Indian IT sector revenues aggregate $64 billion: NASSCOM

11 Feb 2008

Mumbai: Trade body and 'voice' of the IT – BPO industry in India NASSCOM has announced key findings from the Strategic Review 2008.

Findings indicate software and services exports are expected to cross $40 billion, and the domestic market is expected to touch $23 billion in FY08.

Positive market indicators and a strong track record strongly support the optimism of the industry in achieving its aspired target of $60 billion in software and services exports, and $73-75 billion in overall software and services revenues, by FY2010.

The Strategic Review 2008 will be formally released at the NASSCOM's upcoming conference - India Leadership Forum, scheduled to be held from 13 to 15 February, 2008, in Mumbai.

Commenting on the key findings of the Strategic Review 2007, Lakshmi Narayanan, chairman NASSCOM and vice-Chairman, Cognizant, said ''The robust growth of the Indian IT-BPO industry by over 33 per cent in the current fiscal year reinforces the confidence of global corporations in India. As we move towards 2010, trends indicate that the industry is firmly poised for broad-based growth across industries and service lines, thereby strengthening India's leadership position as the primary sourcing location for software, IT infrastructure and business process- related services.''

Som Mittal, president, NASSCOM said, ''The Indian IT industry has been rapidly evolving; growth is on track to achieve, if not exceed the targets for 2010. The trends are interesting and findings indicate that the domestic market is poised for growth with IT spends trending upwards, particularly by the Government. We also see an increasing level of specialisation within the industry both in IT services and BPO, exhibiting signs of a rapidly maturing industry. However, there are global macro economic challenges; talent, manpower and infrastructure issues will need to be addressed and resolved, collectively. The industry has shown resilience and has taken several steps to mitigate the impact.''

In addition to the direct positive impacts on national income growth, foreign exchange reserve accumulation and employment generation, the sector has also spawned several ancillary industries, triggered a rise in direct-tax collections and propelled an increase in consumer spending, attributed to the significantly higher disposable incomes. It is estimated that every rupee earned in the Indian IT-BPO sector induces nearly another rupee of economic spending in the rest of the economy and every job created in the sector induces the creation of 4 more jobs in the economy.

The Strategic Review 2008 looks at various aspects relating to the Indian IT-BPO sector's performance in 2007. The report estimates the growth expected in the current fiscal FY2008, detailing the service line trends observed across the various industry segments over the past year and assessing India's competitiveness as a sourcing destination. It analyses the sustainability of each individual factor contributing to India's leadership position and provides a view of the outlook projected for the global and Indian IT-BPO industries – outlining the opportunities, challenges and agenda for key stakeholders to further extend India's leadership in this space.

Key Highlights of the IT-ITES sector performance in FY 2007-08

IT Industry-Sector-wise break-up| $ (billion) | FY2004 | FY2005 | FY2006 | FY2007 | FY2008 E |

| IT Services | 10.4 | 13.5 | 17.8 | 23.5 | 31.0 |

| -Exports | 7.3 | 10.0 | 13.3 | 18.0 | 23.1 |

| -Domestic | 3.1 | 3.5 | 4.5 | 5.5 | 7.9 |

| ITES-BPO | 3.4 | 5.2 | 7.2 | 9.5 | 12.5 |

| -Exports | 3.1 | 4.6 | 6.3 | 8.4 | 10.9 |

| -Domestic | 0.3 | 0.6 | 0.9 | 1.1 | 1.6 |

| Engineering Services and R&D, Software Products | 2.9 | 3.8 | 5.3 | 6.5 | 8.5 |

| -Exports | 2.5 | 3.1 | 4.0 | 4.9 | 6.3 |

| -Domestic | 0.4 | 0.7 | 1.3 | 1.6 | 2.2 |

| Total Software and Services Revenues Of which, exports are | 16.7 | 22.5 | 30.3 | 39.5 | 52.0 |

| 12.9 | 17.7 | 23.6 | 31.3 | 40.3 | |

| Hardware | 5.0 | 5.6 | 7.1 | 8.5 | 12.0 |

| -Exports | n.a. | 0.5 | 0.6 | 0.5 | 0.5 |

| -Domestic | n.a. | 5.1 | 6.5 | 8.0 | 11.5 |

| Total IT Industry (including Hardware) | 21.6 | 28.2 | 37.4 | 48.0 | 64.0 |

Note: Figures may not add up due to rounding off.

Source: NASSCOM

Global Sourcing Trends in 2007

- Worldwide technology products and related services sector spends are estimated to have grown at 7.3 per cent to nearly reach $1.7 trillion in 2007

- IT-BPO services, growing at an above-sector-average rate of nearly 8 per cent, remain the largest category, accounting for an increasing share of the worldwide technology sector revenue aggregate.

