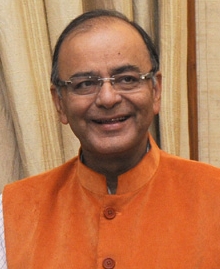

Jaitley promises more capital funds to PSU banks

12 Jun 2015

Finance minister Arun Jaitley today promised to spare more funds than provided in the budget for capital infusion into public sector banks, saying there's "merit" in their demand, even as he said banks should have reduced interest rates further in order to increase credit flows.

Finance minister Arun Jaitley today promised to spare more funds than provided in the budget for capital infusion into public sector banks, saying there's "merit" in their demand, even as he said banks should have reduced interest rates further in order to increase credit flows.

"Banks have made a strong case for additional capital... And over the next few months, this is something the government is going to seriously look at," Jaitley said after meeting heads of PSU banks.

Acknowledging that banks need funds to lend amidst bulging portfolio of non-performing loans. Jaitly said, "...I do believe it's a case which has merit."

He suggested that he himself would like to sort-out issues relating to major projects stalled purely due to financial constraints and discuss with concerned banks, state governments and other ministries. He also called for doubling of loans to the small business sector from Rs50,000 crore in 2014-15 to Rs1,00,000 crore in 2015-16.

Jaitley asked chief executives of both public sector banks (PSBs) and private sector banks as to why the banking system, in response to RBI's rate cut of 75 basis points since January 2015, only effected a 25 basis point rate cut.

The CMDs of banks, both PSBs and private banks, said until the cost of funds (deposits) for the banks, as reflected in the re-pricing of their liability book at the new rate comes down, and liquidity levels at the new lower costs are tested, full transmission would not be viable. However, all banks unanimously expressed that in a period of 2-3 months, greater transmission of lower rates could be seen.

At the annual review meeting of with CEOs of banks (including private banks), insurance companies and financial institutions, the finance minister also expressed concern over the modest 7 per cent growth of domestic credit reported by public sector banks.

Agricultural credit, however, grew by 17.33 per cent over the previous year, which came as a silver lining.

Total domestic credit flow stood at Rs49,01,000 crore during 2014-15.

Jaitley urged the bankers to achieve the target of 20 per cent growth in educational loan asset and also attempt to even out the huge regional disparity in such loans.

Jaitley noted the growth rate of 16 - 18 per cent in housing loans and advised the PSBs to achieve a 30 per cent growth in priority sector housing loans, which are intrinsically secure loans and which are required to provide a stimulus to overall growth.

Besides the credit flows, the meeting reviewed other significant parameters like cost of deposits, share of retail finance in overall credit, growth in deposits, yield on advances etc.

Increasing NPAs, which are impacting credit growth of banks, has been a matter of concern for banks and government. The increase in NPAs is mainly due to some infrastructure projects, slowdown in recovery in the global economy and continuing uncertainty in the global markets leading to lower growth rate of credit, because of which NPA as percentage of total credit has gone up. In addition, the stringent provisioning norms further reduce both future credit flow and profitability of banks.

It emerged in the meeting that a sector by sector approach is necessary for NPA solutions and while companies needed promoter change, others needed greater equity. Jaitley called for systematic steps towards improvement of asset quality by the banks. He also sought a collective examination of solutions that work, so as to de-bottleneck those critical projects of economic value.

He also suggested that the Department of Financial Services and the RBI should interact to examine and sort out the regulatory issues in NPAs and the scope for their modification to ease the pressure on banks.