|

Finance minister P Chidambaram told a forum at Harvard University, Massachusetts, on Tuesday that India and China will continue to be the drivers of world growth in the coming months, with China growing at 8-8.5 per cent in 2013-14 and India at 6.1-6.7 per cent (See China, India will continue to lead world growth: Chidambaram). Finance minister P Chidambaram told a forum at Harvard University, Massachusetts, on Tuesday that India and China will continue to be the drivers of world growth in the coming months, with China growing at 8-8.5 per cent in 2013-14 and India at 6.1-6.7 per cent (See China, India will continue to lead world growth: Chidambaram).

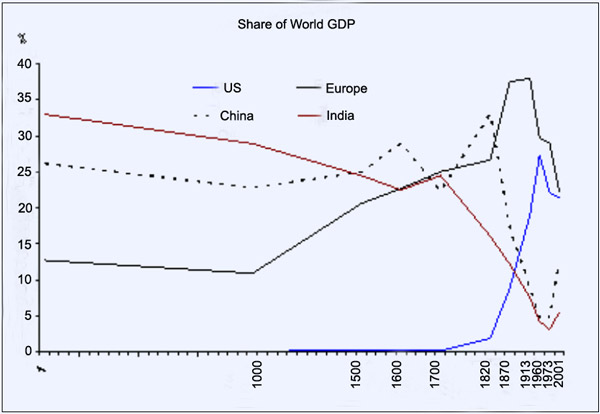

Following is the Text of the Speech of the Union Finance Minister, Shri P. Chidamabarm delivered yesterday at the South Asian Institute and Mahendra Humanities Center at Harvard University: ''It is a great pleasure to be back in the grounds of Harvard University and a great honour to be invited to speak by institutions that are part of Harvard University and the Massachusetts Institute of Technology, including my alma mater, the Harvard Business School. Last time too I spoke at the Harvard Business School and I feared that they may just say 'Once is enough'. I thank the South Asian Institute and Mahendra Humanities Center at the Harvard University for the opportunity. ''Oh, East is East and West is West, and never the twain shall meet. ''Thus, in the year 1889, wrote Kipling in his famous Ballad of East and West. Little did he know that globalization was only less than a hundred years away. ''The rise of once-upon-a-time poor countries has been the central economic story of our time. More than the growth, it is the pace of the growth that tells a more fascinating story. It took Britain 150 years, after the Industrial Revolution, to double its economic output per person. The United States, the emerging market of its time, took 50 years to do so in its period of fast development. ''When China and India began their period of high growth in recent decades, they took 12 and 16 years, respectively, to double per capita GDP. And while Britain and United States embarked on their take-off with a population of 10 million, China and India started out with a population of a billion or so each. So, in terms of force, as a McKinsey report on emerging markets suggests, the two leading emerging economies in the East are experiencing roughly 10 times the economic acceleration of the Industrial Revolution at 100 times the scale. ''In 2012, at market exchange rates, emerging economies accounted for 38 percent of world GDP and 61 percent of world growth. The transformation in world trade has been of a similar magnitude. At purchasing power parity, emerging markets accounted for 80 percent of world growth, with China accounting for 35 percent and India accounting for 10 percent. If you are a businessperson looking for growth and new markets, you have to look East (and perhaps South). ''Another way to see this is to look at market shares. Emerging markets have over three quarter of the world's market share in steel consumption, cell phones, and foreign exchange reserves. They account for more than one-half of the motor vehicles sold, with China overtaking the United States as the largest car market in the world. They account for more than one-half of global investment. While China's investment story has been much commented upon, India's is just starting out. ''Before examining the consequences of this shift in economic power, it might be useful to note that the East is recovering from a long growth recession lasting nearly 250 years. As Angus Maddison of the University of Groningen has noted, India was the largest economy in the world in the early 1700s, before the onset of the Industrial Revolution, with China close behind. India's goods were sold around the world, though not always welcomed. After all, it was only a few miles from here that tea from the East, transported by the British East India Company, was unceremoniously dumped in Boston Harbour 240 years ago. Of course, we respect the sentiment that led you to do it, but hope you will not do it again. Fish do not drink tea and it would be a waste of good Darjeeling. ''Going forward, China and India will continue to be drivers of world growth, with China growing at 8-8.5 percent and India at 6.1-6.7% between 2013 and 2014. ASEAN-4 (Indonesia, Malaysia, Philippines and Thailand) is also projected to grow at more than 5.5 percent. China is reported to have already overtaken the United States in economic size (measured by real per capita GDP in purchasing power parity terms) by 2012-13. ''I do not wish to numb you with numbers. But let me mention one other well-known difference between a number of emerging markets and industrial countries: it is the demographics. A lot of the growth in the East is still to come as it reaps its demographic dividend. For instance, India's share of the working age population will continue to rise. Nearly one-half the additions to the Indian labour force over the period 