Top 5 hedge fund bosses earn $1.5 billion each in 2008

27 March 2009

In spite of the global financial turmoil, the world's 25 highest-earning hedge fund managers took home, on average, $464 million each in 2008, says a survey conducted by New York-based Alpha magazine.

Four hedge fund managers took home more than $1 billion each. Altogether the 25 highest-earning hedge fund managers made $11.6 billion, making 2008 the third-best year on record since Alpha began compiling its exclusive annual ranking of the world's best-paid managers eight years ago.

Four hedge fund managers took home more than $1 billion each. Altogether the 25 highest-earning hedge fund managers made $11.6 billion, making 2008 the third-best year on record since Alpha began compiling its exclusive annual ranking of the world's best-paid managers eight years ago.

However, by comparison, the average take home pay in 2007 was a whopping $892 million.

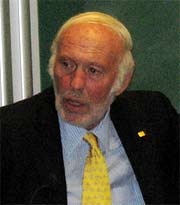

Leading the list was James Simons of New York's Renaissance Technologies, who took home $2.5 billion in 2008, slightly below the $2.8 billion in 2007, but substantially igher than $1.7 billion and $1.5 billion in 2006 and 2005 (the largest compensation among hedge fund managers that year[4]) and $670 million in 2004. .

Simons' fees are among the highest in the world; a 5-per cent management fee and a 44-per cent performance fee. Renaissance specialises in rapid-fire trading across almost every possible market and it relies heavily on computer-driven programmes developed by its more than 100 PhD-qualified staff.

He was followed by John Paulson, who held the No.1 spot in 2007. Paulson, who was among the first investors to bet that US housing prices would decline nationally, earned $2 billion last year. In 2007, Paulson earned an estimated $3.7 billion.