Rich using farm land to evade tax: Jaitley

16 Mar 2016

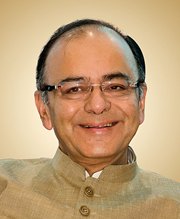

Finance Minister Arun Jaitley today said some wealthy people were evading taxes by masquerading as farmers, and the government would act against them.

Finance Minister Arun Jaitley today said some wealthy people were evading taxes by masquerading as farmers, and the government would act against them.

In a statement in Rajya Sabha, Jaitley maintained that the tax department is probing cases where evaders have passed off their unaccounted income as agricultural income, which is not taxed in India.

Between 2007-08 and 2015-16, 321 people in the Bengaluru region, 275 in Delhi, 239 in Kolkata, 212 in Mumbai, 192 in Pune, 181 in Chennai, 162 in Hyderabad, 157 in Thiruvananthapuram and 109 in Kochi declared agricultural income of at least Rs1 crore, PTI reports citing official data.

A total of 2,746 entities and individuals declared agricultural income of above Rs1 crore in this period. It is no secret that while some of these individuals own farmhouses and land, they don't earn their living as farmers.

''There is no proposal to tax farmers' agricultural income given the state our agricultural sector is in. But if someone misuses this provision and tries to pass off non-agricultural income as agricultural income, then we will probe that individual case,'' Jaitley said.

He indicated many of these evaders have political links.

''There are many prominent people who have done this and against whom an investigation is being conducted. When the investigation concludes and some names come to the fore, please don't call it political victimization,'' he added.

Income tax department assessing officers, as part of a recent directive, have been asked to ''verify'' a select number of cases in this category under assessment years 2011-12 to 2013-14.

Jaitley was responding to queries posed by Janata Dal (United) leader Sharad Yadav and Bahujan Samaj Party leader Mayawati. Both leaders pointed out that individuals were using the farm income route to mask black money.

Agricultural income is not subject to income tax. Though the tax department has often cited the exclusion of farmers as one of the main reasons for the low tax base of 40 million, no government has ever moved towards taxing this sector given the politically sensitive nature of such a move.

However, the government has been taking a number of steps to ensure this dispensation given to the farm sector is not misused. In this year's budget, the government proposed to collect tax at source at the rate of 1 per cent on purchase of luxury cars exceeding a value of Rs10 lakh and any purchase of goods and services in cash exceeding Rs2 lakh.

Chief economic adviser Arvind Subramanian, in the annual Economic Survey in February, also made a case for taxing the well-off irrespective of their source of income.

''Subsidies to the well-off need to be scaled back. Regaining legitimacy must be as much about phasing down these bounties as it is about better targeting of subsidies for the poor ... reasonable taxation of the better-off, regardless of where they get their income from-industry, services, real estate, or agriculture-will also help build legitimacy,'' the survey said.