2011-30 will be in the age group 30-49, even while the share of this group in advanced countries will decline. This means greater production, savings and investment in India as the demographic dividend is reaped. ''So what do these changes in the locus of global demand mean? Before I turn to that, let me first say that not all the patterns we had seen emerge in global savings and investment, before the global financial crisis of 2008, were sustainable. Indeed, the financial crisis could be seen as evidence that the imbalances that were building up were unsustainable. ''Simply put, the industrial world, even as its population was ageing and as promised entitlements were becoming due, increased spending, and financed the spending with huge amounts of debt. Many emerging markets built up substantial trade surpluses as they gleefully catered to industrial countries' demand. And, ironically, they financed industrial countries' consumption by investing their savings in industrial countries' paper. ''This served both industrial countries and emerging markets while it lasted. For industrial countries, strong consumption growth papered over looming fiscal problems. Emerging markets too benefited as net exports grew . But it could not last. Sovereign debt, bank debt, and household debt in the industrial world increased to the point that investors were reluctant to buy more paper. Hence, the industrial world is being forced into austerity. ''Emerging markets too have not been immune to the resulting slowdown. Even though, unlike other emerging markets, India has been a net importer of goods and capital, it too has become more open over this period – the sum of Indian goods and services traded exceeded 55 percent of GDP in 2011-12. The slowdown in industrial countries has affected India, especially exports. '' Ladies and gentlemen, the world has to adjust. Industrial countries have to save more while emerging markets have to spend more. Such an adjustment will help industrial countries pay down heavy debt loads, even while leaving global demand to be supported by the emerging markets. Of course, the nature of spending will vary across emerging markets. China probably has to consume more, while India has to invest more. But as the world moves towards one where consumption and investment shifts towards the emerging markets, especially in Asia, and ageing industrial countries will learn to save more, what are the opportunities and challenges? That is what I want to speak on in the next fifteen minutes. ''I wish to talk about challenges to corporations, to the location of investment, to global financing, to social pressures, and to global governance that will come about from these momentous changes. Start first with corporations around the world. As demand from emerging markets accounts for not just the bulk of a multinational company's growth but also the majority of its sales, it will have to make changes. Products must now be designed for the emerging markets rather than designed for industrial countries. Who would have imagined that buying a burger at McDonalds could mean getting an aloo tikka - or potato - burger? Shift in demand will require big changes in the mindset of the product designers as well as changes in the location of decision making. ''Some industrial country firms have managed the transition. For instance, it may interest you to note French luxury brand Hermes' foray into saris. The patterns for these saris are based on the popular Hermes scarves, which in turn, interestingly, were inspired by Indian design (Financial Times, October 7, 2011). In another interesting twist, a Spanish porcelain manufacturer now has an entire range of Buddhist and Hindu deities, including several fascinating interpretations of the popular elephant-headed Hindu god Ganesha and images of Kwan Yin, a goddess of compassion revered in Buddhism, Taoism and Confucianism. ''Such changes require corporations to restructure their decision making. After all, it is easy for fashion decisions to be made in New York when the primary wearers of the fashion are promenading outside the store windows on Fifth Avenue. But what if they are 10,000 miles away? Can you make product decisions at long distance? Or do you have to shift headquarters to Shanghai or Hong Kong, as global bank HSBC has done? ''Emerging market companies understand local needs better. Consider frugal engineering, an entirely new way of designing, engineering, and delivering products cheaply so that they can cater to the enormous number of people making a few dollars a day. To produce innovative frugal products, emerging market firms know they need the design capabilities and technologies possessed by industrial country companies as well as the scale from catering to global markets. Indeed, while the number of majority acquisitions increased globally by 6 percent, acquisitions of industrial country companies by emerging market firms grew at an annual rate of 26 percent. India, Malaysia, and China, account for more than half of the M&A deals, with India spearheading the acquisitions market.

