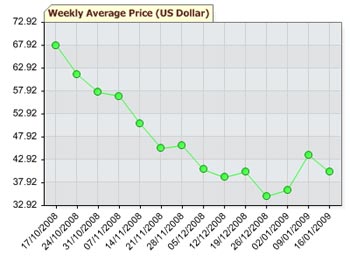

Oil hovers around $38

14 January 2009

The price of crude oil fell for six consecutive days in New York trading on concern that the OPEC production cuts would not be enough to offset weaker demand, before rising marginally to $38 per barrel on some reports that the production cut just might have done what it was supposed to.

Light sweet crude for February delivery was reported up 36 cents to $37.96 a barrel, higher than the $37.19 from a day earlier.

Reports quoted Deutsche Bank's report from a week earlier as suggesting that oil consumption would drop by 1 million barrels per day this year as the US, Europe and Japan go through their first simultaneous recessions since the Second World War, even as OPEC members indicated that they would reduce sales to oil refining companies in a bid to reign in the fall of oil prices. Oil prices are already lower by 59 per cent from a year ago.

Reports quoted Deutsche Bank's report from a week earlier as suggesting that oil consumption would drop by 1 million barrels per day this year as the US, Europe and Japan go through their first simultaneous recessions since the Second World War, even as OPEC members indicated that they would reduce sales to oil refining companies in a bid to reign in the fall of oil prices. Oil prices are already lower by 59 per cent from a year ago.

A report by Goldman Sachs, which last year predicterd oil prices at $200 per barrel, now echoes the view of Deutsche Bank, saying that the "weak underlying economic fundamentals" were most likely to overshadow the oil market, which made the bank predict a new low of $30 per barrel in a 9 January report.

Goldman's analysts were reported as saying that oil inventories in the Organization for Economic Cooperation and Development (OECD) nations were likely to hit their highest level in a decade within the coming two months, while suggesting that the OPEC production cuts might support oil prices, though it would take some time for them to have an impact.

Organization of Petroleum Exporting Countries (OPEC) supplies over 40 per cent of the world's oil. The cartel had agreed last month to cut production quotas by nine per cent to ensure better prices for oil in the face of the global recession that has eroded demand for the commodity. In the last six months, oil prices have plummeted by over $100 a barrel.