- Outsourcing continues to be the primary growth driver, sustained by gradual shifts in regional spending patterns – with increasing traction in Europe and Asia Pacific offsetting a marginal decline in share of the Americas.

- Underlying this steady growth in services spends is the increasing adoption and continued evolution of the global sourcing supply-chain. Global sourcing of technology related services is estimated to have grown by about 30 per cent to reach $70-76 billion in 2007.

- Increasing emphasis on innovation-led growth added to the secular trend in technology related spending, with IT-enablement.

- Global delivery now being recognized as complementary means of effectively increasing productivity, reducing time-to-market and thereby increasing the returns on innovation investment.

Indian IT-BPO Performance in FY2008

- The Indian IT-BPO revenue aggregate is expected to grow by over 33 per cent and reach $64 billion by the end of FY2008.

o IT exports (including hardware exports) are expected to cross $40.8 billion in FY2008 as against $31.9 billion in FY2007, a growth of 28 per cent.

o Domestic IT market (including hardware) is estimated to reach 23.2 billion in FY2008 as against $16.2 billion in FY2007, a growth of 43 per cent

- The direct employment in the sector is expected to reach nearly 2 million, an increase of about 375,000 professionals over FY2007.

o IT services exports, BPO exports and Domestic IT industry provides direct employment to 865,000, 704,000 and 427,000 professionals respectively.

- As a proportion of national GDP, the Indian technology sector revenue has grown from 1.2 per cent in FY1998 to an estimated 5.5 per cent in FY2008.

Software and Services Exports FY2008:

|

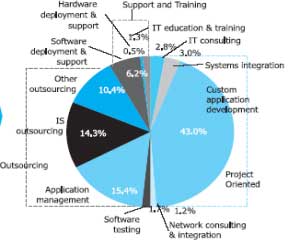

| Split by service offerings in IT Services |

- Exports remain the mainstay of the sector and are estimated to reach $40.3 billion in FY2008, contributing nearly 64 per cent to the overall revenue aggregate

- IT services (excluding BPO, product development and engineering services), contributing to 57 per cent of the total software and services exports, remains the dominant segment and is expected to cross $23 billion, a growth of 28

per cent in FY2008.

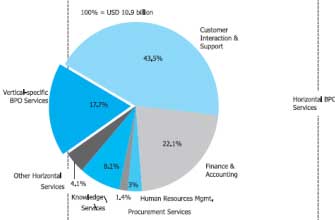

Split by service offerings - BPO services, accounting for over 27 per cent of the export aggregate, is the fastest growing segment across software and services exports driven by scale as well as scope. Export revenues for this segment are expected to cross $10.9 billion, a growth of 30 per cent in FY2008.

Split by service offerings in S/w

products & Eng. Services - Export revenues from relatively high-value-added services such as engineering and R&D, offshore product development and made-in-India software products is estimated to be growing at over 27 per cent, and are forecast to reach $6.3 billion in FY2008.

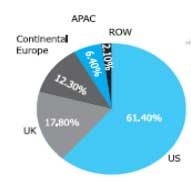

Geographic market

exposure of IT-BPO Exports - While US & UK remained the largest export markets (accounting for about 61 per cent and 18 per cent respectively, in FY2007), the industry is steadily increasing its exposure to other geographies. Exports to Continental Europe in particular have witnessed notable gains, growing at a CAGR of more than 55 per cent over FY2004-2007.

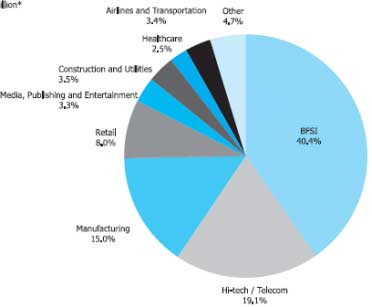

Vertical Split for Indian IT-BPO Exports - Banking, Financial Services and Insurance (BFSI) remains the largest vertical market for Indian IT-BPO exports, followed by High-technology and Telecom accounting for nearly 60 per cent in FY2007. Manufacturing and Retail followed, contributing 23 per cent to the aggregate. Other key segments include Media, Healthcare, Airlines and Transportation, and Utilities.

Domestic IT Market in FY2008

- Technology adoption in the domestic market also reported steady gains in 2007. This segment is expected to cross $23 billion in FY2008, reporting healthy growth across all key segments.

o Hardware remains the largest segment of the domestic market, and is expected to grow at 44 per cent in FY2008.

o Domestic IT services spends are estimated to be growing at about 43 per cent in FY2008.

- Software and services and BPO spending growth in the domestic market is being supported by increasing adoption, and is expected to grow by over 42 per cent and 45 per cent, respectively.

- Growing levels of technology adoption are now accompanied by a steady appreciation of the rupee, is also making India more attractive as a market – even for players that had earlier maintained a stricter focus on exports.