''What I find interesting is the extent to which these companies have gone global. The UNCTAD calculates a trans-nationality index based on the average of foreign assets to total assets, foreign sales to total sales, and foreign employment to total employment. In this, Hutchison has a whopping score of 80.8 percent, TATA Steel 64.5 percent and Singapore Telecom 64.3 percent. In comparison General Electric has a score 59.7 percent, Toyota Motor Corporation 52.1 percent and Exxon Mobil 66 percent. That is, some of the new eastern multi-national companies are actually more global than established global giants. Tatas is the largest private sector employer in the U. K. today. ''Let me turn to investment. The shift in activity will create enormous new investments, not just in China but elsewhere too. As one example of what is likely, the Delhi Mumbai Industrial Corridor, a project with Japanese collaboration entailing over $ 90 billion in investment, will link Delhi to Mumbai's ports, covering an overall length of 1483 km and passing through six States. This project will have nine mega industrial zones, high speed freight lines, three ports, six airports, a six-lane intersection-free expressway connecting the country's political and financial capitals, and a 4000 MW power plant. ''India saves a lot – the savings rate at its lowest in recent years was about 30 percent of GDP. But India's savings fall short of its investment needs. Moreover, India needs intelligent risk capital that will ensure that investments are monitored and brought to fruition. And India needs long term patient capital that is willing to collect a return over many years. ''Industrial countries, with their ageing populations, would seem to have a matching need – a need, as they increase their savings, to see them invested in attractive long term instruments producing adequate returns. There is a perfect match here provided both sides work at reducing barriers. We constantly hear of moves in industrial countries to engage in financial protectionism, to keep savings at home in order to finance overextended industrial country governments. Any move in this direction would be terribly misguided. ''At the same time, emerging markets have to increase the comfort level of international investors, to improve their sense that their capital is well protected. After all, why would they invest over the long term if their capital can be expropriated by a change in laws or by the whims of the government? The best guarantor of investment protection is a stable and democratic political structure, a belief in the rule of law, and a transparent and independent legal system. India has all three. So have many other emerging markets. ''The rise of the East may also be contributing to social tensions. Historically, advanced industrial economies have adapted by creating new jobs and endowing their workers with the skills to do those jobs. But the pace with which the East has grown may have reduced the time companies and workers in industrial countries have had to adapt. The high levels of persistent unemployment in industrial countries may reflect, in part, the lack of such adaptation. This is creating new problems. How will the West deal with a 55 year old auto worker who is too old to learn a new trade but too young to retire? How will advanced industrial countries find people for the jobs that are vacated by retiring workers if their fertility rates fall below the replacement rate? The answers will determine the character of such societies in the years to come. The wrong answer is to blame immigration, trade or technological progress. The right answer will be to harness these forces to provide the remedies. ''Emerging markets too have their problems of adaptation. Some sections of their people are already in the post-industrial society that we see around us here in Cambridge. They live in gated communities, travel to air-conditioned offices in air-conditioned cars, invest in equal proportions at home and abroad, consume as much as their peers in industrial economies, and believe naively that they have shut out the heat and the dust and the pain and the suffering of the emerging market. But governments cannot ignore the growing disparity between these winners in the process of globalization and the masses, the majority of whom in a country like India are still dependent on agriculture or low paying casual jobs. Inclusive growth is not an option for India , it is an imperative. ''In my view, a good, decent job is the best form of inclusion. So, India's efforts have been focused on trying to enable the poor to obtain better nutrition and health, education and skills, and financing, that will allow them to secure good livelihoods. In this regard, India is in the middle of a massive effort to empower the poor through a system of rights-based entitlements including the right to information, the right to education, the right to medical care, and the right to food. Inclusive growth will enable India to have a fairer, and in many ways more stable, society. ''Let me turn finally to the geo-political implications of the rise of the East. As the people in the East look for houses, cars and bikes, and washing machines, it will create enormous demands for resources; it will entail higher expenditure; and it will present severe challenges to the environment. Our planet, given current mitigation technologies, will not allow all of us to enjoy the lifestyles of the rich countries – there is an overall budget constraint imposed by the environment. Of course, technologies will improve, but for now sustainable development will require all of us to adapt. ''I do not want to dwell on what needs to be done. But I think environmental sustainability adds to the range of economic issues on which we need global dialogue and global co-operation. And, I am afraid, the quality of that dialogue, and the degree of co-operation, has, so far, been deficient. ''In part, this is a consequence of the rapid rise of the East. Global multilateral organizations were set up to deal with a set of problems based on an agenda and a framework set by the industrial countries. The problems have changed, the players are different, and their relative importance has altered significantly, but the organizations, the agenda setting, and the lens through which solutions are devised have not changed enough. ''Even as the old great powers still dominate the multilateral organizations, thus causing emerging markets to remain silent or sullen, new structures like the G-20 are yet to find traction. There is a vacuum in global economic policy discussion that can prove dangerous as the shift in economic power creates new frictions. Perhaps we need new multilateral institutions, institutions set up for the post-financial crisis era that are not compromised by the legacy and the power structures of the past. A real concern is that the old great powers do not feel the need for change because they know the emerging markets do not have common goals and can be easily divided. But denying emerging markets real power will be very shortsighted. ''Let me also acknowledge that there is the potential for tension within the countries of the East, as competition for resources and markets increases. In recent months we have seen talk of conflict over islands, underwater resources, or even water itself. We need to work collectively to reduce these tensions and to ensure that trade, investment, and mutual gain trumps narrow self interest. ''Finally, as the East grows in economic strength, it will need the intellectual heft to provide the solutions to the myriad problems that will arise. Speaking as an Indian, let me say our universities are growing in strength. But great institutions of learning like Harvard University can play an important role: by teaching our youth, by training our teachers, and by engaging in intellectual dialogue that will strengthen mutual understanding. ''Let me end by saying that the rise of the East is not, and should not be seen as, a threat to the West. Properly managed, it can result in enormous gain for all and a true meeting of civilizations. Perhaps the third line of Kipling's poem will in fact come true: ''But there is neither East nor West, Border, nor Breed, nor Birth.'' It is with that hope that I leave you today. And I thank you for your kindness and patience.'' (See: China, India will continue to lead world growth: Chidambaram)

|