Globally focused funds in India still few and far between

12 Jul 2010

Global Markets Make a Turnaround in 2009

The global financial markets witnessed testing times with the surfacing of the subprime crisis. However, the year 2009 marked a turnaround for markets worldwide, with economic fundamentals improving and stronger earnings growth outlook. Appetite for equities resurfaced in 2009, with investors flocking back to the asset class after risk aversion in late 2007 and 2008. Emerging markets led the recovery with Latin America and Emerging Europe topping the charts in 2009, and Asia (except Japan) following close behind. Emerging markets have been receiving a lot of attention and foreign fund flows lately, with strong growth prospects, improving fundamentals and rising domestic consumption.

Our favourite region for 2010 is global emerging markets. The valuations of some of the emerging markets are also reasonable with major representatives like Brazil, Russia and Israel trading at P/E Ratios of below 14X. Rising inflationary expectations are also expected to benefit the resource-rich countries like Brazil, Russia and Indonesia. Earnings growth for this region is expected to be 29 per cent in 2010 and around 18 per cent in 2011 (See Table 1).

On the economic front too, GDP growth for 2010 is forecast to improve, compared to a disappointing 2008 and lacklustre 2009. According to the World Economic Report released by the International Monetary Fund (IMF) in October 2009, GDP growth for advanced economies is expected to expand by 1.25 per cent in 2010 compared to a 3.5 per cent contraction in 2009, while for emerging economies, real GDP growth is forecast to reach almost 5 per cent in 2010, up from 1.75 per cent in 2009.

On similar lines, the recently released Global Economic Prospects 2010 report by the World Bank says that GDP growth for rich countries is expected to pick up to 1.8 per cent in 2010 after declining by 3.3 per cent in 2009. Meanwhile prospects for developing countries are more robust in 2010, with them expected to grow 5.2 per cent this year, up from 1.2 per cent in 2009.

| Table 1: Performance, Valuations and Earnings Growth of Key International Indices | |||||||

| Returns are based on index levels as at 15 Jan 2010 (in Local Currency Terms) | Change since 30 Dec 2009 | 2009 | 2008 | P/E Yr 2010 | P/E Yr 2011 | Earnings Growth 2010 (%) | Earnings Growth 2011 (%) |

| USA (S&P 500) | 0.90% | 25.80% | -38.50% | 14.5 | 11.9 | 27.5 | 22.3 |

| Europe (DJ Stoxx 50) | 1.30% | 29.30% | -45.60% | 12.3 | 10.2 | 25.3 | 20.5 |

| Japan (Nikkei 225) | 4.10% | 24.00% | -42.10% | 17.1 | 13.5 | 82.8 | 26.2 |

| Emerging Markets (MSCI EM) | 3.10% | 78.30% | -54.50% | 11.8 | 9.9 | 29.0 | 18.4 |

| Asia ex-Japan (MSCI Asia ex-Japan) | 3.10% | 71.70% | -53.60% | 14.0 | 12.0 | 29.7 | 16.7 |

| Singapore (STI) | 1.00% | 65.10% | -49.20% | 13.8 | 12.7 | 29.0 | 8.9 |

| Hong Kong (HSI) | 0.70% | 50.50% | -48.30% | 13.7 | 11.1 | 21.1 | 23.5 |

| Taiwan (Taiwan Weighted) | 3.00% | 82.00% | -46.00% | 18.6 | 15.8 | 56.3 | 17.2 |

| South Korea (KOSPI) | 1.10% | 51.30% | -40.70% | 10.4 | 9.2 | 36.7 | 13.2 |

| China (HS Mainland Composite Index) | 2.20% | 53.80% | -48.90% | 13.5 | 11.6 | 20.8 | 16.6 |

| Malaysia (KLCI) | 2.20% | 48.10% | -39.30% | 14.5 | 12.7 | 12.8 | 14.4 |

| Thailand (SET Index) | 1.60% | 65.90% | -47.60% | 11.4 | 9.9 | 13.5 | 14.5 |

| India (SENSEX) | 1.20% | 82.00% | -52.90% | 16.3 | 13.7 | 23.4 | 18.6 |

| Indonesia (JCI) | 4.40% | 95.30% | -50.60% | 14.0 | 11.7 | 17.9 | 19.7 |

| Source: iFAST Financial Compilations, Bloomberg | |||||||

Globally Focused Mutual Funds: A Convenient Tool for Building a Global Portfolio

For the average Indian investor, international avenues are still a relatively unexplored territory. However, the easing of overseas investment norms for mutual funds has now made it possible for the retail investor in India to participate in international markets and add a foreign flavour to one's portfolio. The Reserve Bank of India, the country's central bank, increased the overseas investment limit for mutual funds in India to $7 billion in April 2008 (from $5 billion at the end of 2007), with an individual fund house limit of $300 million. These steps were taken by the RBI to move towards greater capital account convertibility and also to rein in the appreciation of the rupee due to record high foreign inflows in 2007.

