|

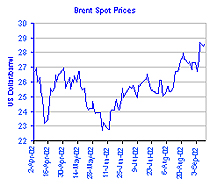

Mumbai: The war hysteria created by the US-UK joint raid on Iraqi air defences has pushed oil prices to the upper side of their historical price curve. From now on, we would see the price of oil move in tandem with the rising possibility of a war involving Iraq. Mumbai: The war hysteria created by the US-UK joint raid on Iraqi air defences has pushed oil prices to the upper side of their historical price curve. From now on, we would see the price of oil move in tandem with the rising possibility of a war involving Iraq.

There are already reports of the US having already shipped men and material to West Asia. The result: crude prices almost touched $29 per barrel, a level that spells trouble for world economic growth. At these levels, it seems that a war premium of around $6 per barrel has already been built into crude oil prices, and much will depend on the stance that Saudi Arabia takes during the OPEC meeting to be held later this month. What effect a price hike will have on the Indian economy is a key issue to be looked at. The answer depends on the duration of the war its inevitable results. The markets seem to be pricing in a war, but the general impression seems to be that any war will be a short one.  The expectation is that while oil prices have the potential to flare up when a war starts, a quick US victory will soon see prices fall below their current levels. The assumption seems to be that a change of regime in Iraq will probably see more Iraqi oil being made available internationally, as a consequence of the sanctions being eased. The expectation is that while oil prices have the potential to flare up when a war starts, a quick US victory will soon see prices fall below their current levels. The assumption seems to be that a change of regime in Iraq will probably see more Iraqi oil being made available internationally, as a consequence of the sanctions being eased.

| | INDIA | Average Brent Price

(US$/barrel) | Real GDP Growth India (%) | Inflation (WPI) | | FY 1999 | 12.1 | 6.4 | 5.9 | | FY 2000 | 22.2 | 6.1 | 3.3 | | FY 2001 | 28.5 | 4.0 | 7.2 | | FY 2002 | 23.8 | 5.4 | 3.6 | | As far as the global demand for oil is concerned, economists are still divided as to whether the global economy will go through a double dip or whether a recovery is in the offing. The more realistic scenario for crude seems to be that even if a recovery gets under way, it is likely to be weak, and the demand for oil is therefore unlikely to be robust. As far as India is concerned, rising oil prices will have a negative impact on the Indian economy. Rising crude prices would result in increasing imports and, subsequently, a rise in the current account deficit. The other impact will be on inflation, which would affect aggregate purchasing power and therefore growth.  The inflationary impact would be transferred through an increase in domestic fuel prices, thereby affecting consumption demand and raising industrial costs. This rise in inflation due to higher fuel prices is unlikely to lead to a change in the central banks easy money stance, but further interest rate cuts will be ruled out. The inflationary impact would be transferred through an increase in domestic fuel prices, thereby affecting consumption demand and raising industrial costs. This rise in inflation due to higher fuel prices is unlikely to lead to a change in the central banks easy money stance, but further interest rate cuts will be ruled out.

There will be no cause for alarm on the balance of payments front either. The structure of the balance of payments, including current and capital accounts, has undergone significant changes in the past 10 years. What is noteworthy is the transformation of the current account composition. Despite the widening trade deficit, the current account deficit has remained under 2 per cent in the past five years due to a steady rise in the inflow of invisibles. It is the emergence of the new economy that has led to a strong growth in the net inflow of invisibles. The two main sources of inflows that have brought this improvement are remittances from non-resident Indians and software exports. These inflows together have more than trebled in the past six years. Structural changes in the past 10 years have significantly improved the Indian economys ability to absorb the current oil-price shock without throwing it into another crisis or even dragging the gross domestic product growth to less than 5 per cent. But a $5-per barrel rise in oil prices is expected to have an annual impact of around $4 billion on the current account, an impact that can be easily absorbed. But as far as psychological impact and sentiment are concerned, there is little doubt that higher oil prices would further worsen the gloomy outlook for the economy this year.

|