|

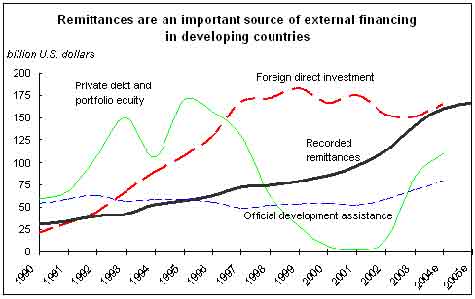

Officially recorded remittances worldwide exceeded $232 billion in 2005, of which developing countries received $167 billion - more than twice the level of development aid from all sources. Officially recorded remittances worldwide exceeded $232 billion in 2005, of which developing countries received $167 billion - more than twice the level of development aid from all sources.

Remittances sent through informal channels could add at least 50 per cent to the official estimate, making remittances the largest source of external capital in many developing countries, says the World Bank's Global Economic Prospects (GEP) report for 2006.

But the fees charged by remittance service providers are often as high as 10 to15 per cent for small transfers typically made by poor migrants. The GEP urges action to reduce these fees, which are often much higher than the actual cost of carrying out the transactions.

The report says increased competition in the remittance transfer market would result in lower fees, thereby increasing the disposable income of poor migrants, as well as their incentives to send more money home.

Reducing remittance costs would do more to encourage the use of formal remittance channels than will regulation of so-called informal services. While regulation is necessary to curb money laundering and terrorist financing, it must be implemented in a way that does not interfere with the objective of reducing remittance costs.

The report cites the experience of India, the Philippines and the US-Mexico corridor, as examples for others to follow for reducing remittance transfer fees. This requires government action to open the postal system to increase competition for remittance transfers, issuance of a consular identification card to facilitate opening of bank accounts by Mexican migrants in the US, and the use of cell-phone text messaging for remittance transfers, among others.

Despite the emphasis on remittances from developed countries, remittances sent from developing countries (south-south flows) represent between 30 and 45 per cent of total remittances.

Top 5 inward remittance earning countries: | Country | Remittances | | India | $21.7 billion | | China | $21.3 billion | | Mexico | $18.1 billion | | France | $12.7 billion | | The Philippines | $11.6 billion | The GEP recommends increasing access by poor migrants and their families to formal financial services for sending and receiving remittances. This could be done by encouraging the expansion of banking networks, allowing domestic banks in origin countries to operate overseas, providing recognized identification cards to migrants, and facilitating the participation of micro-finance institutions and credit unions in the remittances market.

In addition to raising consumption levels in the migrants' families, the steady stream of foreign exchange that remittances deliver can improve a country's creditworthiness for external borrowing. Where financial institutions can securities remittance deposits, they can expand access to capital in developing countries and lower borrowing costs.

While encouraging reforms to facilitate an increased flow of remittances, the report: - Opposes efforts by governments to tax remittances and cautions against providing incentives to direct remittances to specific areas or sectors through matching-fund programmes.

- Arguing that these schemes have met with little success in the past, the report advises governments to treat remittances like other private income.

- Similarly, as private funds, remittances should not be viewed as a substitute for development assistance, the report argues.

This year's GEP, titled The Economic Implications of Remittances and Migration, also forecasts that economic growth in developing countries will slow to 5.9 per cent this year, and to 5.7 per cent in 2006, (See: Global economic growth to slow down in 2006: World Bank) down from 6.8 per cent in 2004.

Developing economies will continue to grow at historically very high rates, and more than twice as fast as high-income economies. Growth in the high-income economies is also expected to slow from 3.1 per cent growth in 2004 to around 2.5 per cent in 2005 and 2006.

The recent strong economic performance of developing countries suggests that reforms undertaken over the past decades have had a positive impact on growth trends, as for example, in Africa, where the per capita incomes have risen by 1.8 per cent a year, in marked contrast to falling incomes during the 1980s and 1990s.

Economic gains from migration

On the theme of this year's GEP - remittances and migration - the report shows that an increase in migrants would raise the work force in high-income countries by three per cent by 2025 that could increase global real income by 0.6 per cent, or $356 billion. Such an increase in migrant stock would be in line with the migration trend observed during the past three decades.

The relative gains are much higher for developing-country households than rich-country households, rivaling potential gains from global reform of merchandise trade - with $162 billion going to new migrants, $143 billion to people living in developing countries, and $51 billion to people living in high-income countries.

The GEP also notes that remittances and migration should be seen as a complement to local development efforts in low-income countries. "Migration," the GEP says, "should not be viewed as a substitute for economic development in the origin country as ultimately, development depends on sound domestic economic policies."

The report also cites the need for developing countries faced with a large exodus of skilled workers and university graduates (the so-called "brain drain") to improve working conditions in public employment, invest more in research and development, and help identify job opportunities at home for returning migrants with advanced education.

|