 MW Kishanganga HEP In J&K.

Axis Bank: The central bank has rejected its request for gold & silver import in FY19.

Jet Airways: The airline will buy 75 Boeing 737 Max jets worth up to USD 9.7 billion.

IndusInd Bank ties up with JSW Foundation to support women athletes

Max Financial Services' board meeting on April 9, 2018, to consider and evaluate proposals for raising of funds by way of debt instruments

Kansai Nerolac entered into share purchase agreements (SPAs) to acquire 100% equity stake in Marpol for an aggregate consideration of Rs 36 crore

Bhansali Engineering Polymers board meeting on April 13, 2018, to consider audited financial results and recommendation of dividend to members for FY 17-18

Dilip Buildcon completed highway project and entitled to a maximum bonus of one annuity payment of Rs 177,300,000 for earlier completion.

9:02 am Market Check: Benchmark indices were higher in pre-opening trade, following positive lead from global stocks.

The 30-share BSE Sensex was up 73.53 points at 33,092.60 and the 50-share NSE Nifty rose 55.60 points to 10,184.

The SGX Nifty also indicated strong opening for the frontliners, rising 153 points to 10,283 on the Singapore Stock Exchange.

Tata Motors, SBI, Bank of Baroda, JSW Steel, JSPL, Tata Steel, Bank of India, UCO Bank, Allahabad Bank and Vijaya Bank gained up to 3 percent

Wall Street’s three major indexes staged a comeback to close around 1 percent higher on Wednesday as investors turned their focus to earnings and away from a trade conflict between the United States and China that wreaked havoc in earlier trading, Reuters reported.

The Dow Jones Industrial Average rose 230.94 points, or 0.96 percent, to close at 24,264.30, the S&P 500 gained 30.24 points, or 1.16 percent, to 2,644.69 and the Nasdaq Composite added 100.83 points, or 1.45 percent, to 7,042.11.

Asian shares bounced from two-month lows on Thursday as world equities recovered from a selloff triggered by escalating Sino-US trade tensions, with investors hoping a full-blown trade war between the world’s two biggest economies can be averted, Reuters reported.

Markets in mainland China, and those in Hong Kong and Taiwan are closed on Thursday.