MF assets rise for the first time in four quarters

04 Jul 2012

The Indian mutual fund industry recorded growth in quarterly average assets under management (AuM) for the first time in the past four quarters.

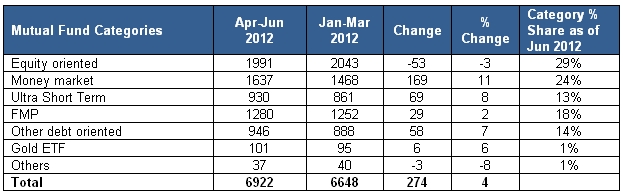

AuM rose by 4 per cent (or Rs274 billion) to Rs6.92 trillion in the April-June 2012 quarter from Rs6.65 trillion in the previous quarter (excluding domestic FoFs) as per the latest numbers announced by the Association of Mutual Funds in India (AMFI).

Debt-oriented funds were the key contributors to the rise. Assets of money market funds or liquid funds grew by Rs169 billion, ultra short term debt funds byRs 69 billion, fixed maturity plans (FMPs) by Rs29 billion and other debt-oriented funds by Rs58 billion over the past quarter.

Equity funds witnessed a decline of Rs53 billion in AUM owing to weak sentiments prevailing in the asset class in the quarter gone by.

29 out of 44 fund houses post rise in average AUM

Two-thirds of the industry (29 out of 44 fund houses) registered a rise in average AuM in the latest quarter.

Birla Sun Life Mutual Fund reported the highest rise in absolute terms. Its average AUM rose by Rs 61 billion or 10 per cent to Rs672 billion in the June quarter.

SBI Mutual Fund followed with its average AUM up Rs51 billion or 12 per cent to Rs472 billion.

Fidelity Mutual Fund reported the highest fall in absolute terms of Rs13 billion or 15 per cent in its average AuM to Rs74 billion.

Chart 1 – Mutual fund quarterly average AUM Trend

Source: AMFI

HDFC Mutual Fund retains its top position

HDFC Mutual Fund maintained its top position by asset size at Rs926 billion in the June quarter; its assets rose by Rs27 billion or 3.1 per cent.

Reliance Mutual Fund maintained second position with assets of Rs807 billion (up 3.3 per cent or Rs26 billion), while ICICI Prudential Mutual fund was third with Rs730 billion assets (up 6.3 per cent or Rs 43 billion).

The share of the top 5 mutual funds' average assets stood at 54% in the June quarter while the share of the top 10 funds was 78%. The bottom 10 fund houses continued to occupy less than 1 per ent of the average AuM.

Money market funds are key contributors to the AUM rise

Debt-oriented funds, especially money market funds, saw the highest gain in assets across categories, up 11.5 per cent (or Rs169 billion) to Rs1.64 trillion in the June quarter, forming 24 per cent of the industry assets.

This is the first quarter of gain in assets for money market funds in four quarters and could have been prompted by slight easing in liquidity pressures in the domestic financial system. Liquidity in the banking system has eased due to proactive measures by the RBI to cut interest rates in its annual policy review in April and due to gilt purchases from the open market. The RBI in its annual policy cut its key interest rate, the repo, by 50 bps to 8 per cent, the first cut by the central bank in around three years.

Fixed maturity plans (FMPs) continued to find favour among investors, with their average assets steadily increasing in the past eight quarters. In the latest quarter, category assets rose by 2.3 per cent or Rs29 billion to Rs1.28 trillion - 18 per cent of industry assets. High interest rates in the economy over the past two years have benefitted FMPs as investors are able to lock into higher yields.

Equity mutual funds' AuM fell 2.6 % in the quarter

Average AUM of equity-oriented mutual funds fell by 2.6 per cent or Rs53 billion to Rs1.99 trillion primarily due to weak sentiments prevailing in the asset class in the quarter gone by. Domestic equity markets, represented by the S&P CNX Nifty, fell 0.3 per cent in the quarter amid downbeat domestic and global cues.

Gold ETFs' average AuM crossed Rs100-bn mark

Gold exchange traded fund's (ETFs) AUM rose 5.8 per cent or Rs6 billion to Rs101 billion during the quarter ended June 2012 on the back of inflows and rise in gold prices, which rose by 4.5 per cent in the quarter as per the CRISIL Gold Index.

Table 1 – Category-wise Average AUM (Rs billion)

Categories as per CRISIL Fund Analyser (CFA)

Source: AMFI, CFA

Table 2 – Top 10 AMCs by Average AUM (Rs billion)

Source: AMFI