The Indian government took the first step of relaxing overseas investment for mutual funds in January 2003 by increasing the limit from $500 million to $1 billion. However, investment was only allowed in shares of overseas companies which had a shareholding of at least 10 per cent in an Indian listed company (also known as the 10 per cent reciprocal shareholding rule). This dramatically reduced the investment universe of mutual funds to shares of only a handful of international companies, thus limiting their attractiveness.

The government later removed the 10 per cent reciprocal shareholding rule and also increased the overseas fund investment limit in tranches to $7 billion presently. The first global fund to be launched in India was Principal Global Opportunities, which was earlier restricted to only a handful of stocks due to the 10 per cent rule, but now invests into another emerging market fund of the parent fund house. The assets of the fund have grown, but not substantially, rising from about Rs70 crore at its launch in April 2004 to touch a high of Rs651 crore in October 2007, and stood at about Rs146 crore at the end of 2009.

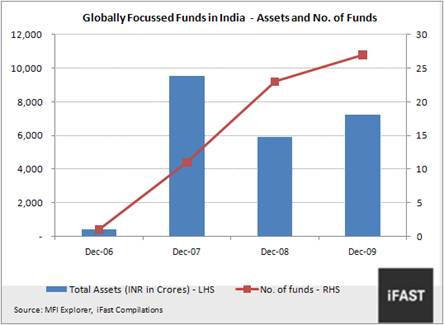

The relaxation of limit has helped asset management companies in India to increase assets managed by such funds, prompting others to also join the bandwagon and launch similar schemes. In 2007, a total of 10 such equity funds (excluding institutional plans) were launched which focused on international markets. In the year 2008, 12 funds were launched that invested abroad, followed by only four fund launches in 2009.

| Table 2: Performance of Globally Focused Funds in India | ||||||

| Fund Name | Perf. Figures based on Prices as at | 1 mth | 3 mth | 6 mth | 1 yr | 2 yr |

| Mirae asset global commodity stocks fund- growth | 18-Jan-10 | 6.06 | 6.34 | 34.39 | 106.25 | - |

| Fidelity International opportunities fund- growth | 18-Jan-10 | 5.18 | 6.60 | 28.43 | 94.10 | 3.10 |

| ICICI Prudential indo asia equity fund retail- growth | 18-Jan-10 | 3.63 | 4.75 | 22.94 | 88.35 | -1.81 |

| AIG world gold fund- growth | 14-Jan-10 | 0.39 | 2.49 | 33.97 | 73.62 | - |

| BSL International equity plan b-growth | 18-Jan-10 | 4.28 | 3.95 | 20.88 | 73.15 | -5.61 |

| Principal global opportunities fund- growth | 14-Jan-10 | 1.41 | 3.57 | 28.35 | 64.29 | -3.14 |

| HSBC emerging market fund- growth | 18-Jan-10 | 2.40 | -0.31 | 16.46 | 64.18 | - |

| DSP blackrock world gold fund - regular plan - growth | 15-Jan-10 | -0.59 | -1.02 | 19.52 | 63.78 | 0.91 |

| Sundaram global advantage fund- growth | 11-Jan-10 | 2.82 | 7.14 | 31.59 | 60.52 | -0.84 |

| FT asian equity- growth | 18-Jan-10 | 2.48 | 3.11 | 12.24 | 59.74 | 4.31 |

| BSL commodities equities fund global multi commodity plan retail- growth | 18-Jan-10 | 3.70 | 3.69 | 18.53 | 35.41 | - |

| DWS global thematic offshore fund - growth plan | 13-Jan-10 | 2.29 | 3.21 | 15.68 | 28.85 | -7.42 |

| BSL International equity plan a -growth | 18-Jan-10 | -0.24 | 1.19 | 11.56 | 27.73 | -3.67 |

| TATA growing economies infrastructure fund plan b- growth | 18-Jan-10 | 5.22 | 2.51 | 29.17 | - | - |

| TATA growing economies infrastructure fund plan a- growth | 18-Jan-10 | 3.46 | 2.69 | 25.51 | - | - |

| DSP blackrock world mining fund- growth | 15-Jan-10 | 5.32 | - | - | - | - |

| Source: iFAST Financial Compilations | ||||||

However the assets managed by globally focused funds stood at only Rs7,259 crore ($1.55 billion) at the end of 2009, still quite far away from the total overseas investment limit of $7 billion allowed by the government. (Refer to Chart 1 for assets and number of globally focussed funds in India)

Performance of Globally Focused Funds In India

Presently a variety of globally focused funds are available, which not only invest in equities but also participate in other asset classes like gold, real estate and commodities. Besides this, there are global funds concentrating on certain key markets like China, Latin America and other emerging markets. Many of the funds use the 'fund of funds' route for investing abroad, by investing in a global fund of the parent fund house abroad. Some even invest directly in international stocks. Table 2 highlights the performance of some globally focused funds in India.

