|

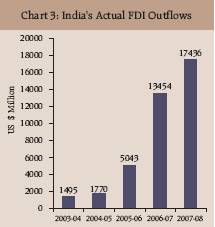

Mumbai: Indians invested around $23.072 billion in 2,261 ventures overseas, including partnerships, joint ventures and wholly-owned subsidiaries, during the financial year 2007-08, recording a growth of 24.4 per cent in the number of proposals and 53.2 per cent in amount of investment over the past year.  Overseas investments from India, excluding those by individuals and banks, rose 29.6 per cent to $17.4 billion in 2007-08, backed by major acquisitions by India Inc with its growing appetite for overseas presence and the hunt for energy assets. Overseas investments from India, excluding those by individuals and banks, rose 29.6 per cent to $17.4 billion in 2007-08, backed by major acquisitions by India Inc with its growing appetite for overseas presence and the hunt for energy assets.

Returns on these investment, in the form of dividend, royalty, repayment of loans and licence fees, also rose by 76.7 per cent to $916 million in 2007-08, from $518 million a year ago, according to Reserve Bank of India data. Equity accounted for 61.2 per cent of the proposals for investment, while loans for 11.4 per cent and guarantees for 27.4 per cent. During 2007-08, automatic route covered 99.6 per cent of the proposals involving 96.4 per cent of the amount of investments. The rest were through the approval route. During January-March 2008, 666 proposals for a total of $4.635 billion were cleared for investments abroad in JVs and wholly-owned subsidiaries, as against 549 proposals amounting to $7.115 billion during the corresponding period of the previous year, RBI said. Equity accounted for 60.4 per cent of the investment proposals, followed by loans (28.1 per cent) and guarantees (11.5 per cent). During the quarter, 99.5 per cent of the proposals involving 91.4 per cent of the investments were through the automatic route and the rest were through approval route, the RBI said. India Inc invested around $13.45 billion overseas in 2006-07 in partnership firms, joint ventures and wholly-owned subsidiaries abroad, besides remittances for production sharing agreements for oil exploration.  Nearly 81.6 per cent of India Inc's overseas investments in 2007-08 were in the form of equity and the remaining 18.4 per cent in loans. About 95 per cent of the outward FDI proposals were worth over $5 million, the RBI said in a review of the trends in overseas investments by Indian business. Nearly 81.6 per cent of India Inc's overseas investments in 2007-08 were in the form of equity and the remaining 18.4 per cent in loans. About 95 per cent of the outward FDI proposals were worth over $5 million, the RBI said in a review of the trends in overseas investments by Indian business.

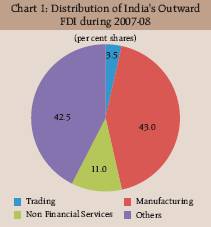

''Outward FDI witnessed a substantial pick-up from 2006-07 onwards, facilitated largely by progressive liberalisation of overseas investment policies," the RBI said. Of the total outward investments by Indian entities, manufacturing sector led with a 43 per cent share, followed by the non-financial services (11 per cent) and trading (4 per cent) The manufacturing sector proposals were mostly in sectors like electronic equipment, fertilisers, agricultural and allied products and gems and jewellery. Non-financial service sector investments included areas such as telecommunications, medical services and software development services.

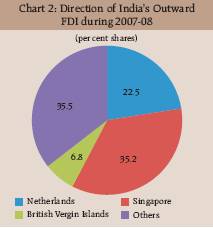

Singapore, Mauritius, Cyprus and the UAE together accounted for over 50 per cent of the proposals for outward FDI ($5 million and above) during January-March, 2008. Singapore, Mauritius, Cyprus and the UAE together accounted for over 50 per cent of the proposals for outward FDI ($5 million and above) during January-March, 2008. For financial year as a whole (2007-08), 35 per cent of the proposals for outward FDI ($5 million and above) were towards destination of Singapore, followed by Netherlands (23 per cent) and British Virgin Islands (7 per cent), the RBI said.

|