|

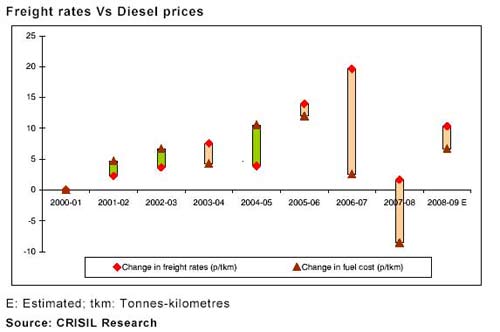

Diesel prices, which account for 60-65 per cent of the total cost for a transporter, are a key determinant of road freight rate. CRISIL Research expects truck freight rates to increase by 5 per cent, in the light of Rs 3 per litre diesel price hike. The sustainability of these freight rates would depend on industrial growth. If there is any moderation in industrial growth, profitability of transporters would decline. Transporters are expected to pass on the - Rs 3 per litre - hike in diesel prices to consumers. But the pricing flexibility and consequently the profitability of transporters may be undermined in the event of an oversupply of freight carrying capacity on account of moderation in industrial growth. The hike in diesel prices is expected to result in a 5 per cent increase in the freight rates on contractual fleet. Spot transactions are however likely to have varied increases depending on the route. On some routes, transporters propose to increase rates by as much as 10-15 per cent initially, which may eventually stabilise at lower levels due to market dynamics. At present, the fleet is almost equally divided between spot and contractual arrangements. The operating costs for transporters are estimated to have increased by 8 paise per tkm (tonne-kilometre) since January 2008; 7 paise per tkm on account of increase in fuel costs and 1 paise per tkm due to increase in the cost of tyres and other inputs. Truck freight rates increased by nearly 2 paise per tkm, subsequent to the diesel price hikes effected in February, and are expected to go up by another 6-7 paise per tkm now. The above analysis takes into consideration the two factors that determine the pricing flexibility of road transporters, competition from railways and the demand-supply scenario of trucks. Since railway freight rates are not expected to increase, the cost competitiveness of road freight will reduce further. However, the inter-modal shifts will continue to be driven largely by structural advantages and the impact of relative pricing on growth in road freight is expected to be marginal. The demand-supply scenario for mid-sized and heavy goods vehicles has been favourable in 2006-07 and 2007-08. The Supreme Court order in November 2005 instructing states to enforce weight norms resulted in tightness in freight carrying capacity in 2006-07. The sharp drop in truck purchases in 2007-08, due to higher interest costs have resulted in a 9.4 per cent decline in incremental tonnage capacity of mid-size and heavy trucks, as compared with an 8.1 per cent increase in the index of industrial production. This sustained the favourable fleet demand-supply scenario, even after adjusting for reported slackness in the enforcement of weight norms in 2007-08. Consequently, obtaining freight contracts has remained easy, explaining the ability of the transporters to maintain firm freight rates in 2006-07 and 2007-08.

Nonetheless, industrial growth has become a key monitorable in 2008-09. Since February 2008, transporters have started reporting sluggishness in freight availability. While this period coincides with slower industrial production, it also marks the resumption of growth in commercial vehicle purchases. Any further slow down in freight growth would constrain the cash flows of transporters, especially those of small fleet operators, who typically pay large commissions to freight originators. In the base scenario for 2008-09, with industrial growth remaining at around 8 per cent, cash flows from new multi-axle vehicles are expected to remain healthy. However, CRISIL Research estimates that cash flows will drop to near break-even levels for small fleet operators, if industrial growth falls to 6 per cent.

|