It can be seen that funds investing in commodities stocks, emerging market stocks and gold mining stocks have managed to outperform others over the last one year. The top performing global fund in India over a one year period is Mirae Global Commodity Stocks Fund, which has a mandate to invest up to 35 per cent of its portfolio in stocks of commodities and related companies in India, and at least 65 per cent of the portfolio will be invested overseas in Asian and Emerging Markets. The second best performing global fund was Fidelity International Opportunities Fund which is not a pure global fund, as it has a mandate to invest only up to 30 per cent in international markets (biased towards Asia ex Japan) and at least 65 per cent must be invested in Indian equities. Both these funds invest internationally through stock directly and not via the feeder fund route.

Benefits and Limitations of Globally Focused Funds

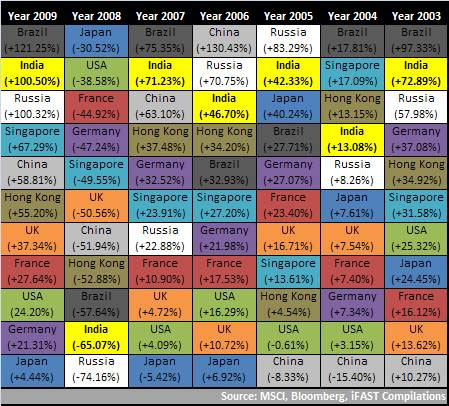

The biggest benefit of a global fund is diversification. It allows the investor to diversify his/her portfolio geographically. All markets go through periodic cycles. There is no certainty that a particular market performing well presently will continue to outperform in the future too. Table 3 highlights the performance of some key international markets. It can be seen that China was among the top performing markets in 2006 and 2007, but was a bottom performer in years 2003, 2004 and 2005. Thus a globally focused fund will help to reduce the diversification risk of an investor and at the same time follow a professional approach of investing their funds with the requisite expertise in international markets.

However, investors in these global funds need to take note of some drawbacks too. One of the biggest disadvantages of these global funds is the unfavourable capital gains tax treatment as compared to other traditional mutual funds in India. Presently, funds investing primarily in foreign securities (even equities) and fund of funds (FoF) schemes are recognised as debt-oriented funds by the taxman in India. Thus they lose out on the beneficial capital gains tax treatment of equity-oriented funds.

Equity oriented funds are presently subject to a short term capital gains tax of 15 per cent (plus surcharge and cess) while long term capital gains is exempt from taxation. However debt-oriented funds are subject to long term capital gains tax of 10 per cent (without indexation) and 20 per cent (with indexation). Short term capital gains of debt-oriented funds are taxed at the applicable tax rate. To escape this apparent drawback, some mutual funds in India restrict the overseas exposure of their funds to 35 per cent of the portfolio, and invest the balance 65 per cent in Indian equity holdings, thus enabling the fund to be recognised as an equity-oriented fund by the exchequer.

The other threat to global funds is the currency risk, which could at times erode a substantial part of the original gains.

Conclusion

The overseas investment limit of mutual funds in India is far from exhausted, indicating that Indian investors have still not fully caught on to the concept of borderless investing. But going forward, as the Indian market opens up and matures, global funds are likely to find wider acceptance amongst portfolios of Indian investors. The Indian government also has to extend tax benefits to these funds to bring them on the same level of other traditional mutual funds (enjoying tax benefits) and thus make them more acceptable to investors.

With the Indian markets having run up significantly in the past year, valuations are starting to look rich in some pockets. Through the global funds route an investor can look in participating in international and emerging markets that look more attractive to India from a valuations and earnings growth perspective. Thus the crucial 'geographical diversification' benefit of these funds discussed above is reason enough for these funds to command a marginal allocation in every mutual fund portfolio.

Fundsupermart.com is one of the largest online distributors of mutual funds in South East Asia, with regional presence in Singapore, Hong Kong, Malaysia, and now, India. www.fundsupermart.co.in is the online mutual fund information and transaction site for self-directed investors and is part of iFAST Financial India Pvt Ltd.

Key Points

- Global markets made a turnaround in 2009 due to improving economic fundamentals and upward revision of earnings growth. Emerging markets led the pack and received strong inflows.

- According to the World Bank, GDP growth for developing countries is expected to be more robust at 5.2 per cent in 2010, up from 1ta.2 per cent in 2009. GDP growth for rich countries is expected to rise 1.8% in 2010 compared to a contraction of 3.3% in 2009.

- Presently the overseas investment limit for mutual funds in India is $7 billion. However the assets managed by globally focused funds stood at only Rs 7,259 crore ($1.55 billion) at the end of 2009, still quite far away from the total overseas investment limit.

- Global funds investing in commodities stocks, emerging market stocks and gold mining stocks and have managed to outperform over the last one year. The top performing global fund in India over a one year period is Mirae Global Commodity Stocks Fund.

- The biggest benefit of a global fund is geographical diversification.

- The biggest disadvantage of global funds in India is that presently funds investing primarily in foreign securities (even equities) and fund of funds (FoF) schemes are recognised as debt-oriented funds by the taxman. Thus they lose out on the beneficial capital gains tax treatment of equity-oriented funds.

- Global funds are also subject to currency risk.