Ford to focus on Mustang, trucks, SUVs to boost bottomline

27 April 2018

Avid lovers of Ford will now have to just admire old clippings of their favourite models, as the American carmaker has decided to dump all car models except the Mustang and focus only on trucks and SUVs.

Jim Hackett, the new CEO, wants to dispose of slow-selling and low-margin Ford car models and focus on the more lucrative trucks and SUVs in a bid to turn around the fortunes of the automaker.

Releasing its first quarter 2018 financial results, Ford said in a sttement, "Building a winning portfolio and focusing on products and markets where Ford can win. For example, by 2020, almost 90 per cent of the Ford portfolio in North America will be trucks, utilities and commercial vehicles.

"Given declining consumer demand and product profitability, the company will not invest in next generations of traditional Ford sedans for North America."

The company also said, over the next few years, the Ford car portfolio in North America will transition to two vehicles – the best-selling Mustang and the all-new Focus Active crossover scheduled for next year. The company is also exploring new “white space” vehicle silhouettes that combine the best attributes of cars and utilities, such as higher ride height, space and versatility.

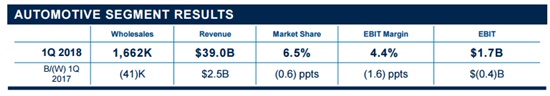

Ford's revenue rose 7 per cent year over year, and net income was higher at $1.7 billion, up 9 per cent year over year, more than explained by a lower tax rate.

Company adjusted EBIT of $2.2 billion was down from a year ago, due to commodity cost increases and adverse exchange rates Ford said.

Ford is now targeting an 8 per cent adjusted EBIT margin in 2020, two years earlier than previously projected. Ford is also targeting its return on invested capital (ROIC) to substantially increase by 2020.

“We are committed to taking the appropriate actions to drive profitable growth and maximise the returns of our business over the long term,” said Jim Hackett, president and CEO. “Where we can raise the returns of underperforming parts of our business by making them more fit, we will. If appropriate returns are not on the horizon, we will shift that capital to where we can play and win.”

The accelerated 2020 targets are enabled by $11.5 billion of cost and efficiency opportunities that span the entire company and include engineering, marketing and sales,manufacturing, material cost and IT. In addition, Ford expects to improve its capitalefficiency. The company had previously expected to spend about $34 billion in capital from 2019 to 2022 and has now cut that by $5 billion, to $29 billion over the same period.

“This quarter is in line with expectations and consistent with our outlook for the full year, but we know we can, and must, do better,”said Bob Shanks, executive vice president and CFO. “The entire team is focused on improving the operational fitness of ourbusiness, as well as meeting and exceeding our accelerated 2020 target of 8 percent margin and ROIC in the high teens.”

Hackett also provided an update to Ford’s strategic framework, declaring that Ford will create long term value by:

Making a full commitment to new propulsion choices, including adding hybrid-electric powertrains to high-volume, profitable vehicles like the F-150, Mustang, Explorer, Escape and Bronco. The company’s battery electric vehicle rollout starts in 2020 with a performance utility, and it will bring 16 battery-electric vehicles to market by 2022.

In just two years, about 90 per cent of Ford’s North American portfolio would comprise pickups, commercial vehicles and SUVs. The company is doubling its cost-cutting project to more than $25 billion by 2022, Bob Shanks, the chief financial officer, told the media.

The Mustang would not be part of the slashing of sedan cars in North America, but other slow-selling models including the Taurus, Fusion and Fiesta would be eliminated.

The company will focus on commercial vehicles and only on Mustang and hopes to get 8 per cent profit margin in just two years, way ahead of its original plan.

“We’re going to feed the healthy part of our business and deal decisively with areas that destroy value,” Hackett said in an earnings call. “We aren’t just exploring partnerships; we’ve now done them. We aren’t just talking about ideas; we’ve made decisions.”

According to Hackett, Ford’s profit margin should bottom out during the year.